Form 1099 is a series of documents used for reporting various types of income other than wages, salaries, and tips. These forms are important for tax reporting purposes and are often required to be submitted by businesses and individuals to the IRS.

Form 1099 Printable refers to the option of downloading and printing these forms from the IRS website or other authorized sources. This allows taxpayers to easily access the necessary documents without having to wait for them to be mailed.

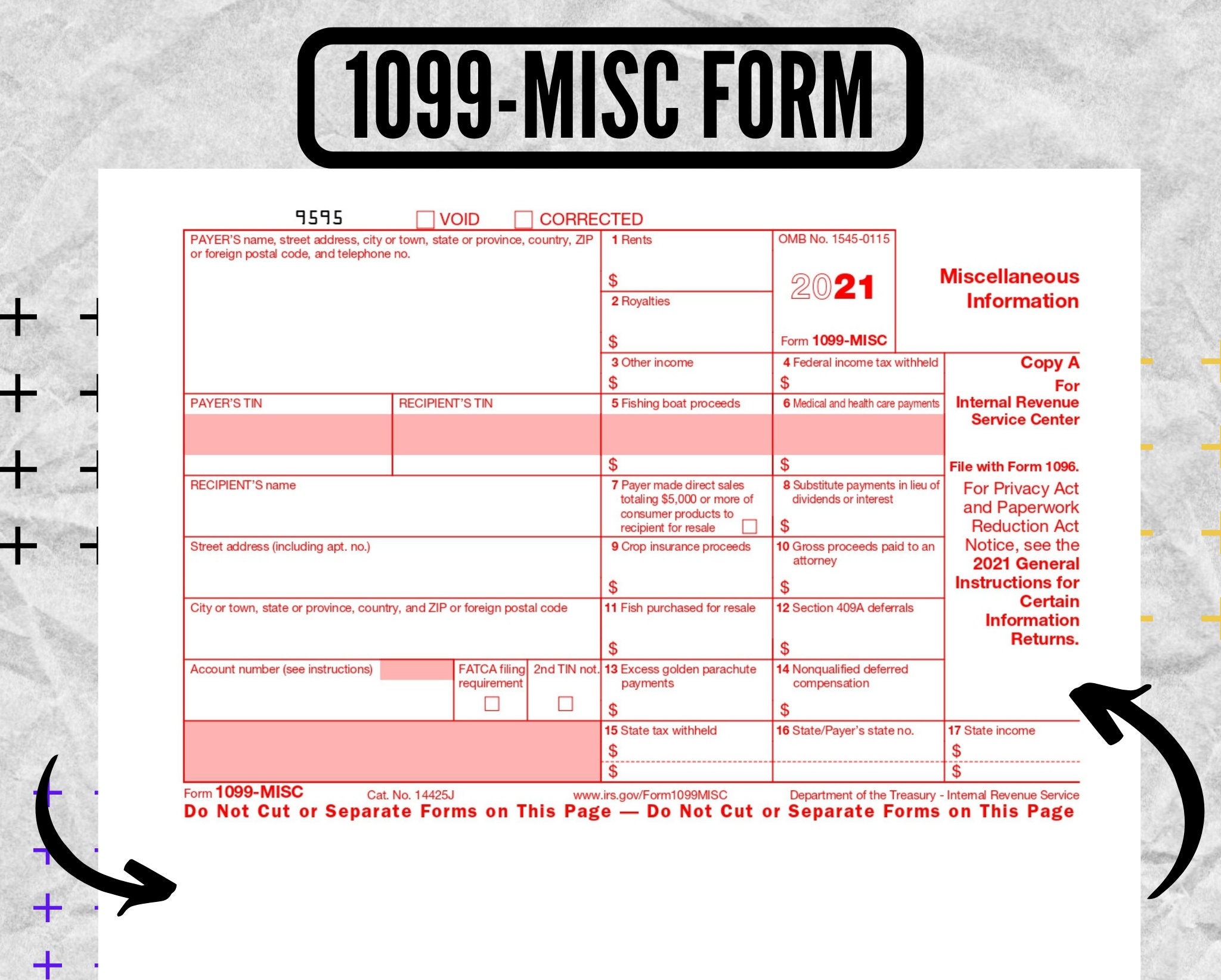

There are several types of Form 1099, each corresponding to different types of income. Some common examples include Form 1099-MISC for miscellaneous income, Form 1099-INT for interest income, and Form 1099-DIV for dividend income.

When preparing your taxes, it is important to ensure that you have all the necessary forms, including any applicable Form 1099s. By utilizing Form 1099 Printable, you can quickly obtain these documents and stay organized during the tax filing process.

It is important to note that Form 1099 Printable is only available for certain types of income and situations. If you are unsure whether you need to file a Form 1099, it is recommended to consult with a tax professional or refer to the IRS guidelines.

Overall, Form 1099 Printable provides a convenient and efficient way to access the necessary tax documents for reporting various types of income. By utilizing this option, taxpayers can ensure they have all the required forms in a timely manner and accurately report their income to the IRS.

Make sure to download and print your Form 1099s well before the tax filing deadline to avoid any delays or penalties. Stay organized and informed throughout the tax season to ensure a smooth and stress-free filing process.