When it comes to filing income tax for heavy weight trucks in California, Form 2290 is the required document. This form is used to report and pay the federal excise tax on heavy vehicles with a gross weight of 55,000 pounds or more. It is important for truck owners and operators to understand the process of filing Form 2290 and ensure they comply with all tax regulations.

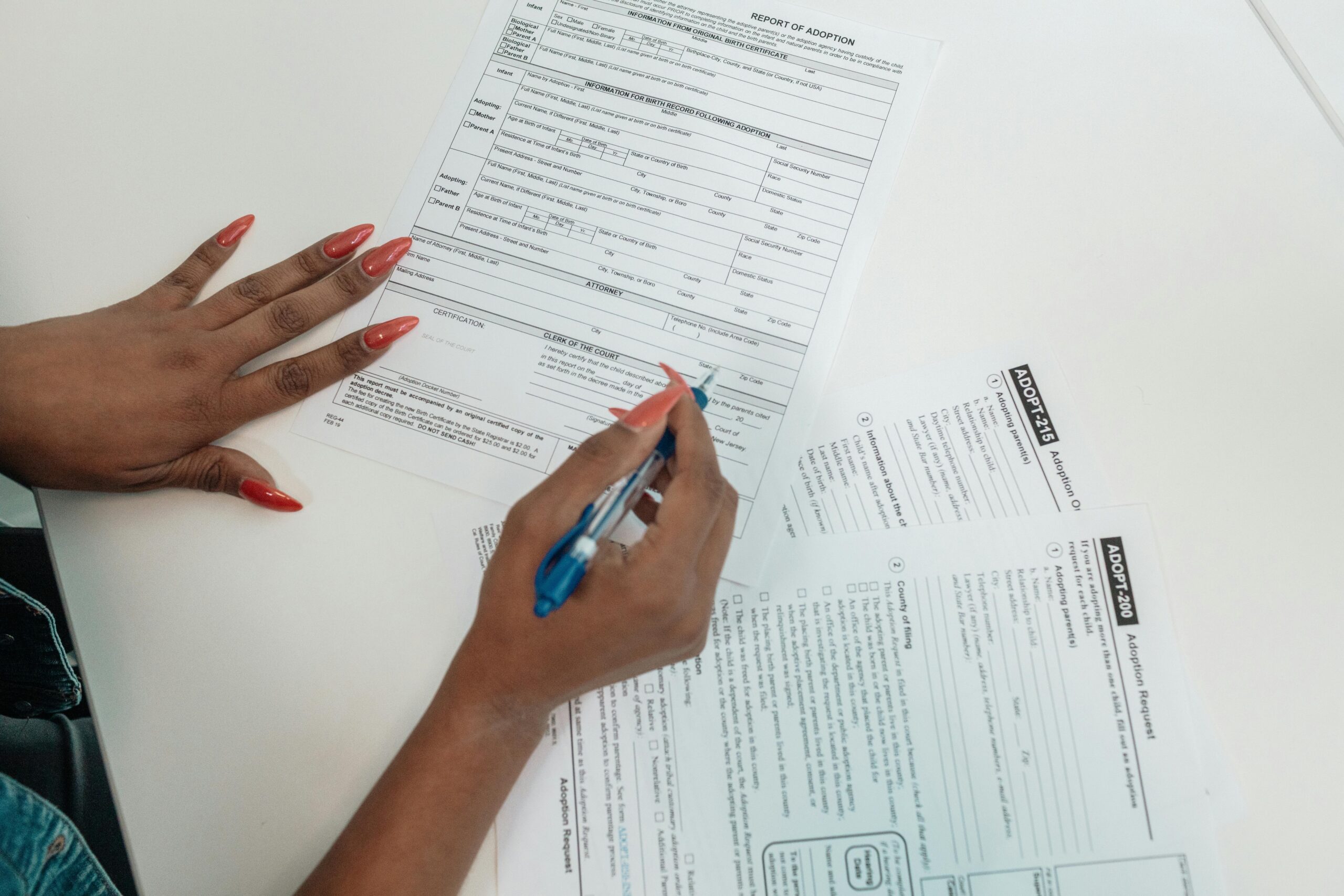

Form 2290 can be printed and filled out manually or filed electronically through the IRS e-file system. For those who prefer to file a paper form, the IRS provides a printable version of Form 2290 on their website. This form includes sections for reporting the taxable gross weight of the vehicle, as well as any credits or refunds that may apply.

Heavy Weight Truck Income Tax Ca Form 2290 Printable

Heavy Weight Truck Income Tax Ca Form 2290 Printable

Truck owners must ensure they have the necessary information on hand before filling out Form 2290, including the vehicle identification number (VIN) and the gross weight of the vehicle. It is important to accurately report this information to avoid any penalties or fines for incorrect filings.

After completing Form 2290, truck owners must submit the form along with payment of the federal excise tax to the IRS by the annual due date. Failure to file or pay the tax on time can result in penalties and interest charges, so it is important to adhere to the deadline.

Overall, understanding the process of filing Form 2290 for heavy weight trucks in California is essential for truck owners and operators. By following the guidelines and ensuring accurate reporting of information, individuals can avoid costly penalties and remain compliant with tax regulations.

In conclusion, Form 2290 is a necessary document for reporting and paying the federal excise tax on heavy weight trucks in California. Truck owners can choose to file the form manually or electronically, with a printable version available on the IRS website. By staying informed and complying with tax regulations, truck owners can effectively manage their tax responsibilities and avoid any potential issues with the IRS.