As tax season approaches, it’s important for Idaho residents to familiarize themselves with the Idaho Individual Income Tax Form for 2019. This form is used to report and pay state income taxes on any income earned throughout the year. Filing taxes can be a daunting task, but having the proper forms and information can make the process much smoother.

Idaho residents can access the printable version of the Idaho Individual Income Tax Form for 2019 online or at their local tax office. It’s important to fill out this form accurately and completely to avoid any penalties or delays in processing. This form will require information such as income earned, deductions, credits, and any taxes already paid.

Idaho Individual Income Tax Form 2019/Printable

Idaho Individual Income Tax Form 2019/Printable

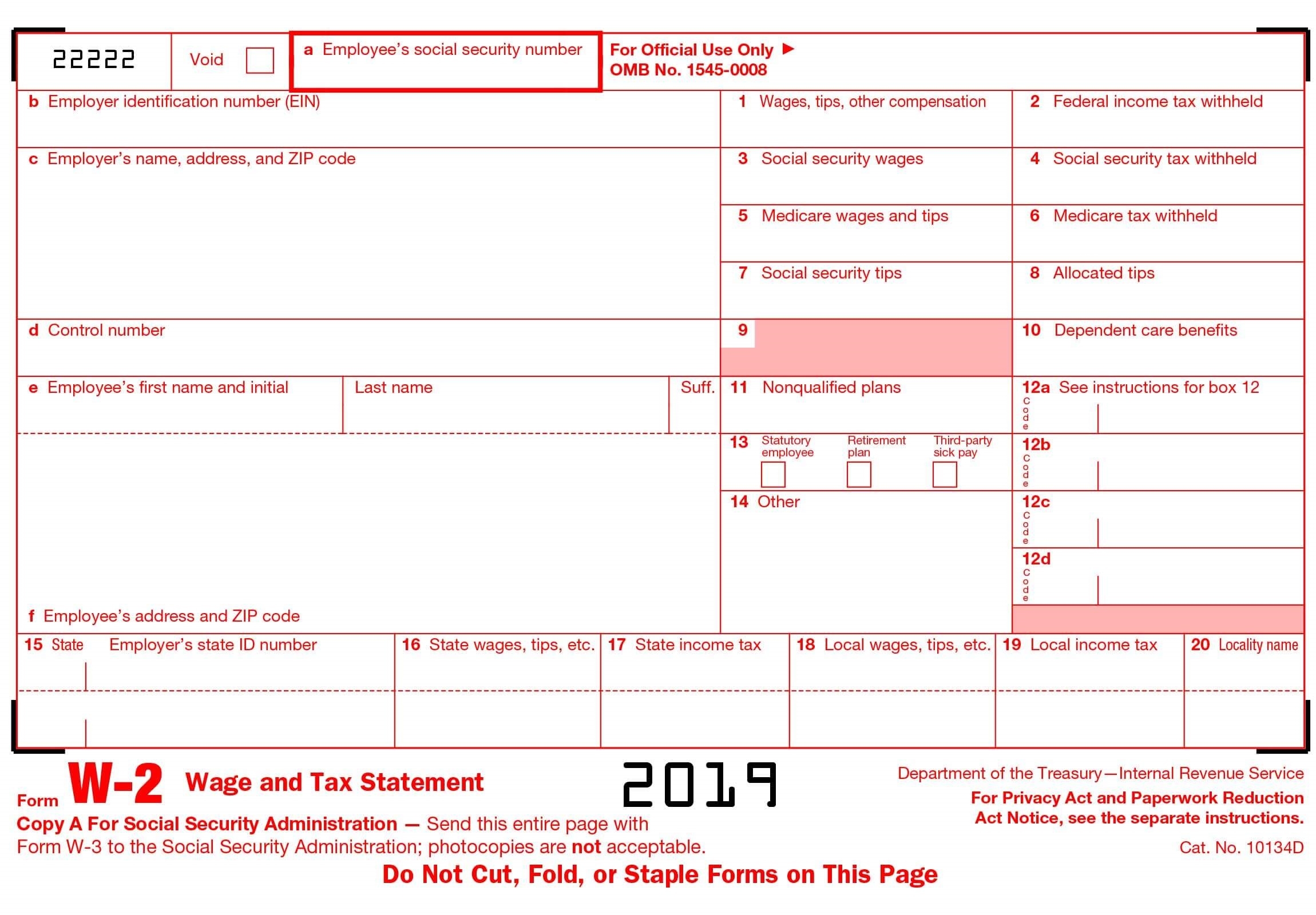

When filling out the Idaho Individual Income Tax Form for 2019, taxpayers should double-check all information to ensure accuracy. Any mistakes or discrepancies could result in delays in processing or even audits. It’s also important to keep all relevant documentation, such as W-2 forms and receipts, on hand in case they are needed to support the information provided on the form.

Once the Idaho Individual Income Tax Form for 2019 is completed, taxpayers can submit it online or by mail. It’s important to file taxes by the deadline to avoid any late fees or penalties. If taxpayers are unable to pay the full amount owed, they can set up a payment plan with the Idaho State Tax Commission to avoid further consequences.

Overall, the Idaho Individual Income Tax Form for 2019 is an essential document for Idaho residents to accurately report and pay their state income taxes. By taking the time to fill out this form correctly and on time, taxpayers can ensure a smooth tax season and avoid any unnecessary complications.

As tax season approaches, be sure to download and print the Idaho Individual Income Tax Form for 2019 to get started on filing your state income taxes. Remember to double-check all information, keep documentation handy, and file by the deadline to avoid any issues. Happy filing!