As tax season approaches, it’s important for individuals and businesses to familiarize themselves with the necessary forms for reporting income. One such form is the IRS 1099 Form, which is used to report various types of income outside of traditional wages. This form is crucial for accurately reporting income to the IRS and ensuring compliance with tax laws.

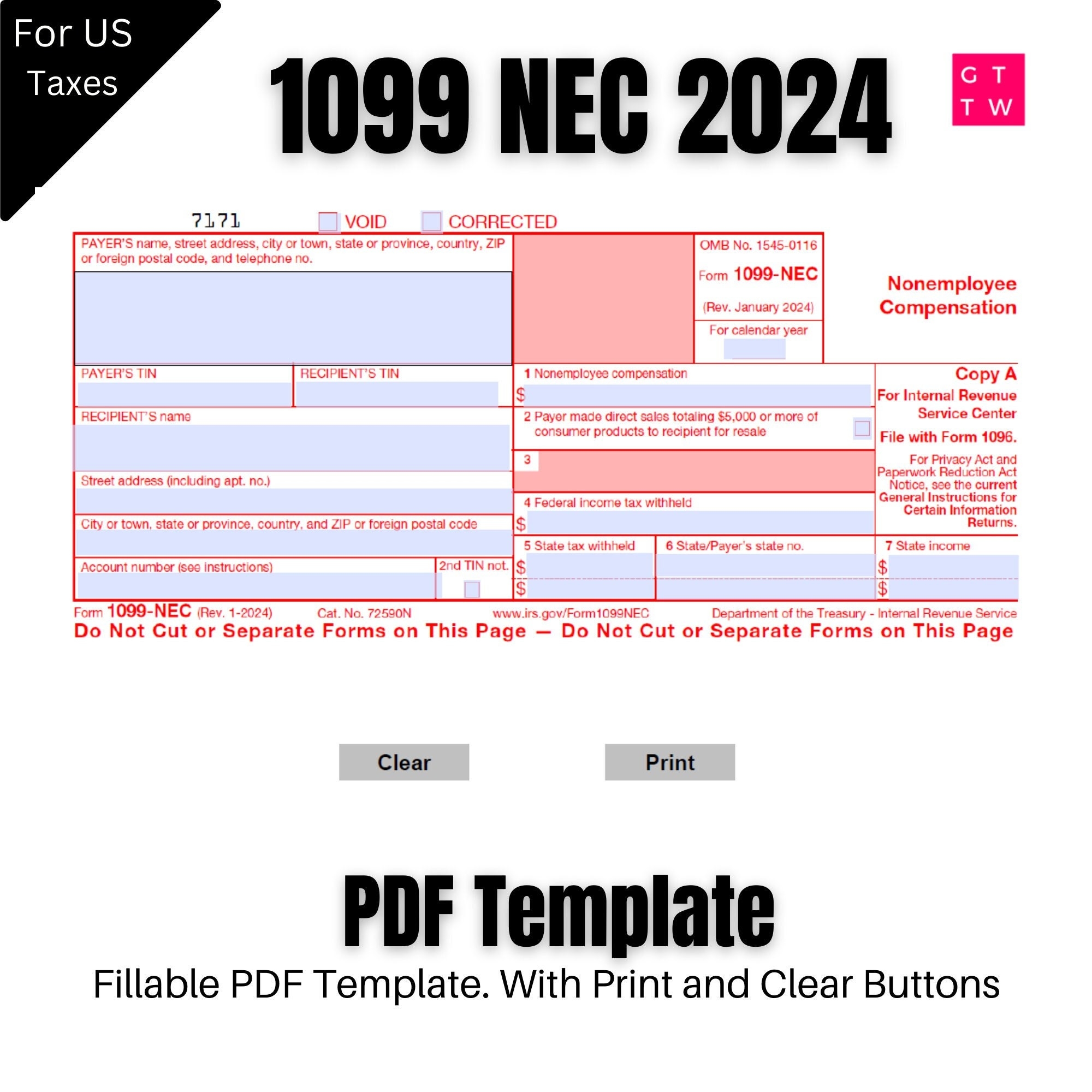

For the year 2024, the IRS has released the updated version of the 1099 Form, which is available for printing and filling out. The printable form can be easily accessed online through the IRS website or through tax preparation software. It is important to ensure that the form is filled out correctly and submitted by the appropriate deadline to avoid any penalties or fines.

When filling out the IRS 1099 Form for 2024, individuals and businesses will need to provide information such as their name, address, taxpayer identification number, and the amount of income earned. The form is used to report various types of income, including interest, dividends, rental income, and self-employment income. It is important to carefully review the instructions provided with the form to ensure that all necessary information is included.

One of the key benefits of using the IRS 1099 Form is that it helps to ensure that all income is accurately reported to the IRS. This helps to prevent any discrepancies or errors in tax filings, which could potentially lead to audits or penalties. By using the 1099 Form, individuals and businesses can streamline the process of reporting income and ensure compliance with tax laws.

In conclusion, the IRS 1099 Form for 2024 is an essential tool for accurately reporting income to the IRS. By using the printable form and carefully filling out all necessary information, individuals and businesses can ensure compliance with tax laws and avoid any potential issues with the IRS. It is important to stay informed about any updates or changes to tax forms and to seek assistance from a tax professional if needed.