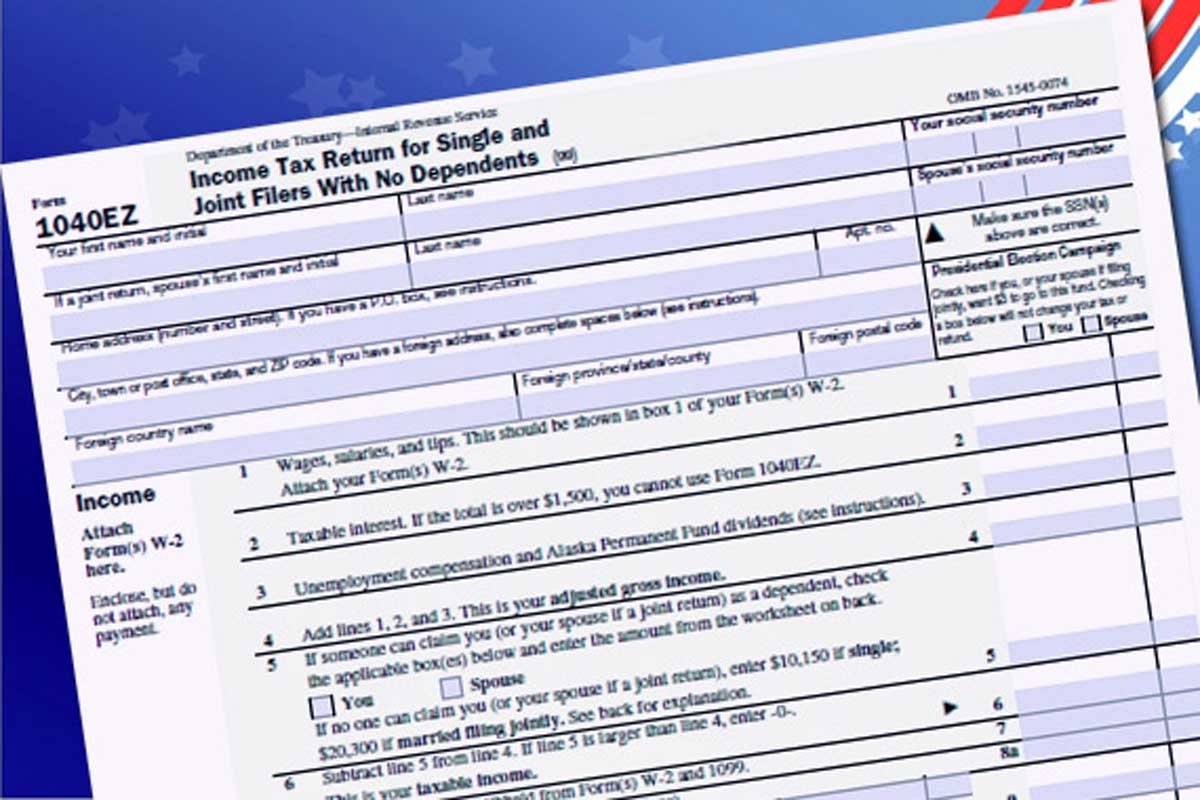

As tax season approaches, many Americans are starting to gather their documents and prepare to file their taxes. One essential form that most individuals will need to fill out is the IRS 1040 Form. This form is used to report an individual’s income, deductions, and credits for the year, and ultimately determines how much tax they owe or are owed in return.

For those looking for a convenient and cost-effective way to file their taxes, the IRS 1040 Form 2024 Printable Free is the perfect solution. This downloadable form can be easily accessed online and printed out at home, saving taxpayers time and money on purchasing physical forms or hiring a professional tax preparer.

Irs 1040 Form 2024 Printable Free

Irs 1040 Form 2024 Printable Free

IRS 1040 Form 2024 Printable Free

With the IRS 1040 Form 2024 Printable Free, taxpayers can accurately report their income, claim deductions and credits, and calculate their tax liability in a straightforward manner. The form comes with detailed instructions to help individuals fill it out correctly and ensure they are taking advantage of all available tax breaks.

One of the benefits of using the IRS 1040 Form 2024 Printable Free is the ability to file electronically, which can speed up the processing of your return and help you receive any refunds more quickly. Additionally, by using this free form, taxpayers can avoid the hassle of waiting in line at the post office or dealing with paper forms that can easily get lost in the mail.

Overall, the IRS 1040 Form 2024 Printable Free is a convenient and user-friendly option for individuals looking to file their taxes accurately and efficiently. By taking advantage of this free resource, taxpayers can save time and money while ensuring they are in compliance with all tax laws and regulations.

So, as tax season approaches, be sure to download the IRS 1040 Form 2024 Printable Free and make the process of filing your taxes a breeze. With this handy form, you can take control of your finances and ensure that you are meeting your tax obligations in a timely and accurate manner.