As a business owner or independent contractor, tax season can be a stressful time. One of the forms you may need to familiarize yourself with is the IRS 1099 NEC Form 2024. This form is used to report nonemployee compensation, such as payments made to independent contractors, freelancers, or other service providers.

Understanding how to properly fill out and file the IRS 1099 NEC Form 2024 is essential to avoid any penalties or fines from the IRS. Luckily, there are printable versions of this form available online, making it easy for you to access and complete.

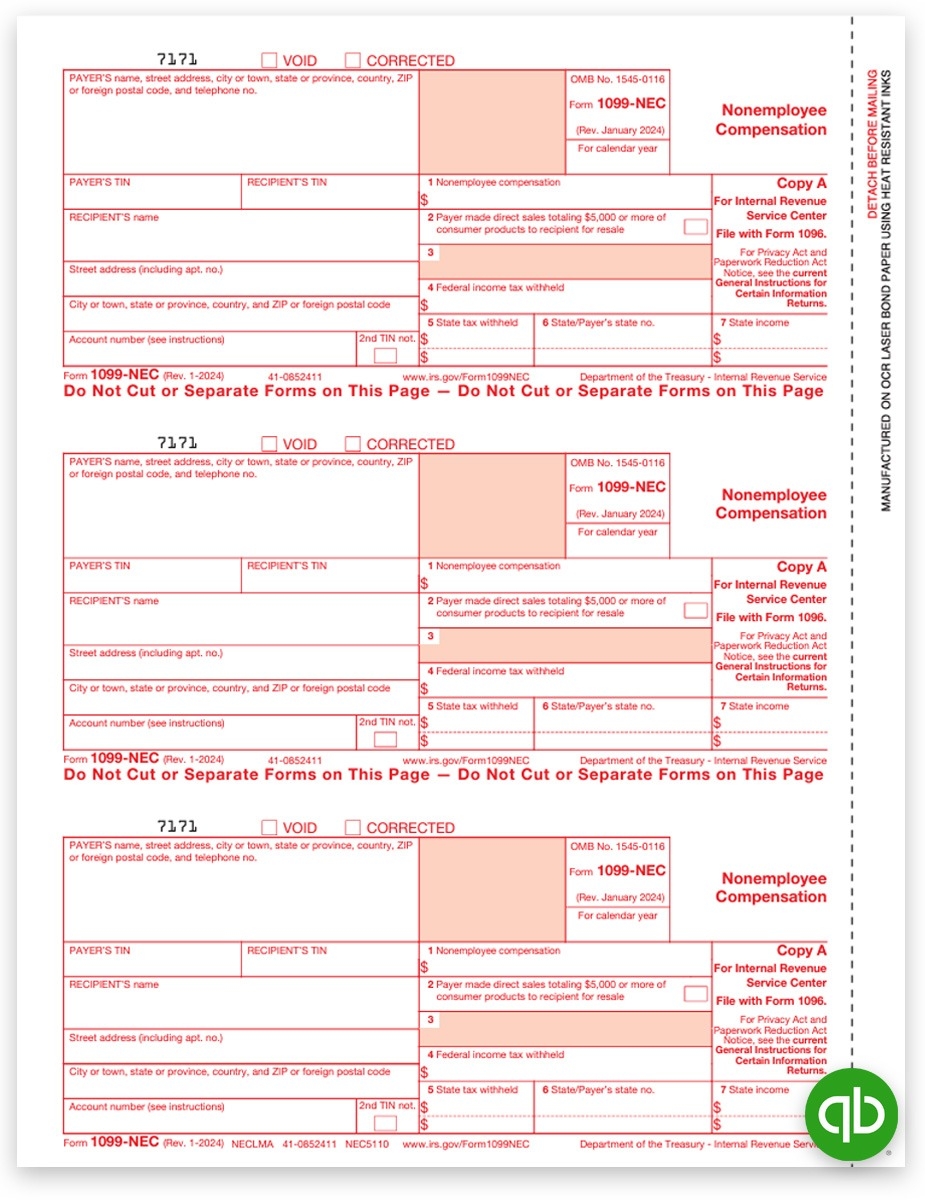

Irs 1099 Nec Form 2024 Printable

Irs 1099 Nec Form 2024 Printable

IRS 1099 NEC Form 2024 Printable

When looking for the IRS 1099 NEC Form 2024 printable version, it’s important to ensure that you are using the most up-to-date version of the form. The IRS updates its forms regularly, so be sure to check the official IRS website for the latest version.

Once you have the form, you will need to fill in the payer’s information, recipient’s information, and details about the nonemployee compensation paid. Make sure to double-check all information for accuracy before submitting the form to the IRS.

It’s also important to remember the deadline for filing the IRS 1099 NEC Form 2024. The deadline is typically January 31st, but it can vary depending on the year and any extensions that may have been granted. Be sure to check the IRS website for the most current deadline information.

Failure to file the IRS 1099 NEC Form 2024 or inaccurately reporting nonemployee compensation can result in penalties from the IRS. It’s crucial to take the time to properly complete and submit this form to avoid any unnecessary issues with the IRS.

In conclusion, the IRS 1099 NEC Form 2024 printable version is a valuable tool for business owners and independent contractors to report nonemployee compensation accurately. By understanding the importance of this form and ensuring it is filled out correctly and filed on time, you can avoid potential penalties and fines from the IRS.