Form W-9 is a document often requested by employers or clients from independent contractors, freelancers, or other individuals who provide services on a non-employee basis. The form is used to gather the taxpayer identification number (TIN) of the individual or entity, which is necessary for reporting income to the Internal Revenue Service (IRS).

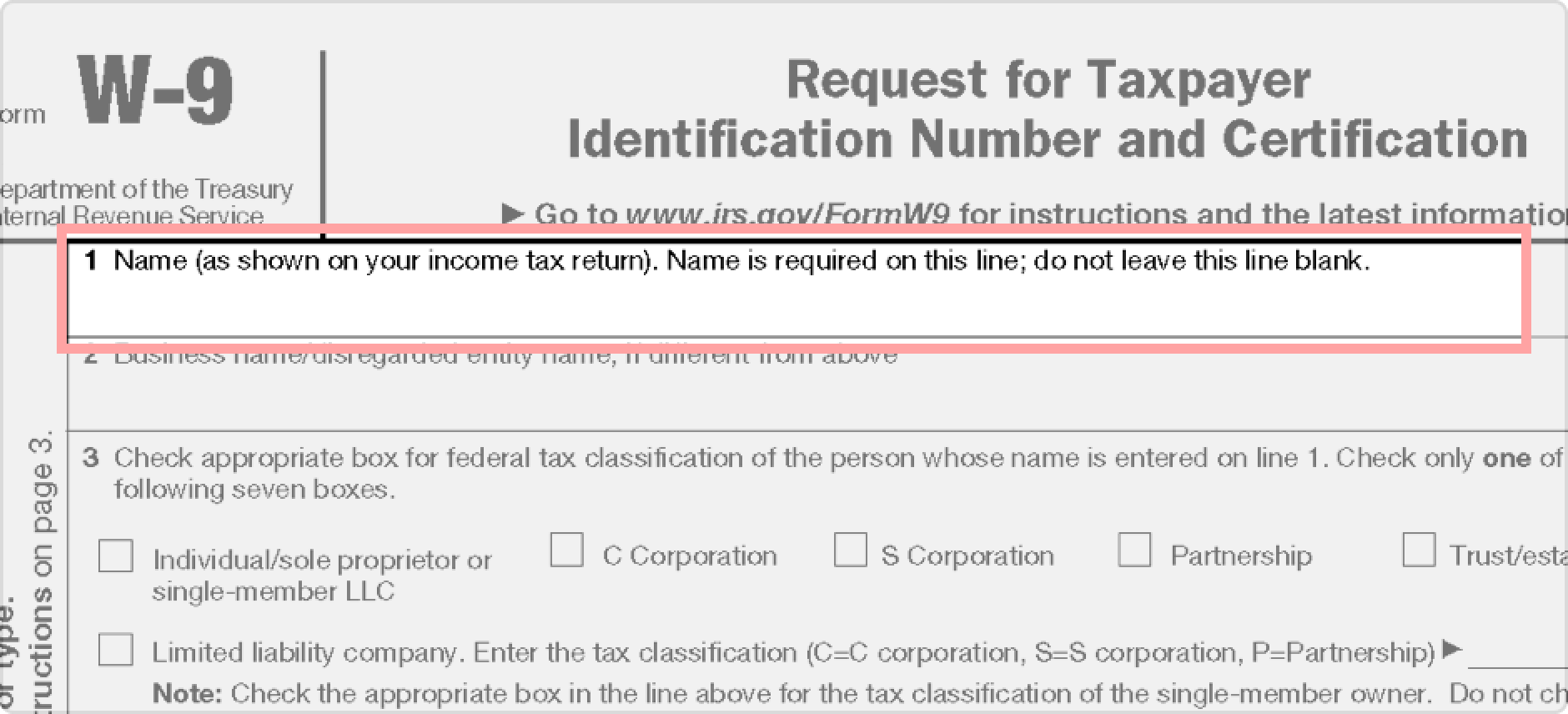

When filling out a Form W-9, the individual or entity must provide their name, address, and TIN. The form also includes a certification that the information provided is accurate and that the individual is not subject to backup withholding. It is important to fill out the form correctly to avoid any issues with tax reporting or payments.

Form W-9 Printable

Form W-9 is readily available for download and printing from the IRS website. The form is typically a one-page document that can be easily filled out by hand or electronically. It is important to ensure that the latest version of the form is used to avoid any discrepancies or errors in reporting.

Once the Form W-9 is completed, it should be provided to the requesting party, such as an employer or client. The information provided on the form will be used to generate Form 1099, which is used to report income paid to the individual or entity during the tax year. It is important to keep a copy of the completed form for your records.

It is important to note that individuals or entities who receive income through Form 1099 are responsible for reporting that income on their tax return. Failure to accurately report income can result in penalties or fines from the IRS. By completing Form W-9 accurately and promptly, individuals can ensure that their income is properly reported and avoid any potential issues with the IRS.

In conclusion, Form W-9 is a crucial document for individuals or entities who receive income on a non-employee basis. By providing accurate information on the form, individuals can ensure that their income is properly reported to the IRS and avoid any potential issues with tax reporting. It is important to fill out the form promptly and keep a copy for your records to ensure compliance with tax regulations.