When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the IRS 1099 form. This form is used to report various types of income, such as freelance work, rental income, and dividends. It is crucial for both the payer and the recipient to accurately fill out this form to ensure compliance with tax laws.

For the year 2025, the IRS has made available a printable version of the 1099 form that can be easily accessed and filled out online. This printable form simplifies the process for taxpayers and reduces the chances of errors in reporting income. It is important to ensure that all the information provided on the form is accurate to avoid any potential issues with the IRS.

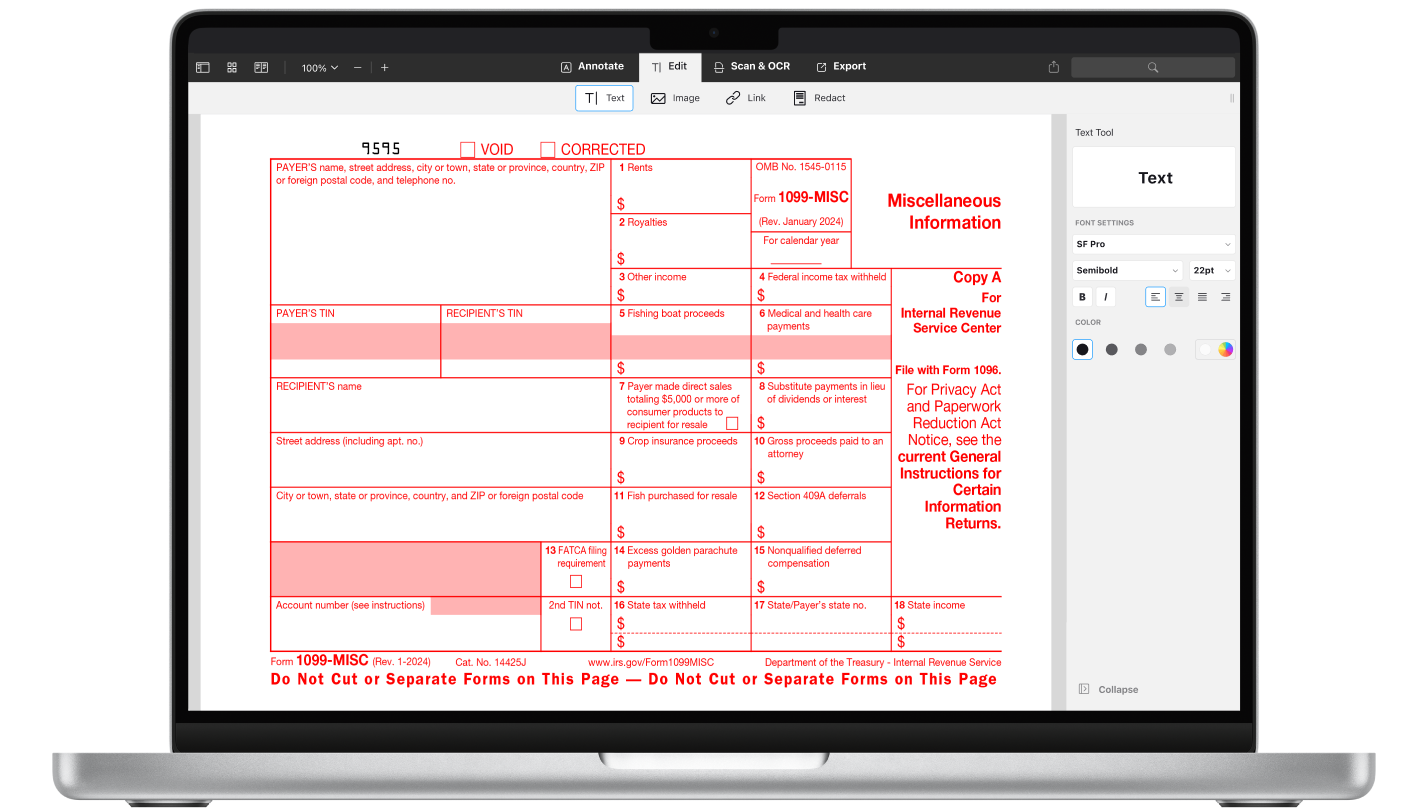

IRS 1099 Form 2025 Printable

The IRS 1099 form for the year 2025 includes sections for various types of income, such as non-employee compensation, interest income, and debt cancellation. It is essential for both payers and recipients to understand which type of income should be reported on this form to avoid any discrepancies. By using the printable version of the form, individuals and businesses can easily fill out the required information and submit it to the IRS on time.

One of the benefits of using the IRS 1099 form 2025 printable version is that it allows for easy access to the form at any time. Taxpayers can simply download the form from the IRS website and fill it out electronically or print it out and complete it by hand. This convenience makes it easier for individuals and businesses to stay compliant with tax laws and avoid penalties for late or incorrect filing.

Additionally, the IRS 1099 form 2025 printable version provides clear instructions on how to fill out each section of the form. This guidance helps taxpayers accurately report their income and ensures that all necessary information is included. By following these instructions carefully, individuals and businesses can minimize the risk of errors and potential audits by the IRS.

In conclusion, the IRS 1099 form 2025 printable version is a valuable tool for taxpayers to report their income accurately and comply with tax laws. By utilizing this form, individuals and businesses can simplify the tax filing process and reduce the risk of errors. It is important to take advantage of this resource and ensure that all information provided on the form is complete and correct.