Illinois state income tax forms for trusts are essential for ensuring that trusts comply with state tax regulations. By accurately filling out these forms, trustees can avoid penalties and ensure that the trust is in good standing with the Illinois Department of Revenue.

Trusts are separate legal entities that are subject to their own tax obligations. Trustees must file state income tax returns for trusts in Illinois if the trust generates income or has property located in the state. Failure to file these returns can result in fines and legal consequences.

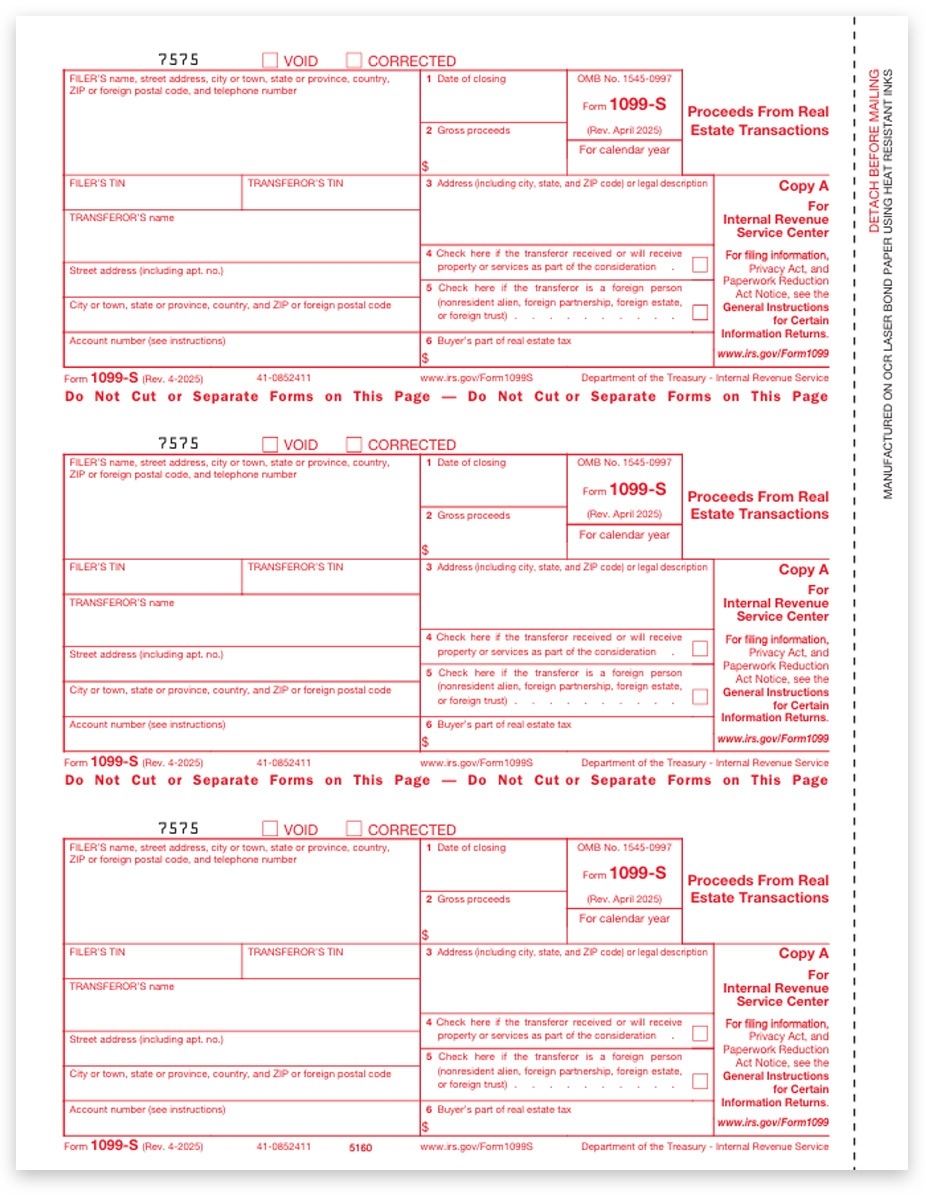

Illinois State Income Tax Form For Trusts Printable

Illinois State Income Tax Form For Trusts Printable

Illinois State Income Tax Form For Trusts Printable

Illinois provides printable state income tax forms for trusts on the Illinois Department of Revenue website. Trustees can easily access these forms online and print them out for completion. The forms typically require information about the trust’s income, deductions, and credits for the tax year.

When filling out the Illinois state income tax form for trusts, trustees must ensure that all information is accurate and up-to-date. Any errors or omissions could lead to delays in processing the return or trigger an audit by the state tax authorities. It is important to review the form carefully before submitting it.

Trustees may also need to include additional documentation with the Illinois state income tax form for trusts, such as schedules detailing specific income sources or deductions. It is important to follow the instructions provided with the form to ensure that all required information is included.

Once the Illinois state income tax form for trusts is completed, trustees can submit it to the Illinois Department of Revenue by mail or electronically, depending on the instructions provided. It is important to keep a copy of the completed form for your records and to track the status of the return.

In conclusion, trustees of trusts in Illinois must ensure that they accurately complete and file the state income tax form for trusts to comply with state tax regulations. By following the instructions provided and submitting the form on time, trustees can avoid penalties and ensure that the trust remains in good standing with the Illinois Department of Revenue.