When it comes to tax season, it’s important to have all the necessary forms ready to file your taxes accurately and on time. One essential form that businesses need to submit to the IRS is the 1096 form. This form is used to summarize and transmit information returns such as 1099s to the IRS. For the year 2025, the IRS has made the 1096 form available in a printable PDF format for easy access and submission.

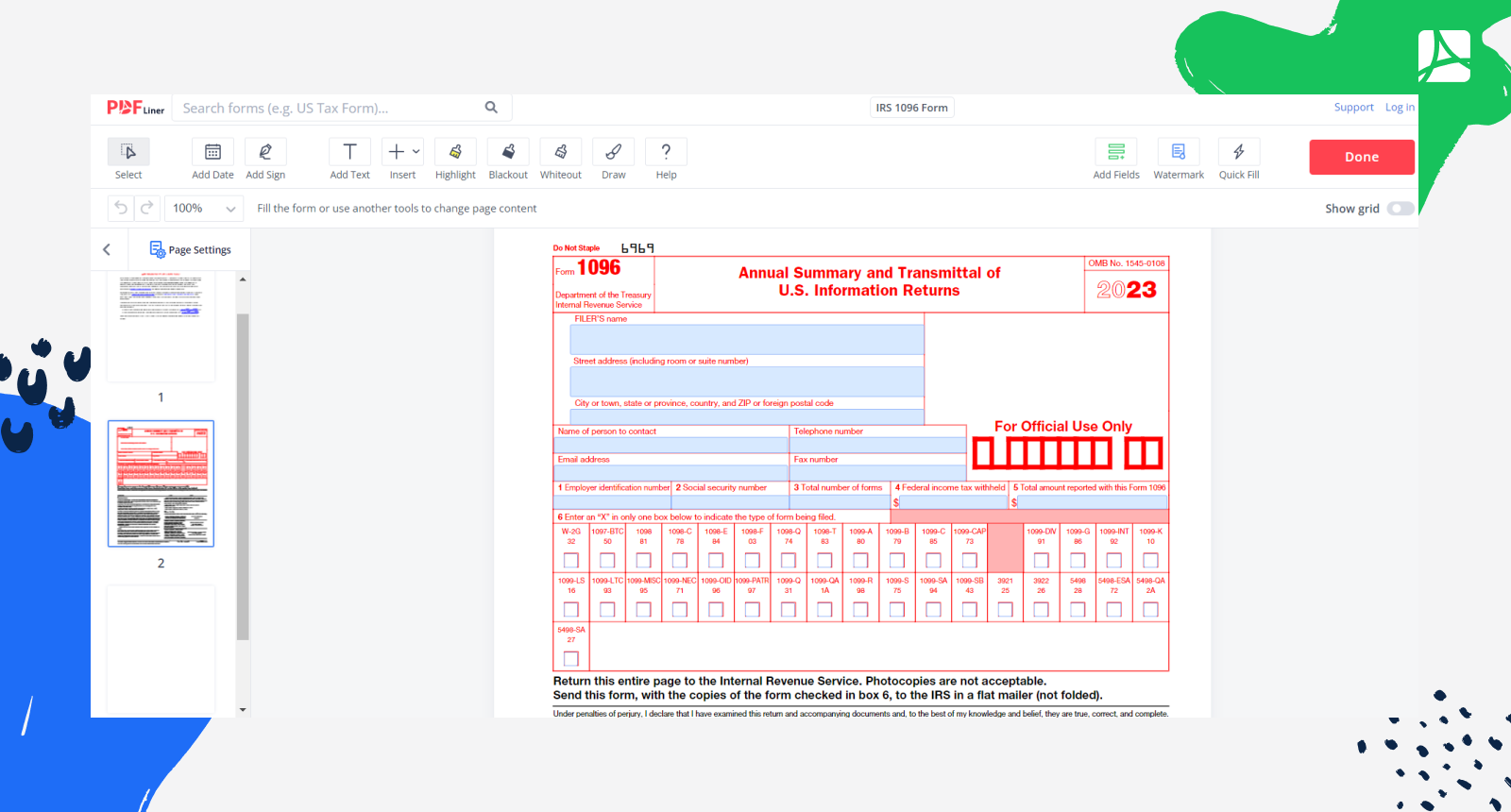

The IRS 1096 Form 2025 Printable PDF is a convenient way for businesses to fill out and submit their summary information returns to the IRS. This form includes fields for the filer’s information, the total number of forms being submitted, and a summary of the total amounts reported on the accompanying 1099 forms. By using the printable PDF version, businesses can easily complete the form electronically and print it out for submission.

Irs 1096 Form 2025 Printable Pdf

Irs 1096 Form 2025 Printable Pdf

One key benefit of the IRS 1096 Form 2025 Printable PDF is that it reduces the risk of errors and ensures that all required information is included. The form is designed to be user-friendly and intuitive, making it easier for businesses to accurately report their information returns to the IRS. Additionally, the PDF format allows for easy storage and retrieval of the form for future reference.

Businesses can download the IRS 1096 Form 2025 Printable PDF directly from the IRS website or through authorized tax preparation software. Once the form is completed, it can be submitted electronically or by mail to the IRS along with the accompanying 1099 forms. It’s important for businesses to ensure that the form is submitted by the deadline to avoid any penalties or fines.

In conclusion, the IRS 1096 Form 2025 Printable PDF is a valuable tool for businesses to summarize and transmit their information returns to the IRS. By using this printable PDF version, businesses can streamline the filing process and ensure compliance with IRS regulations. Make sure to download the form early and submit it on time to avoid any issues during tax season.