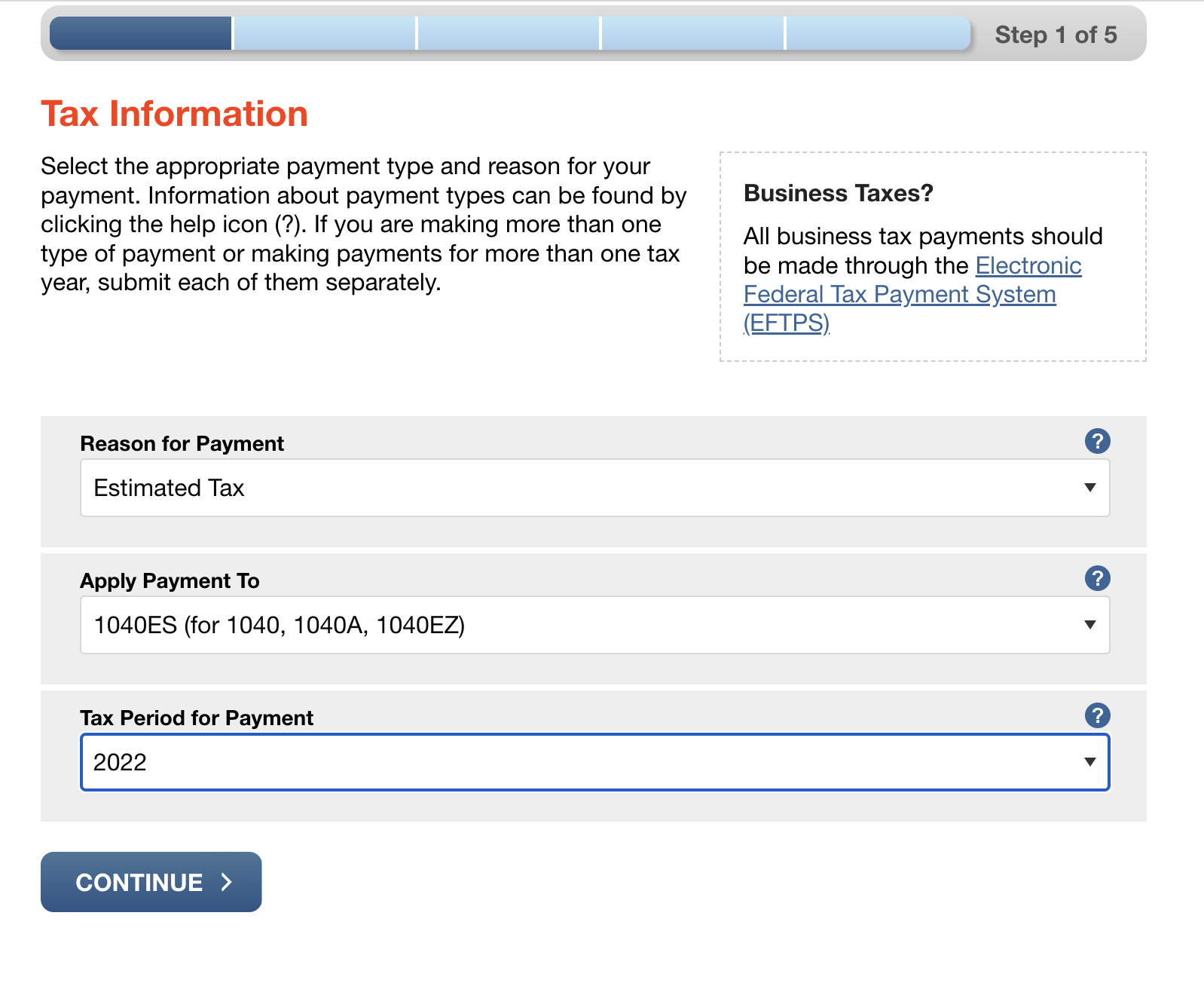

Electronic Federal Tax Payment System (EFTPS) is a convenient way for businesses and individuals to pay their federal taxes online. It offers a secure and easy way to make payments directly from your bank account. One of the forms available for EFTPS payments is the Direct Payment Worksheet Short Form, which allows users to input their payment information quickly and efficiently.

By using the EFTPS Direct Payment Worksheet Short Form, users can make Automated Clearing House (ACH) debit payments for various types of federal taxes, such as income tax, employment tax, and excise tax. This form simplifies the payment process by providing a clear structure for entering payment details and ensuring accuracy in transactions.

Eftps Direct Payment Worksheet Short Form Printable Ach Debit

Eftps Direct Payment Worksheet Short Form Printable Ach Debit

Eftps Direct Payment Worksheet Short Form Printable Ach Debit

The EFTPS Direct Payment Worksheet Short Form is a printable document that can be filled out manually or electronically. It includes fields for the taxpayer’s information, tax type, payment amount, and bank account details. Users can then submit the completed form online or mail it to the appropriate tax authority.

When making ACH debit payments through EFTPS, users must ensure that they have sufficient funds in their bank account to cover the payment amount. The system will process the payment on the scheduled date specified by the taxpayer, providing a convenient way to meet tax obligations without the need for paper checks or in-person visits to tax offices.

Using the EFTPS Direct Payment Worksheet Short Form for ACH debit payments offers several benefits, including increased efficiency, reduced paperwork, and improved accuracy in tax payments. It also provides a secure and reliable method for making federal tax payments, giving users peace of mind that their transactions are processed safely and securely.

In conclusion, the EFTPS Direct Payment Worksheet Short Form is a valuable tool for businesses and individuals who need to make federal tax payments through ACH debit. By utilizing this form, users can streamline the payment process, save time and resources, and ensure that their tax obligations are met in a timely manner. Take advantage of this convenient option to simplify your tax payments and stay compliant with federal tax regulations.