Completing tax forms can be a daunting task for many individuals, but the IRS 1040EZ Form 2024 makes it easier for those with simple tax situations to file their taxes quickly and efficiently. This form is designed for taxpayers who have no dependents, do not itemize deductions, and have an income of less than $100,000.

With the IRS 1040EZ Form 2024 Printable, taxpayers can easily fill out their information, calculate their tax liability, and file their taxes without the need for additional schedules or forms. This simplified form allows individuals to report their income, claim any deductions or credits they may be eligible for, and determine if they owe any taxes or are entitled to a refund.

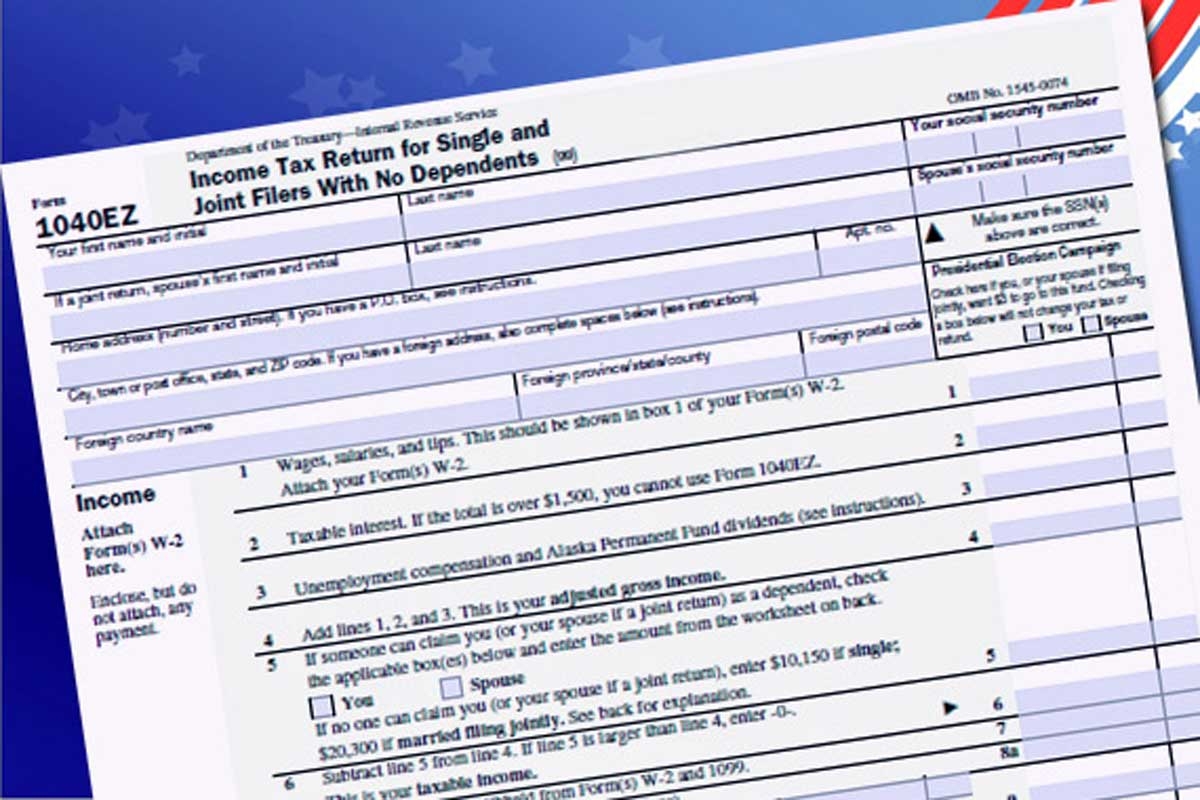

Irs 1040ez Form 2024 Printable

Irs 1040ez Form 2024 Printable

For those who meet the criteria for using the IRS 1040EZ Form 2024, it can be a convenient and efficient way to file their taxes. By following the instructions provided on the form and double-checking their information for accuracy, taxpayers can ensure that their tax return is processed quickly and accurately.

It is important to note that the IRS 1040EZ Form 2024 Printable is only available for certain tax years and may not be applicable for all individuals. Taxpayers should always consult with a tax professional or the IRS website to determine which form is best suited for their individual tax situation.

Overall, the IRS 1040EZ Form 2024 Printable is a useful tool for individuals with simple tax situations to file their taxes quickly and accurately. By taking advantage of this simplified form, taxpayers can streamline the tax filing process and ensure that they are in compliance with the IRS regulations.

As tax season approaches, individuals should consider using the IRS 1040EZ Form 2024 Printable if they meet the eligibility requirements. By doing so, they can save time and effort when filing their taxes and ensure that they are in good standing with the IRS.