As tax season approaches, it’s important for individuals and businesses to gather all the necessary documents to accurately report their income to the IRS. One such document is the 1099 form, which is used to report various types of income other than wages, salaries, and tips. This includes income from freelance work, contract work, rental income, and more.

For those who need to file a 1099 form for the tax year 2023, it can be helpful to have access to a printable PDF version for easy completion and submission. Fortunately, the IRS provides a free downloadable PDF of the 1099 form, making it convenient for taxpayers to fulfill their reporting obligations.

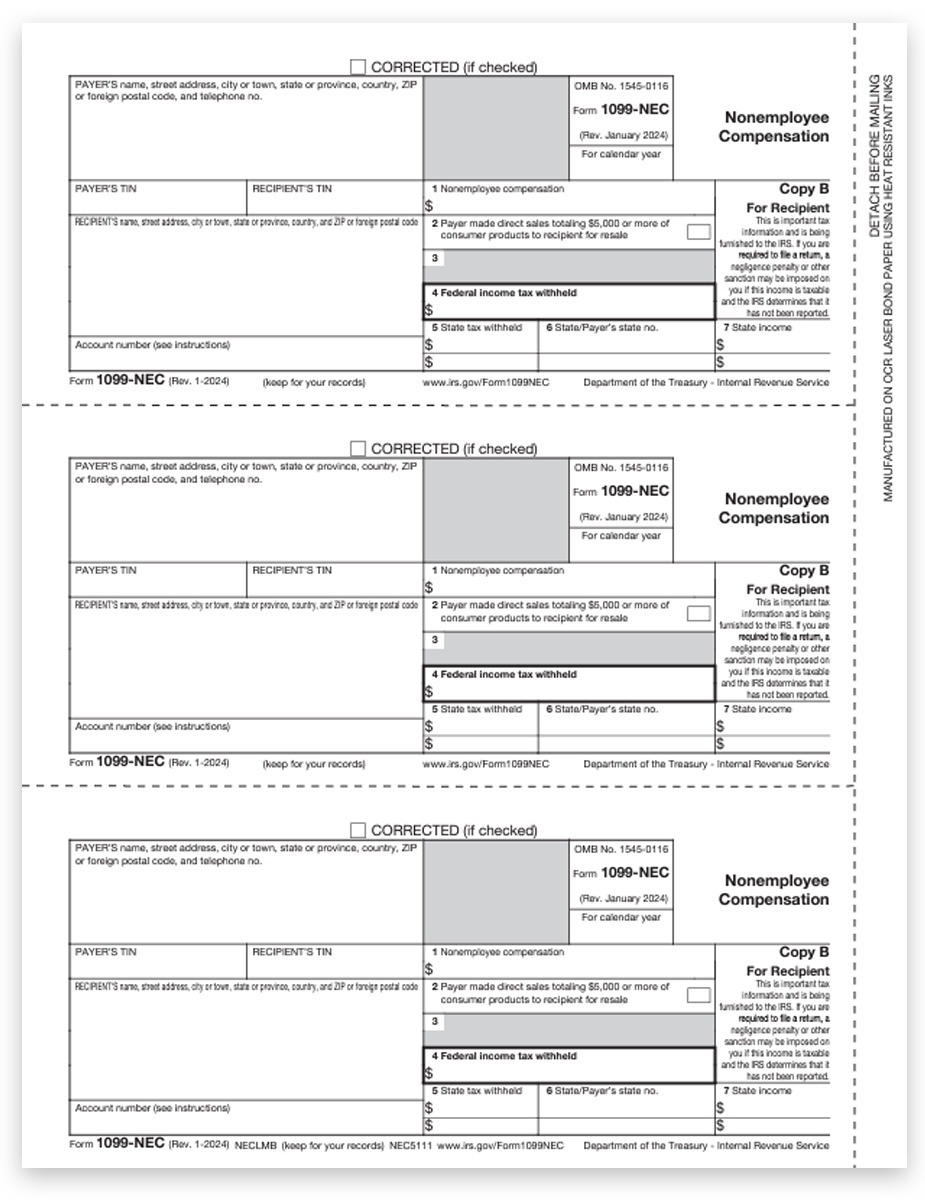

Irs 1099 Form 2023 Printable Pdf Free Download

Irs 1099 Form 2023 Printable Pdf Free Download

When downloading the IRS 1099 form for 2023, individuals and businesses should ensure they have all the necessary information readily available to accurately complete the form. This includes the recipient’s name, address, taxpayer identification number, and the amount of income paid during the tax year. Failing to report this information correctly could result in penalties from the IRS.

Once the form is completed, it should be submitted to the IRS along with any required attachments by the specified deadline. Filing a 1099 form is crucial for both the taxpayer and the recipient, as it ensures that income is properly reported and taxed according to the law.

Overall, having access to the IRS 1099 form for 2023 in a printable PDF format can streamline the reporting process for taxpayers and help them meet their tax obligations. By downloading the form from the IRS website, individuals and businesses can easily stay compliant with tax laws and avoid potential penalties for non-compliance.

In conclusion, the availability of the IRS 1099 form for 2023 as a printable PDF for free download is a valuable resource for taxpayers who need to report various types of income to the IRS. By utilizing this tool, individuals and businesses can ensure that their income is accurately reported and taxed, helping them avoid potential issues with the IRS.