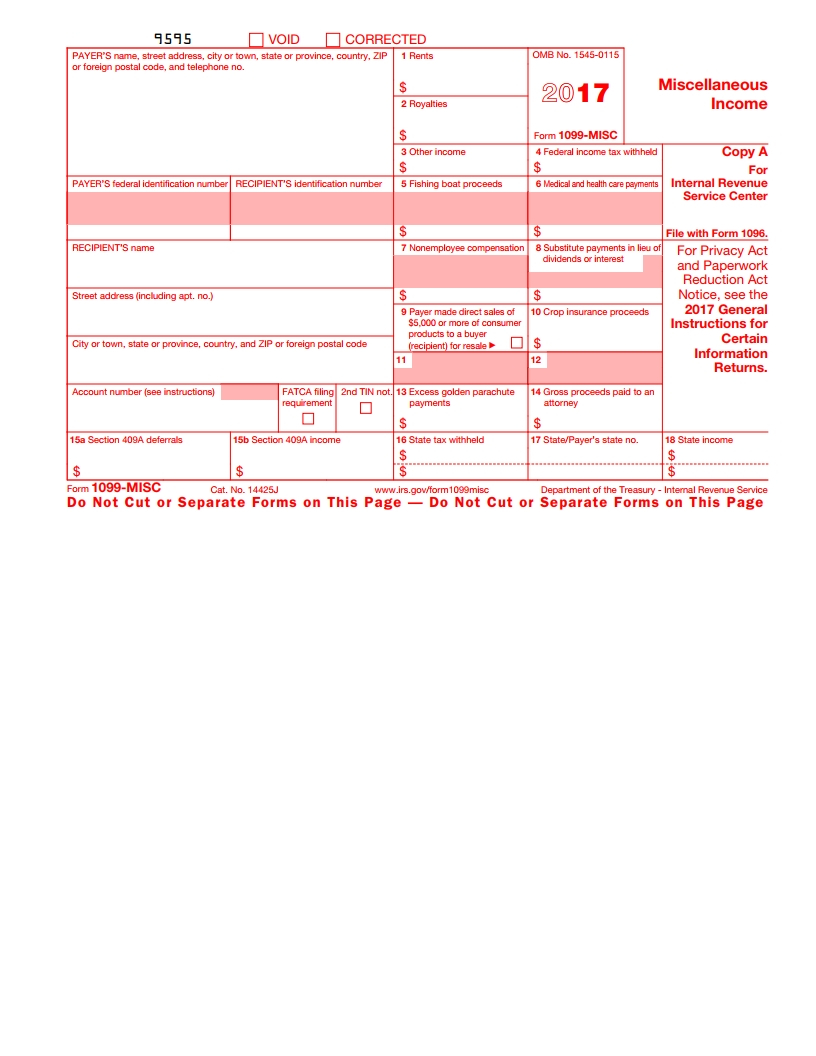

Are you a freelancer or independent contractor who received income during the year? If so, you may need to report that income to the IRS using a 1099 form. The 1099 form is used to report various types of income, such as self-employment income, interest, dividends, and more. One popular form is the 1099-MISC, which is used to report income for non-employees.

For those who need to file a 1099 form, it’s important to have access to a printable version. The IRS provides printable versions of all 1099 forms on their website, making it easy for individuals to report their income accurately and on time.

IRS 1099 Form Printable

When it comes to finding the right 1099 form to report your income, the IRS website is the best place to start. You can easily search for and download the specific form you need, whether it’s the 1099-MISC, 1099-INT, or any other variation. These forms are typically available in PDF format, making it easy to print them out and fill them in by hand.

Once you have the form printed out, you will need to fill in all the necessary information, including your name, address, social security number, and the amount of income you received. It’s important to double-check all the information before submitting the form to ensure accuracy and avoid any potential penalties from the IRS.

After completing the form, you can either mail it to the IRS or file it electronically, depending on your preference. Mailing the form may take longer to process, so filing electronically is often the preferred method for faster results.

Overall, having access to a printable IRS 1099 form is crucial for individuals who need to report their income to the IRS. By utilizing the resources provided by the IRS website, you can easily find and download the form you need to accurately report your income and avoid any potential issues with the IRS.

So, if you find yourself in need of a printable 1099 form, be sure to visit the IRS website to access the necessary forms and get started on reporting your income today.