Filing taxes can be a daunting task for many individuals, but the IRS 1040EZ form aims to simplify the process for those with straightforward tax situations. This form is specifically designed for taxpayers who have no dependents, do not itemize deductions, and earn less than $100,000 in income. It is a shorter and simpler version of the standard 1040 form, making it easier for individuals to file their taxes quickly and efficiently.

The IRS 1040EZ printable form can be easily accessed on the IRS website, allowing taxpayers to download and print the form at their convenience. This form eliminates the need for complex calculations and extensive documentation, making it ideal for those with uncomplicated tax situations. By providing a simplified option for filing taxes, the IRS aims to encourage more individuals to accurately report their income and pay their fair share of taxes.

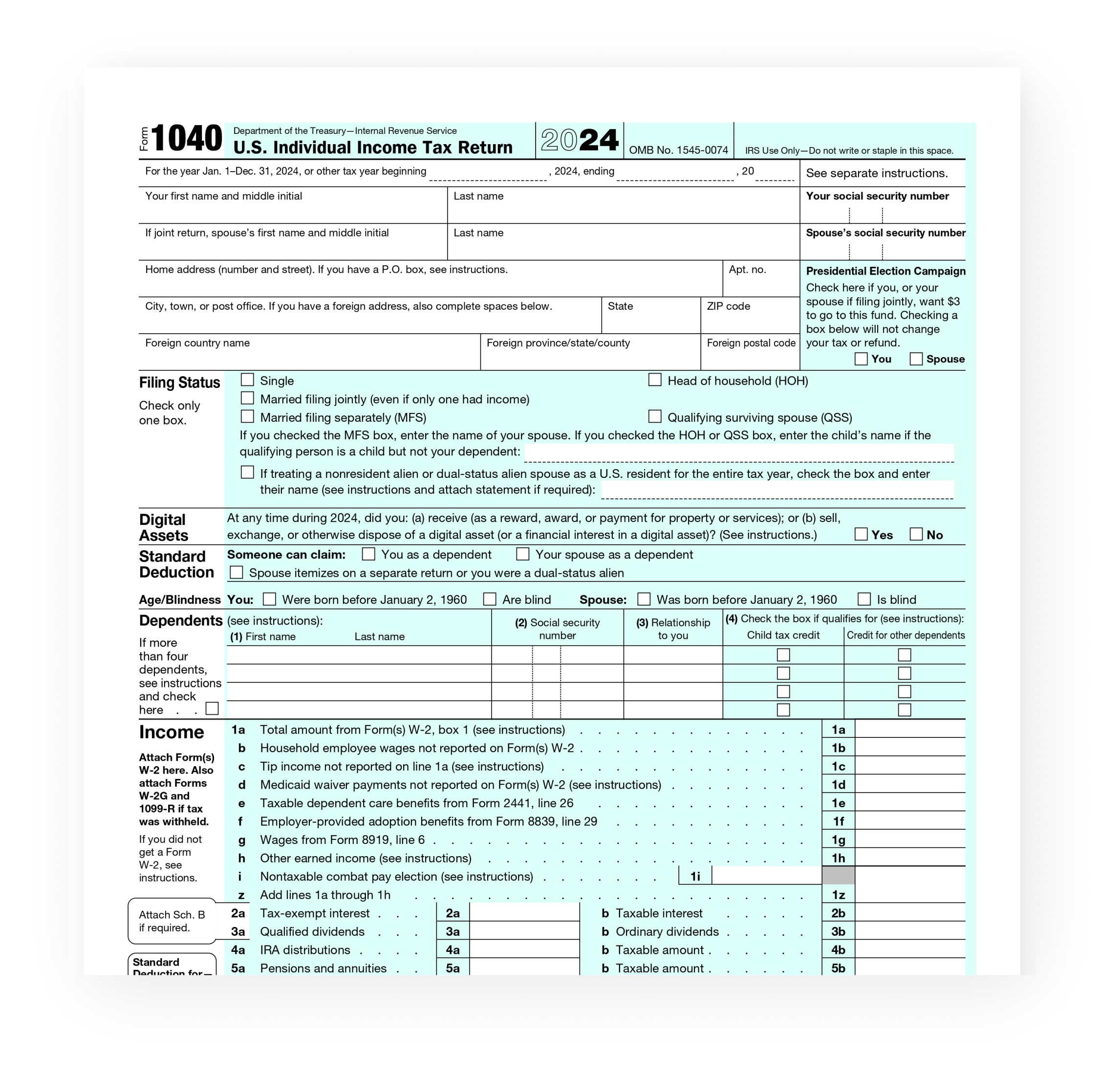

When completing the IRS 1040EZ form, taxpayers will need to provide basic information such as their name, address, social security number, and income details. They will also need to indicate whether they are claiming any deductions or credits, such as the earned income credit. Once the form is completed, taxpayers can either mail it to the IRS or file electronically for faster processing.

It is important for taxpayers to carefully review the instructions provided with the IRS 1040EZ form to ensure that they are accurately reporting their income and claiming any eligible deductions or credits. Filing taxes can be a complex process, but the 1040EZ form simplifies it for those with uncomplicated tax situations. By using this form, taxpayers can save time and reduce the risk of errors in their tax return.

In conclusion, the IRS 1040EZ printable form is a valuable tool for individuals with simple tax situations who want to file their taxes quickly and accurately. By providing a simplified option for reporting income and claiming deductions, the IRS aims to make the tax filing process more accessible to a wider range of taxpayers. Whether you choose to file your taxes by mail or electronically, the 1040EZ form offers a convenient and efficient way to fulfill your tax obligations.

Save and Print Irs 1040ez Printable Form

Payroll printable are ideal for businesses that prefer non-digital systems or need physical copies for employee records. Most forms include fields for employee name, pay period, total earnings, withholdings, and net pay—making them both detailed and easy to use.

Start simplifying your payroll system today with a trusted payroll template. Reduce admin effort, reduce errors, and stay organized—all while keeping your financial logs organized.

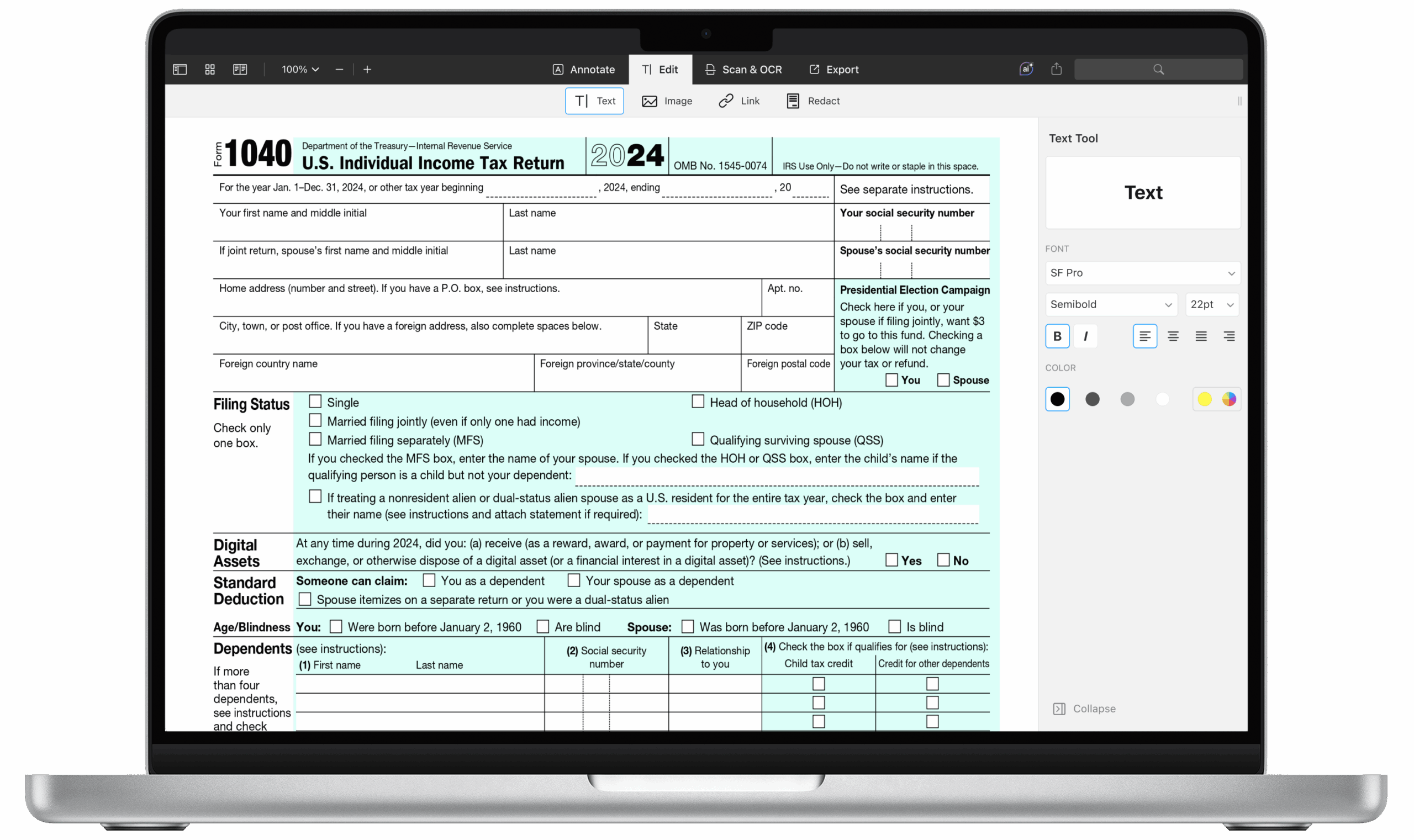

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

Activity Preparing A 1040 Income Tax Form DIY Homeschooler

Activity Preparing A 1040 Income Tax Form DIY Homeschooler

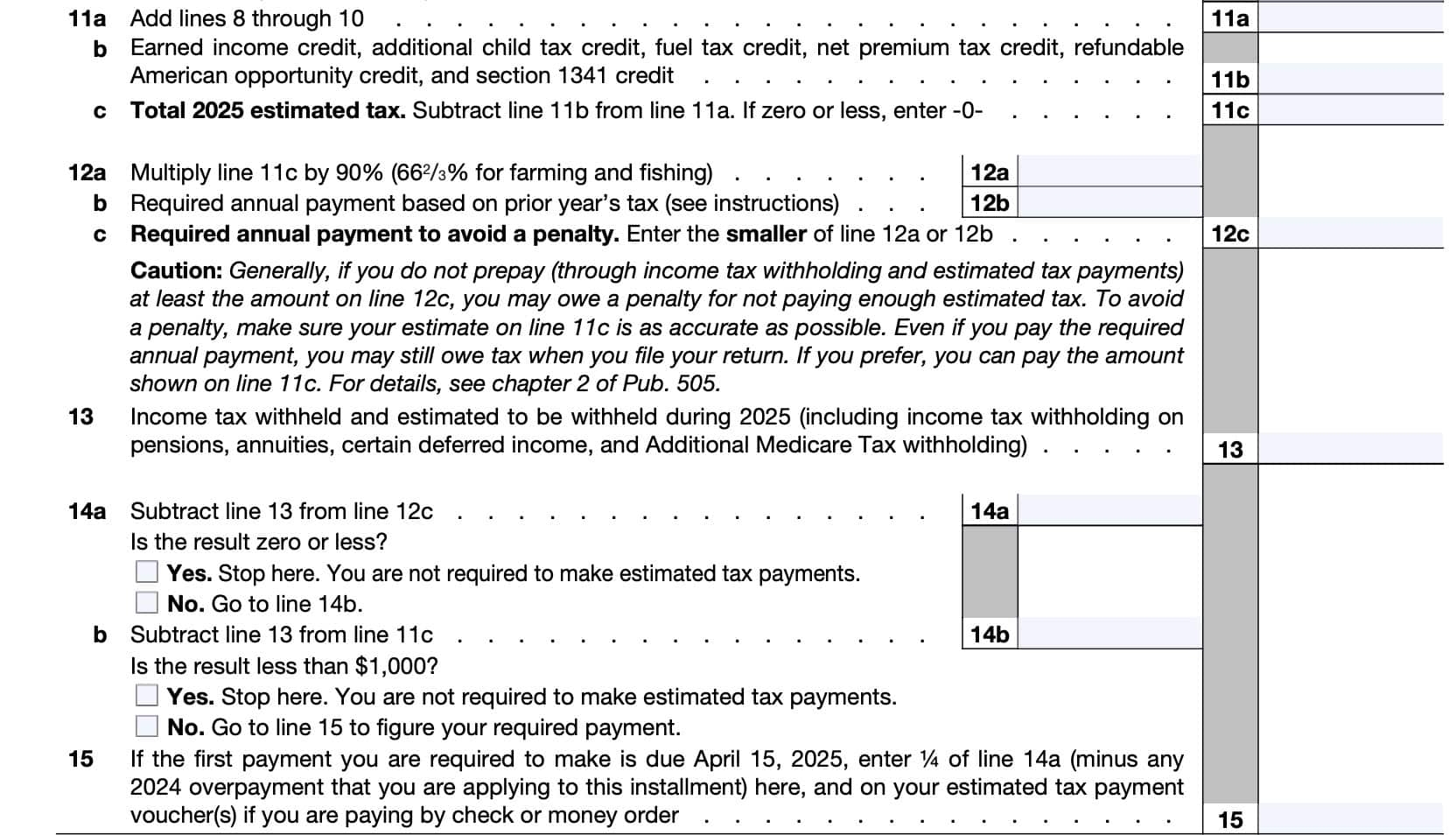

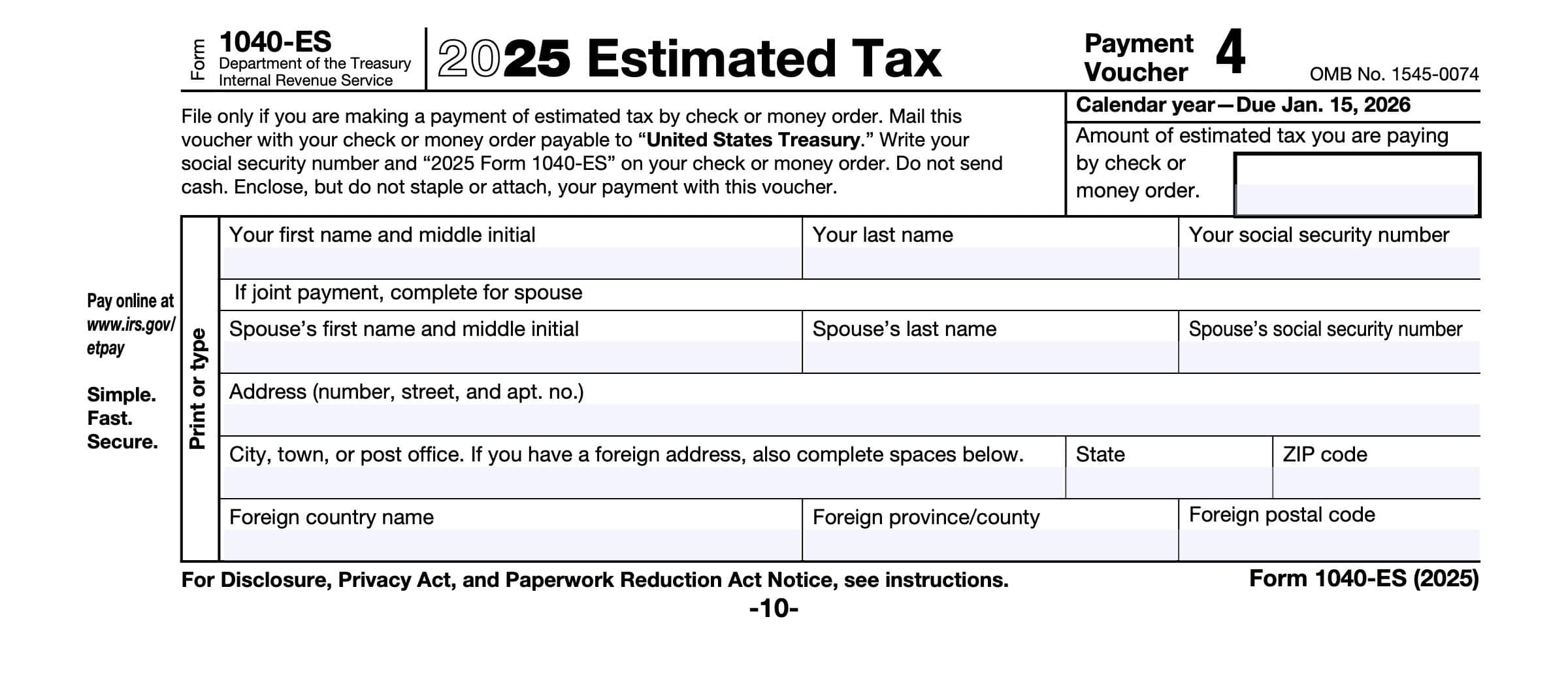

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

Handling payroll tasks doesn’t have to be complicated. A printable payroll template offers a quick, dependable, and user-friendly method for tracking wages, work time, and deductions—without the need for digital systems.

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll helps ensure compliance with regulations. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.