The IRS 1096 Form is used by businesses to summarize and transmit information returns such as 1099s to the IRS. This form is important for businesses to report various types of income, including payments made to independent contractors, interest income, and dividends.

For the year 2024, the IRS has provided a printable version of the 1096 Form that businesses can easily download and fill out. This printable form simplifies the process of reporting information returns and ensures that businesses are in compliance with IRS regulations.

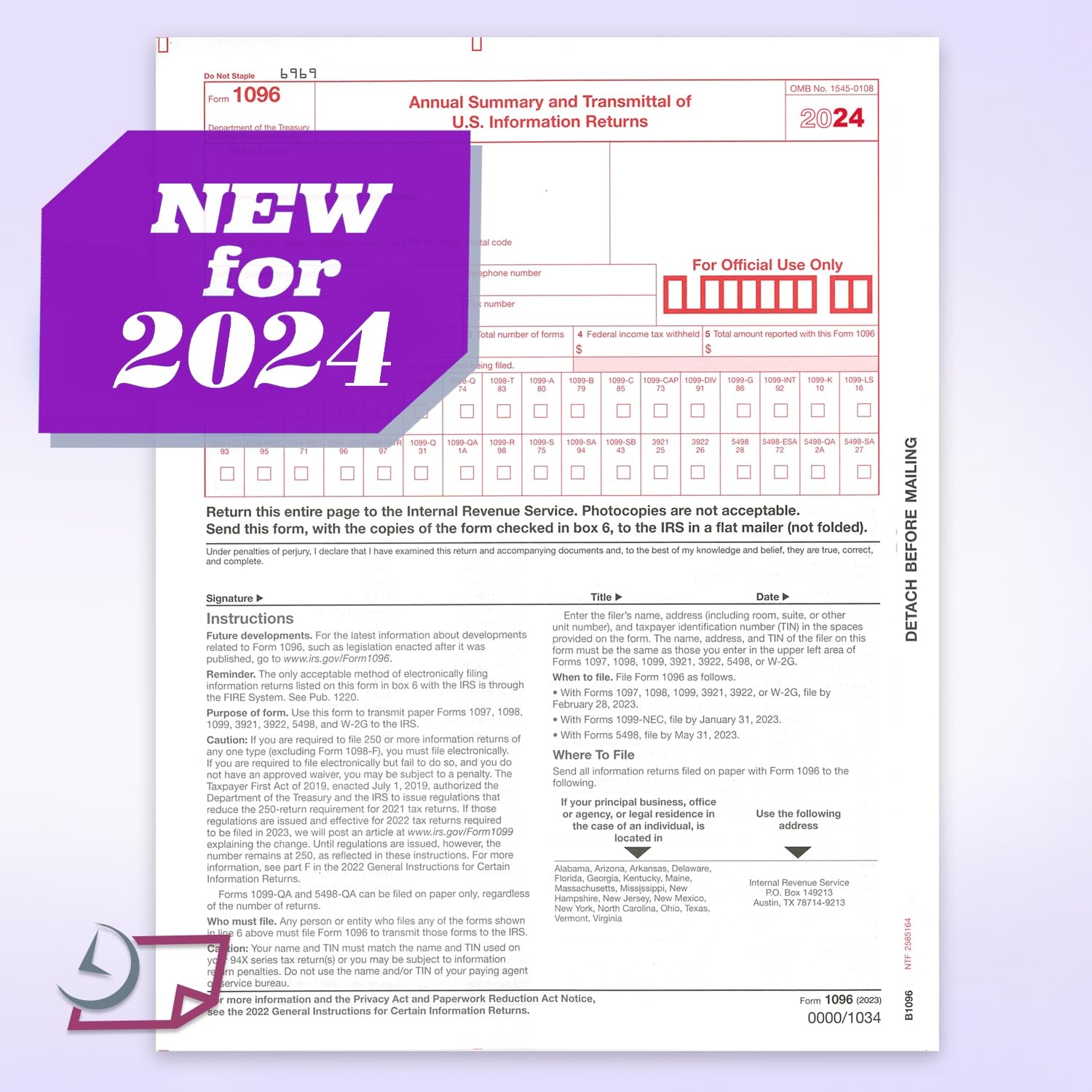

When filling out the IRS 1096 Form for 2024, businesses will need to provide information such as their name, address, and taxpayer identification number. They will also need to include the total number of information returns being submitted and the total amount of federal income tax withheld.

Businesses should ensure that all information on the form is accurate and complete before submitting it to the IRS. Any errors or missing information could result in penalties or delays in processing. It is important to double-check all entries and review the form before mailing it to the IRS.

Once the IRS 1096 Form for 2024 is completed, businesses will need to mail it along with the corresponding information returns to the address provided by the IRS. It is important to submit the form by the deadline to avoid any penalties or fines.

In conclusion, the IRS 1096 Form for 2024 is an essential document for businesses to report information returns to the IRS. By using the printable version of the form, businesses can easily comply with IRS regulations and ensure that all necessary information is submitted accurately. It is important for businesses to take the time to fill out the form correctly and submit it by the deadline to avoid any potential issues with the IRS.