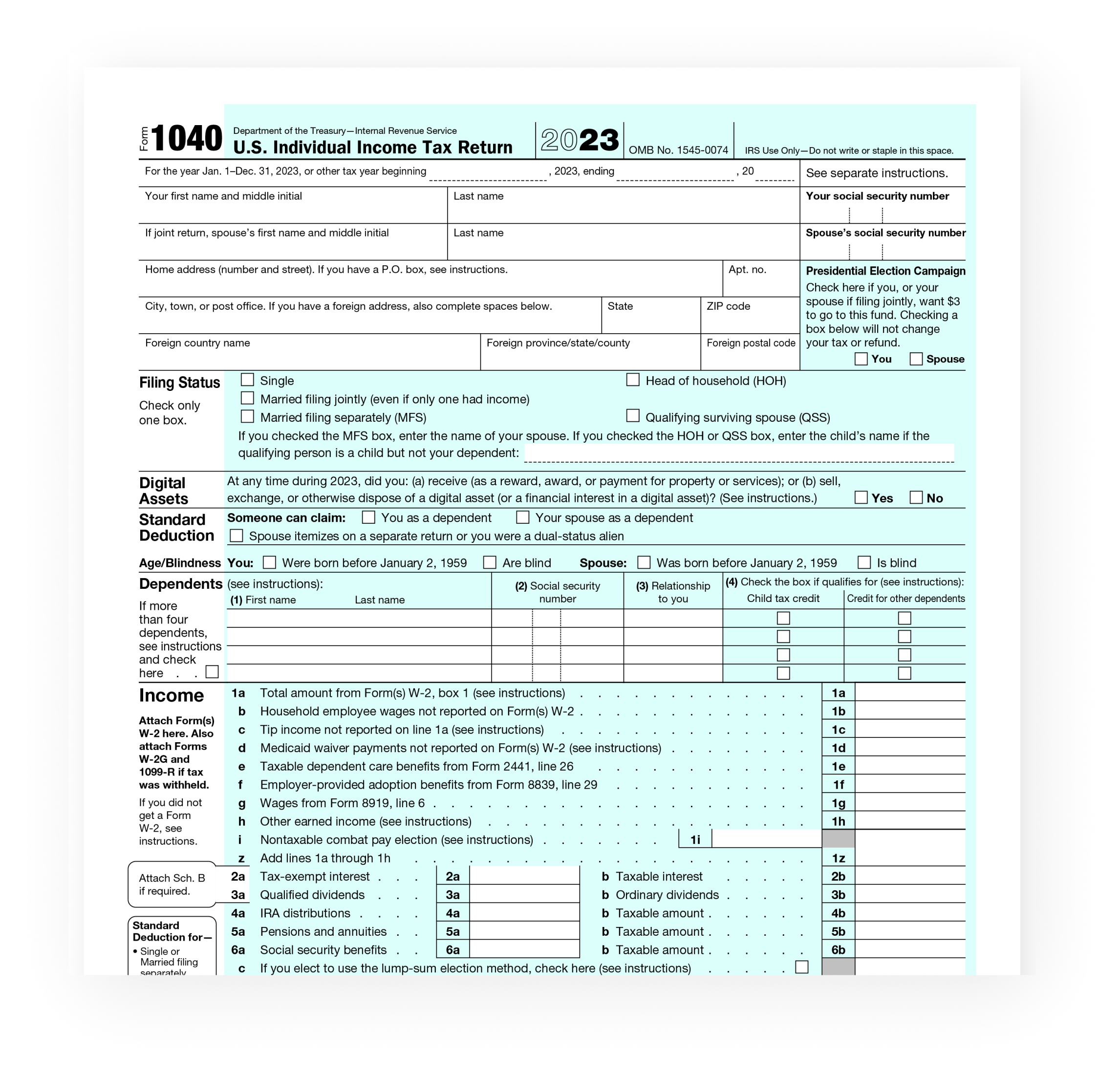

When tax season rolls around, many individuals are looking for an easy and convenient way to file their taxes. One option that is available is the IRS Form 1040, which is the standard form used by taxpayers to report their annual income and calculate their tax liability. This form can be easily accessed and printed for free, making it a popular choice for those who prefer to file their taxes on their own.

With the availability of free printable IRS Form 1040, individuals can save time and money by avoiding the need to purchase tax forms or hire a professional to prepare their taxes. This form can be easily found on the IRS website and can be printed out from the comfort of your own home. It provides a straightforward way to report your income, deductions, and credits, making the tax filing process much simpler.

When using the free printable IRS Form 1040, it is important to carefully review the instructions and ensure that you are accurately reporting all of your income and deductions. This form is designed to help taxpayers calculate their tax liability and determine if they owe any additional taxes or are eligible for a refund. By following the instructions and double-checking your work, you can ensure that your taxes are filed correctly and avoid any potential errors or penalties.

One of the benefits of using the free printable IRS Form 1040 is that it is available in a fillable PDF format, allowing you to easily input your information directly into the form. This can help to reduce errors and make the filing process more efficient. Additionally, the form includes helpful tips and guidance to assist you in completing each section accurately.

Overall, the free printable IRS Form 1040 provides a convenient and cost-effective option for individuals who prefer to file their taxes on their own. By taking the time to carefully review the instructions and accurately report your income and deductions, you can successfully navigate the tax filing process and ensure that your taxes are filed correctly. So why wait? Make use of this free resource and take control of your taxes today.

Closing Thoughts

With the availability of free printable IRS Form 1040, taxpayers have a convenient and cost-effective option for filing their taxes on their own. By following the instructions and accurately reporting your income and deductions, you can successfully navigate the tax filing process and avoid any potential errors or penalties. So take advantage of this free resource and simplify your tax filing experience today.

Easily Download and Print Free Printable Irs Form 1040

Printable payroll template are ideal for companies that prefer non-digital systems or need physical copies for employee records. Most forms include fields for employee name, pay period, total earnings, taxes, and final salary—making them both complete and practical.

Start simplifying your payroll system today with a trusted payroll printable. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your payroll records professional.

Free 1040 Form Generator Fillable 1040 By Jotform

Free 1040 Form Generator Fillable 1040 By Jotform

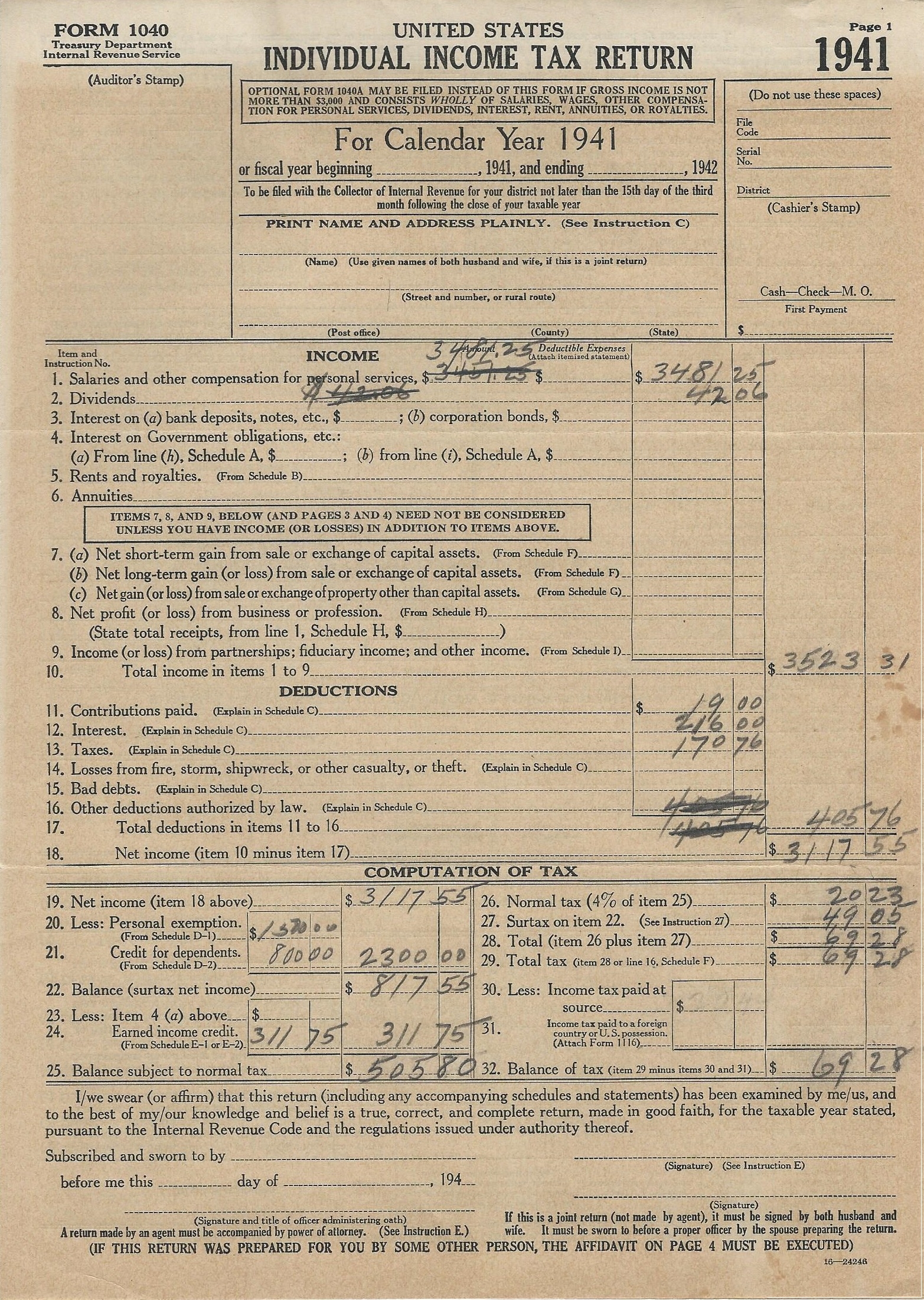

File Form 1040 1941 Jpg Wikimedia Commons

File Form 1040 1941 Jpg Wikimedia Commons

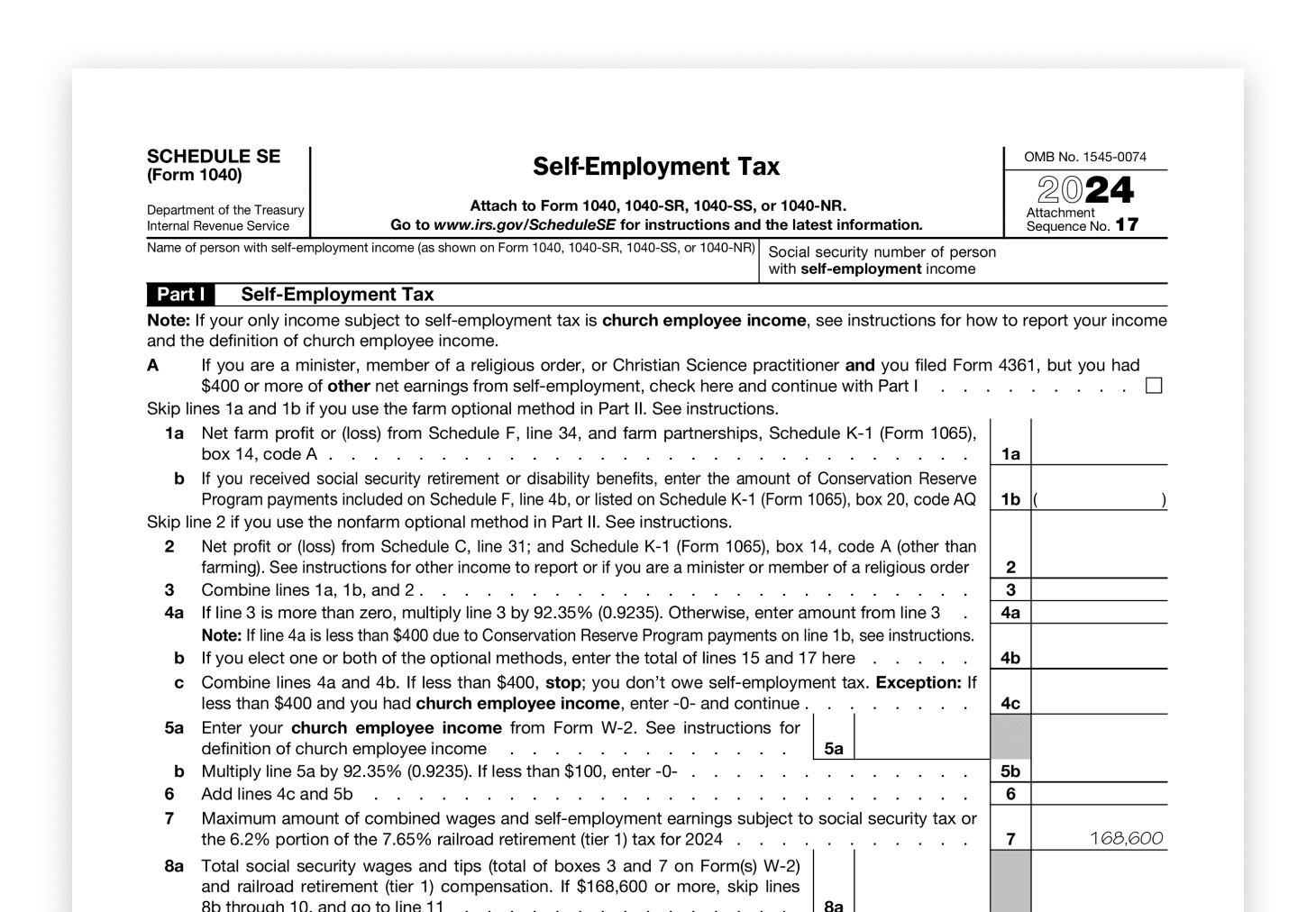

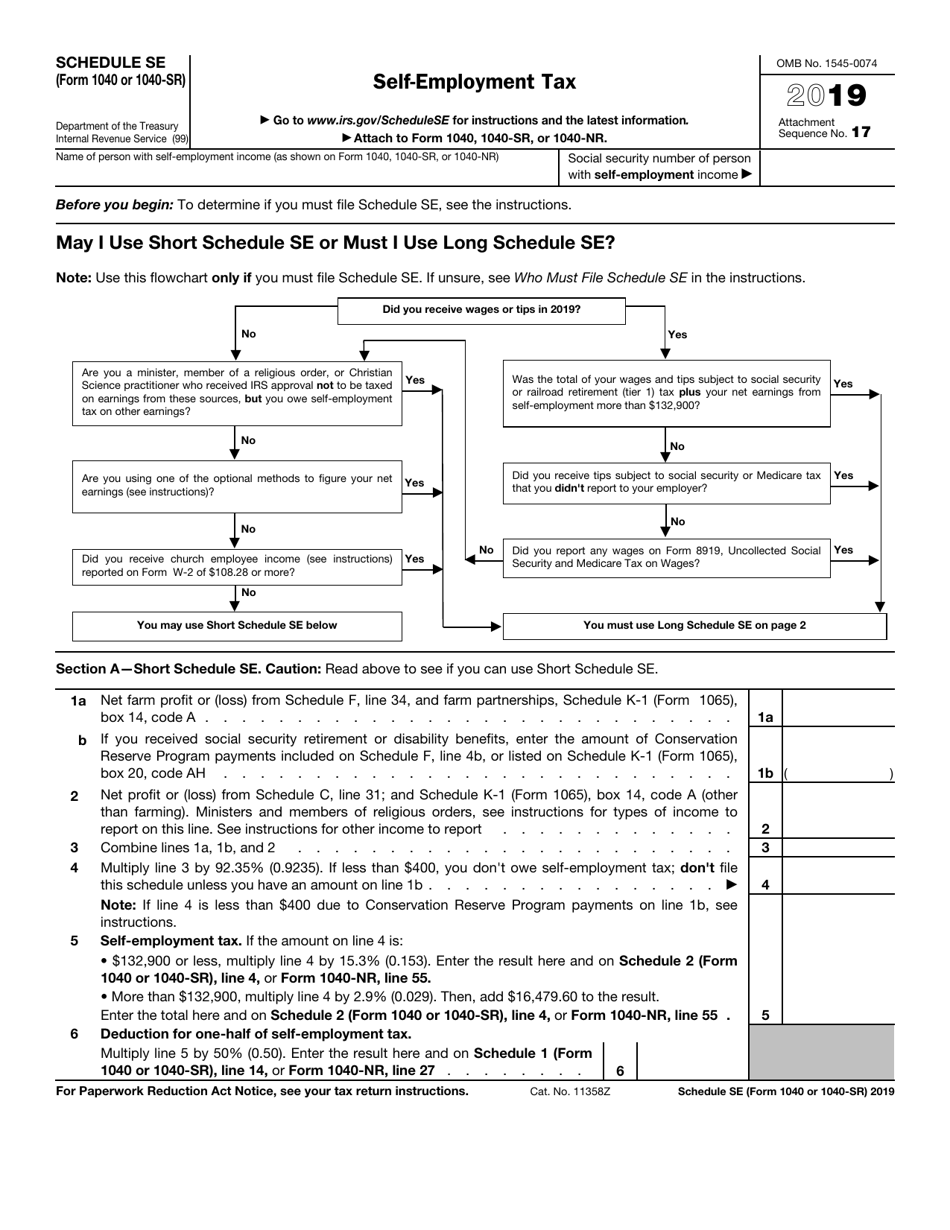

IRS Form 1040 1040 SR Schedule SE 2019 Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 1040 1040 SR Schedule SE 2019 Fill Out Sign Online And Download Fillable PDF Templateroller

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES Worksheets Library

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES Worksheets Library

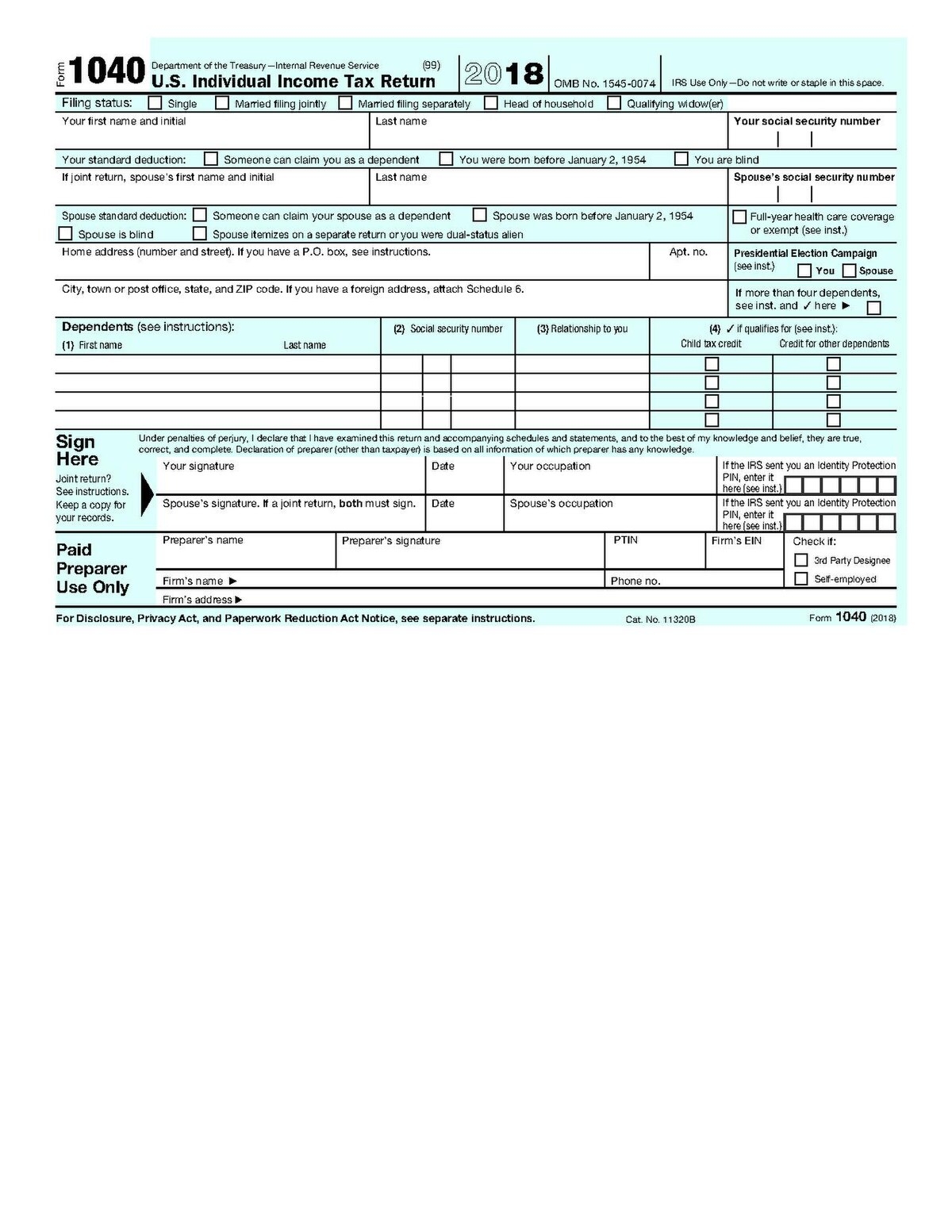

File IRS Form 1040 2018 Pdf Wikimedia Commons

File IRS Form 1040 2018 Pdf Wikimedia Commons

Managing employee payments doesn’t have to be complicated. A printable payroll form offers a fast, reliable, and easy-to-use method for tracking salaries, work time, and withholdings—without the need for digital systems.

Whether you’re a small business owner, HR professional, or independent contractor, using aprintable payroll form helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.