The IRS 1099 NEC form is used to report nonemployee compensation. This form is typically used by businesses to report payments made to independent contractors, freelancers, and other nonemployees. It is important for businesses to accurately report these payments to the IRS and provide a copy to the recipient for tax purposes.

Businesses must issue a 1099 NEC form to any nonemployee who was paid $600 or more during the tax year. This form is crucial for both the business and the recipient to accurately report income and expenses to the IRS. Failing to report these payments can result in penalties and fines.

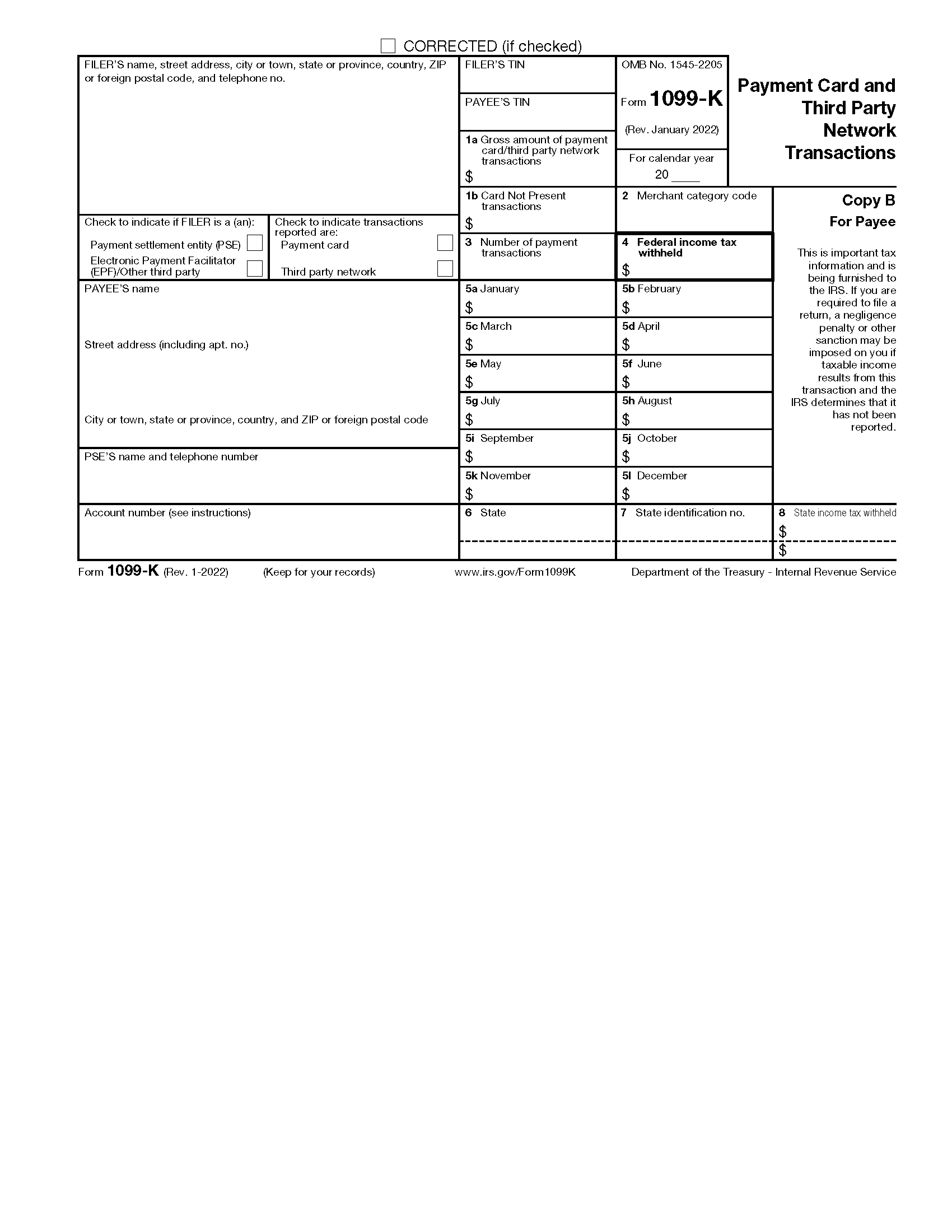

IRS 1099 NEC Printable Form

The IRS provides a printable version of the 1099 NEC form on their website. This form can be downloaded and printed for businesses to fill out and submit to the IRS. It is important to fill out the form accurately and completely to avoid any errors or delays in processing.

When filling out the 1099 NEC form, businesses will need to provide information such as the recipient’s name, address, social security number or taxpayer identification number, and the total amount of nonemployee compensation paid during the tax year. Businesses will also need to provide their own information, such as their name, address, and taxpayer identification number.

Once the form is filled out, businesses will need to send Copy A to the IRS, Copy B to the recipient, and keep Copy C for their records. It is important to submit the form by the deadline to avoid any penalties or fines.

Overall, the IRS 1099 NEC printable form is a crucial tool for businesses to report nonemployee compensation accurately and comply with IRS regulations. By properly filling out and submitting this form, businesses can avoid penalties and ensure that both they and their nonemployees are in compliance with tax laws.

Make sure to download the IRS 1099 NEC printable form from the IRS website and start reporting nonemployee compensation accurately today!