As tax season approaches, it’s important to be prepared with all the necessary forms and documents to ensure a smooth filing process. One essential document that taxpayers will need is the Federal Income Tax Forms 2024. These forms are crucial for accurately reporting income, deductions, and credits to determine the amount of tax owed to the government.

For the year 2024, the IRS has made available printable versions of the federal income tax forms on their website. This makes it convenient for taxpayers to access and fill out the forms from the comfort of their own homes. Whether you are filing as an individual, a business, or a corporation, there are specific forms that you will need to complete based on your financial situation.

Federal Income Tax Forms 2024 Printable

Federal Income Tax Forms 2024 Printable

Federal Income Tax Forms 2024 Printable

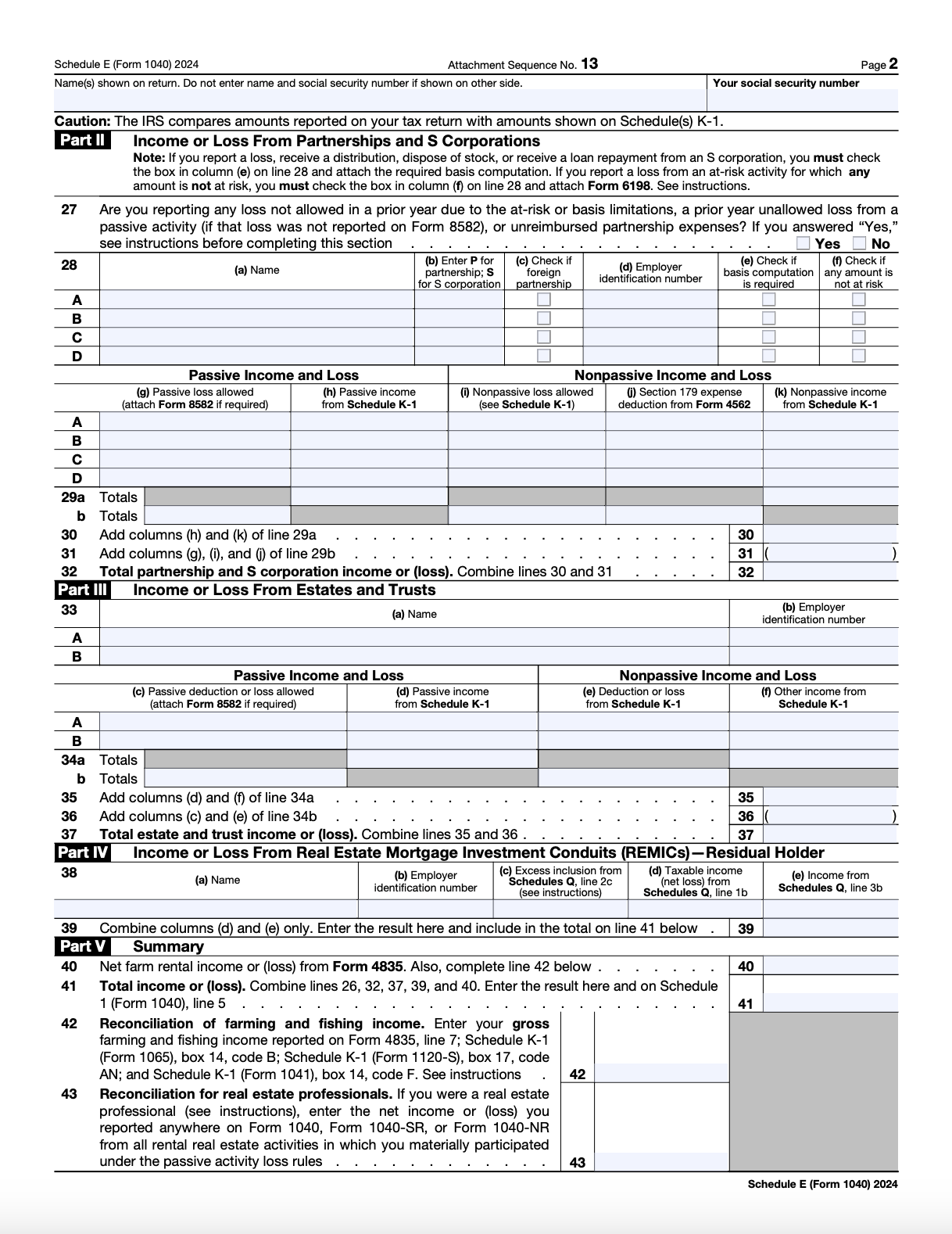

One of the most common forms that individuals will need to fill out is the Form 1040. This form is used to report personal income, deductions, and credits. Additionally, there are various schedules and worksheets that may need to be attached depending on your specific circumstances, such as Schedule A for itemized deductions or Schedule C for self-employment income.

Business owners will need to fill out different forms, such as Form 1065 for partnerships or Form 1120 for corporations. These forms require detailed information about the business’s income, expenses, and deductions. It’s important to accurately report this information to avoid any potential audits or penalties from the IRS.

When filling out the federal income tax forms, it’s crucial to double-check all the information for accuracy. Any errors or discrepancies could result in delays in processing your tax return or even trigger an audit. It’s also important to keep all supporting documents, such as receipts and statements, in case they are needed for verification by the IRS.

In conclusion, being prepared with the necessary federal income tax forms for the year 2024 is essential for a smooth and successful filing process. By accessing the printable forms on the IRS website and diligently filling out the required information, taxpayers can ensure that they are compliant with tax laws and avoid any potential issues with the IRS. Remember to file your taxes on time and accurately to prevent any unnecessary penalties or interest charges.