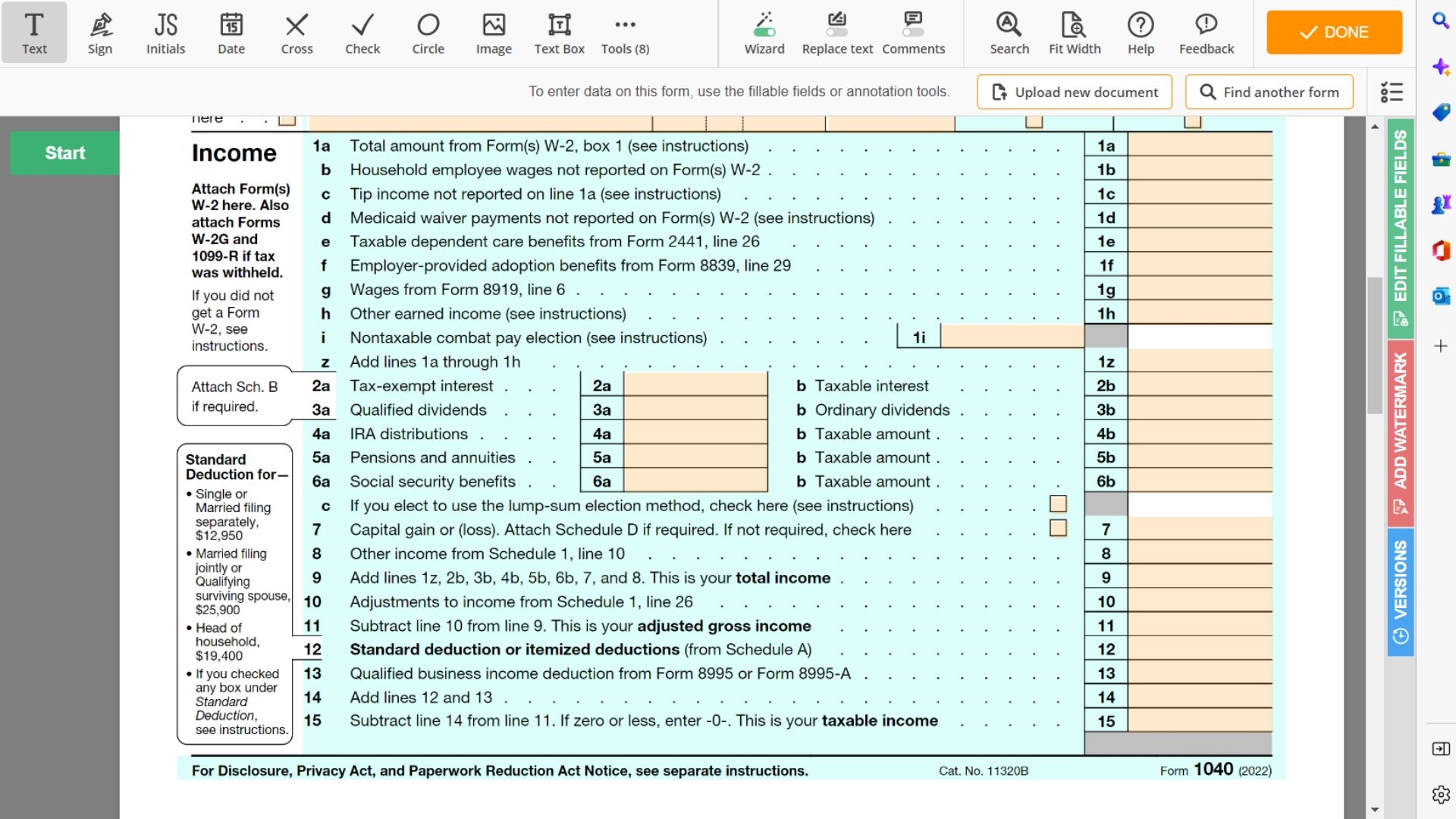

Filing your taxes can be a daunting task, but having the right tools can make the process much easier. One essential form that individuals use to report their annual income and determine any tax liability is Form 1040. This form is used by millions of Americans each year to file their federal income tax returns.

Form 1040 Printable is a convenient option for those who prefer to fill out their tax forms by hand. This form can be easily downloaded from the IRS website and printed out for completion. It provides a clear and organized layout for taxpayers to report their income, deductions, credits, and any taxes owed or refunded.

When filling out Form 1040 Printable, taxpayers must carefully follow the instructions provided by the IRS to ensure accurate reporting of their financial information. It is important to double-check all entries and calculations to avoid any errors that could result in penalties or delays in processing.

One of the advantages of using Form 1040 Printable is that it allows individuals to take their time and work at their own pace when preparing their tax return. This form also serves as a helpful tool for those who prefer to keep hard copies of their financial records for their records.

Another benefit of using Form 1040 Printable is that it can be used by individuals with various income sources, including wages, self-employment income, rental income, and investment income. The form provides different sections for reporting each type of income and allows taxpayers to claim various deductions and credits to reduce their tax liability.

In conclusion, Form 1040 Printable is a valuable resource for individuals who prefer to manually fill out their tax forms. It offers a user-friendly format for reporting income and deductions, and it allows taxpayers to take their time and ensure accuracy in their filings. By utilizing this form, taxpayers can effectively navigate the tax filing process and fulfill their obligations to the IRS.