Managing your finances can be a daunting task, especially when it comes to keeping track of your spending and transactions. One of the most effective ways to stay on top of your finances is by maintaining a checking account register. This simple tool allows you to record all of your deposits, withdrawals, and other transactions, giving you a clear picture of your financial health.

However, many people struggle to find a checking account register that suits their needs. Fortunately, there are free printable options available online that can help you stay organized and in control of your finances.

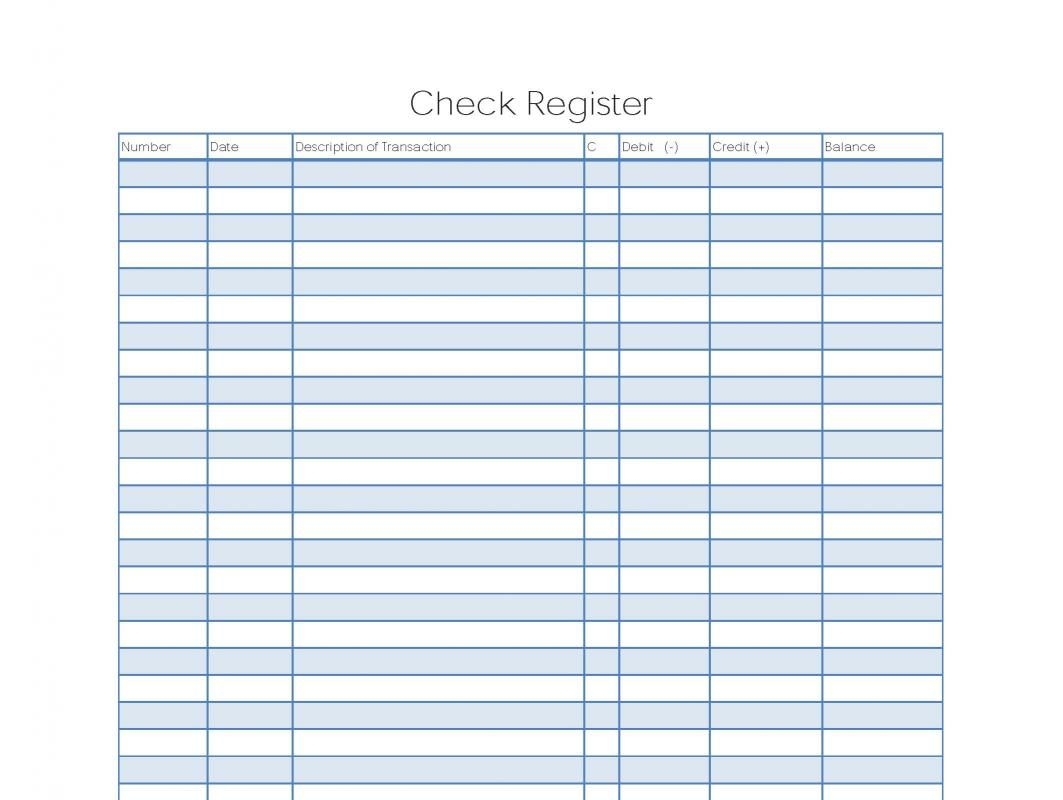

Free Printable Checking Account Register

Free Printable Checking Account Register

Managing staff wages doesn’t have to be difficult. A payroll printable offers a speedy, accurate, and user-friendly method for tracking salaries, shifts, and taxes—without the need for complex software.

Keep Payroll in Order with a Free Printable Checking Account Register – Straightforward & Effective Solution!

Whether you’re a startup founder, payroll manager, or independent contractor, using apayroll template helps ensure proper documentation. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.

Free Printable Checking Account Register

One of the best ways to stay on top of your finances is by using a checking account register. This simple tool allows you to track all of your transactions, including deposits, withdrawals, and other expenses. By keeping a detailed record of your finances, you can easily identify any discrepancies or errors, and make adjustments as needed.

There are many free printable checking account registers available online that you can download and use for your own financial tracking. These templates are easy to use and customize, allowing you to tailor them to your specific needs. Whether you prefer a basic layout or a more detailed format, there are options available that can help you stay organized and in control of your finances.

Using a checking account register can also help you identify any patterns or trends in your spending habits. By tracking your transactions over time, you can see where your money is going and make adjustments to your budget as needed. This can help you save money, avoid unnecessary expenses, and reach your financial goals more quickly.

In conclusion, keeping a checking account register is an essential tool for managing your finances. By using a free printable template, you can easily track your transactions, identify any errors or discrepancies, and stay on top of your financial health. Take advantage of these resources available online and start organizing your finances today!