When it comes to tax season, staying organized is key. One important form that many businesses and independent contractors need to be familiar with is the IRS 1099 NEC form. This form is used to report nonemployee compensation, such as freelance income, to the IRS. Having a printable template for this form can make the process much easier.

For the year 2025, it is important to have the most up-to-date version of the IRS 1099 NEC form. Using a template that is specifically designed for this year can help ensure that you are filling out the form correctly and accurately. Having a printable version of the form also allows you to easily keep records for your own records.

Irs 1099 Nec Form 2025 Template Printable

Irs 1099 Nec Form 2025 Template Printable

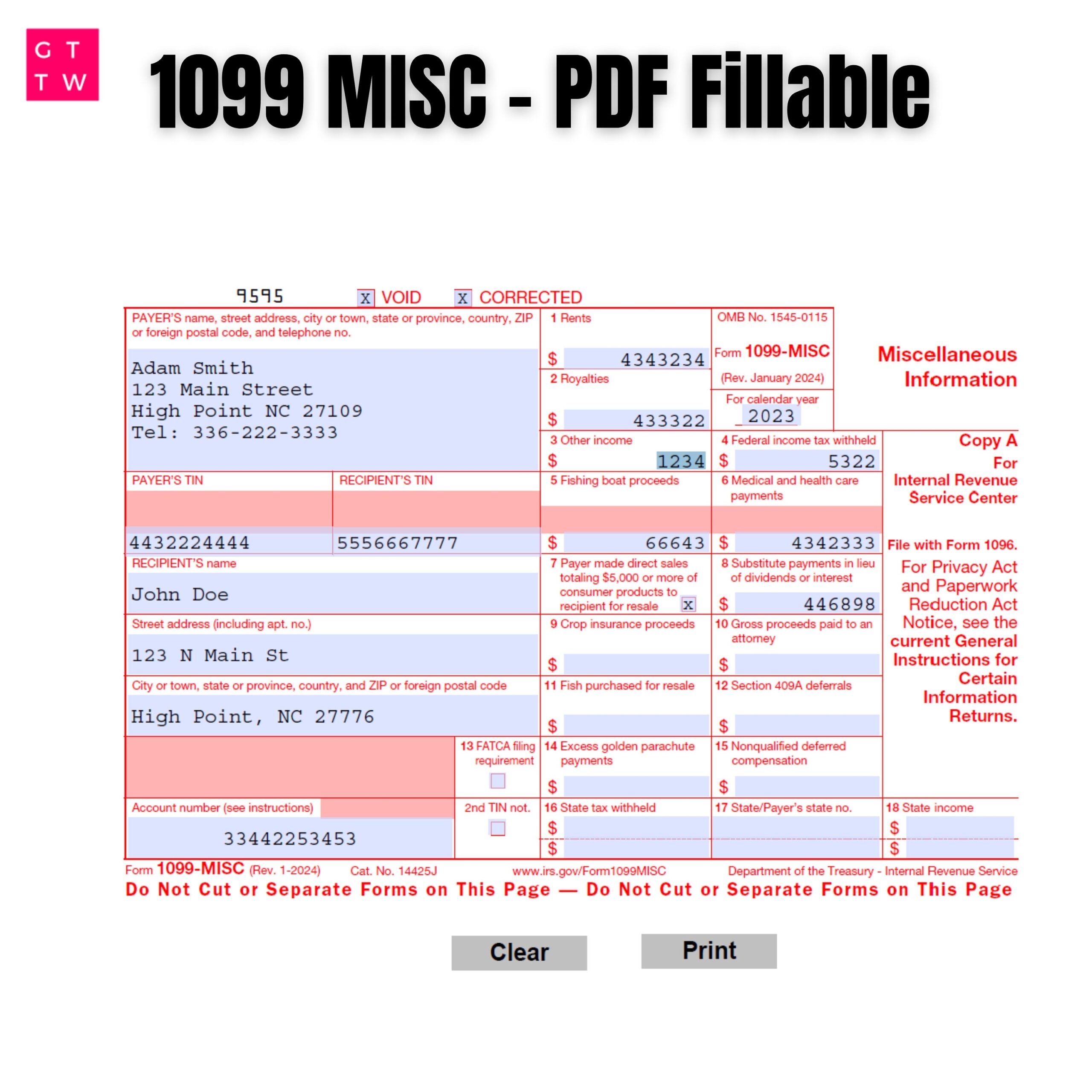

When looking for a printable template for the IRS 1099 NEC form for 2025, make sure that it includes all the necessary fields and information required by the IRS. This includes details such as the payer’s information, recipient’s information, and the amounts being reported. Having a template that is easy to fill out and understand can save you time and prevent errors.

Using a printable template for the IRS 1099 NEC form can also save you money. Instead of having to purchase pre-printed forms, you can simply print out the template as needed. This can be especially helpful for small businesses or independent contractors who may not have the resources to invest in expensive forms.

Overall, having a printable template for the IRS 1099 NEC form for 2025 can make the tax reporting process much smoother and more efficient. By ensuring that you have the most up-to-date version of the form and using a template that is easy to fill out, you can save time and avoid costly mistakes. Make sure to download a reliable template for your tax reporting needs.

In conclusion, having access to a printable template for the IRS 1099 NEC form for 2025 is essential for businesses and independent contractors. This form is crucial for reporting nonemployee compensation to the IRS accurately. By using a template that is specifically designed for the current year, you can stay organized and compliant with tax regulations.