As tax season approaches, it’s important to be prepared with all the necessary forms to accurately file your taxes. Federal Tax Forms 2024 Printable are essential documents that individuals and businesses need to complete in order to report their income and calculate their tax liability. These forms provide the IRS with the information they need to determine how much tax you owe or how much of a refund you are entitled to.

Whether you’re a seasoned taxpayer or a first-time filer, understanding the various federal tax forms is crucial to ensuring you comply with IRS regulations and avoid any potential penalties. By familiarizing yourself with these forms, you can streamline the tax filing process and ensure that you accurately report your financial information.

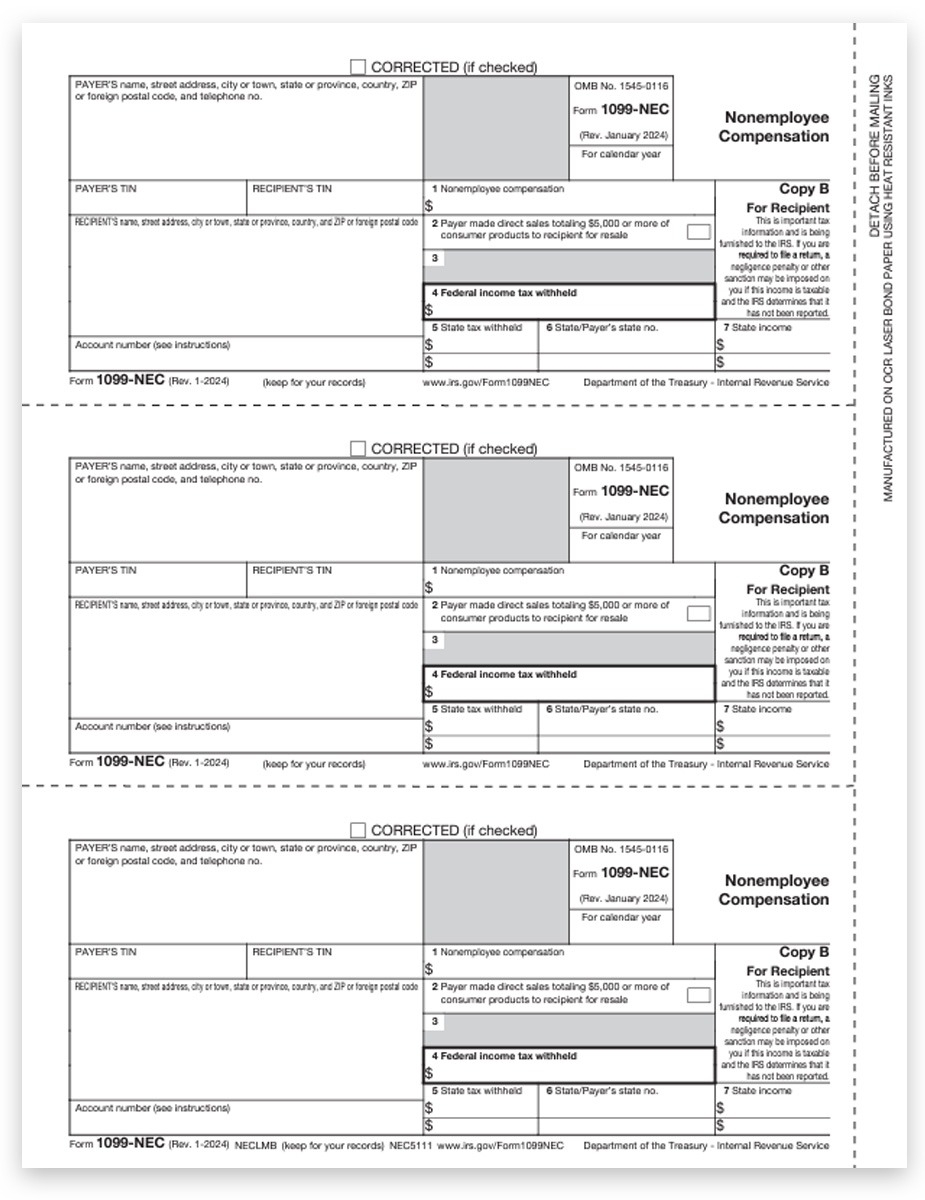

Federal Tax Forms 2024 Printable

Federal Tax Forms 2024 Printable

Federal Tax Forms 2024 Printable

For the tax year 2024, there are several key federal tax forms that individuals and businesses may need to complete. These forms include the 1040, 1040A, and 1040EZ for individual taxpayers, as well as various schedules and worksheets for reporting specific types of income or deductions. Additionally, businesses may need to file forms such as the 1065 for partnerships, 1120 for corporations, and 990 for tax-exempt organizations.

Each form has specific instructions on how to complete it, including which information to include and where to report certain figures. It’s important to carefully review these instructions and double-check your entries to avoid errors that could delay the processing of your tax return. Additionally, be sure to keep copies of all your tax forms and supporting documentation for your records.

When it comes to filing your taxes, accuracy is key. Even a small mistake or oversight can result in penalties or delays in receiving your refund. By taking the time to familiarize yourself with the various federal tax forms and ensuring that you complete them correctly, you can make the tax filing process smoother and more efficient.

In conclusion, Federal Tax Forms 2024 Printable are essential documents that individuals and businesses need to file their taxes accurately and in compliance with IRS regulations. By understanding the various forms and instructions, you can navigate the tax filing process with confidence and peace of mind. Be sure to gather all necessary forms and documentation before filing your taxes to ensure a smooth and successful tax season.