Direct deposit is a convenient and secure way to receive payments directly into your bank account without the need for paper checks. Many employers and financial institutions offer direct deposit as an option for receiving payments such as salaries, pensions, and government benefits.

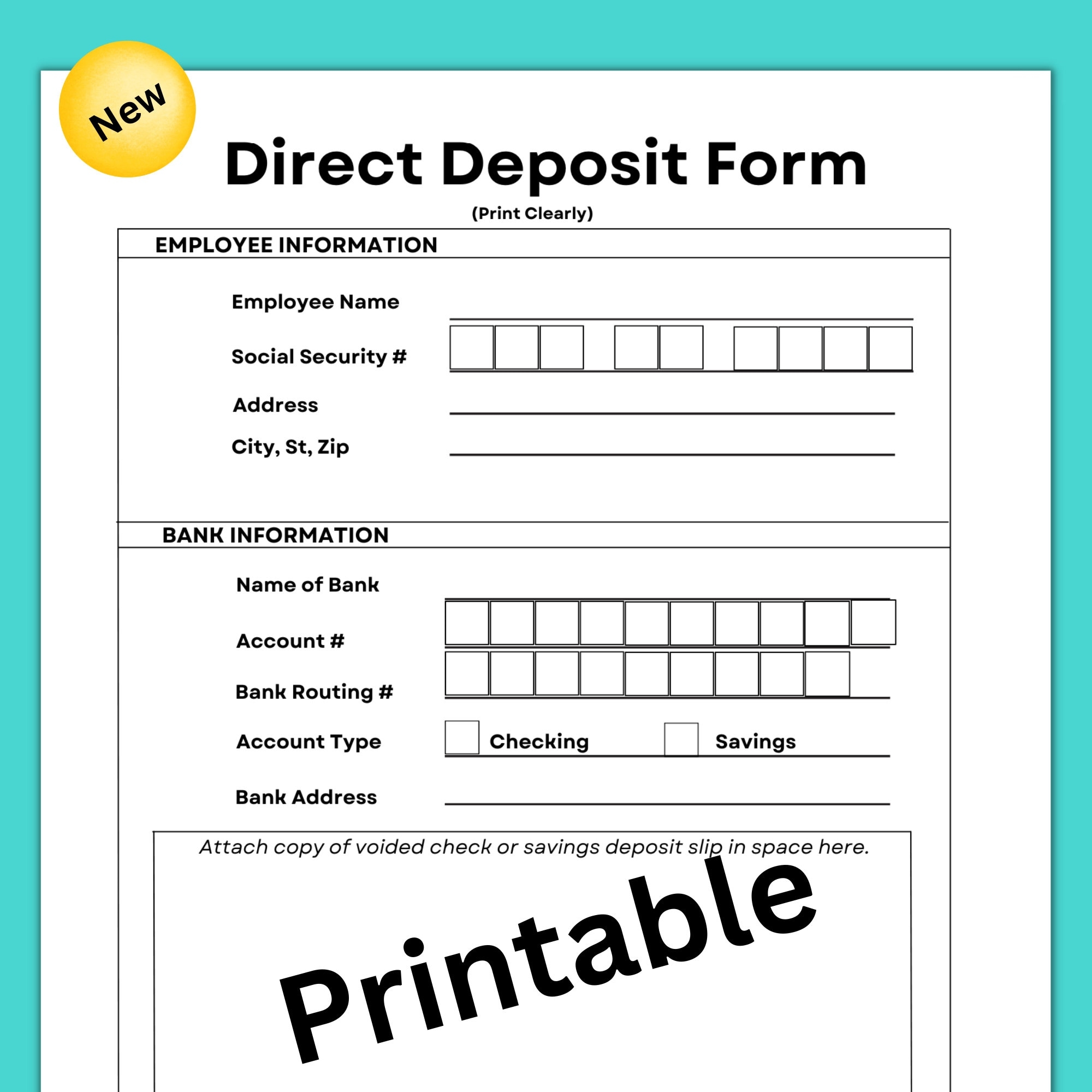

When setting up direct deposit, you will typically need to fill out a direct deposit form provided by your employer or financial institution. This form will require you to provide your bank account information, including your account number and routing number, as well as authorization for the funds to be deposited into your account.

Having a printable direct deposit form can be helpful for individuals who prefer to complete the form electronically or who need to provide a copy of the form to multiple parties. With a printable form, you can easily fill out the required information and submit it to your employer or financial institution.

Before filling out a direct deposit form, it is important to double-check the accuracy of the information you provide. Any errors in your bank account information could result in delays or complications with receiving your payments. It is also advisable to keep a copy of the completed form for your records.

Once you have submitted your direct deposit form, it may take a few days for the direct deposit to become active. During this time, you may continue to receive paper checks or other forms of payment until the direct deposit is fully set up and operational. After the direct deposit is active, you can enjoy the convenience of having your payments automatically deposited into your bank account.

In conclusion, having a printable direct deposit form can make the process of setting up direct deposit easier and more efficient. By providing accurate bank account information and submitting the form in a timely manner, you can ensure that your payments are deposited securely and on time. Direct deposit offers a convenient and reliable way to receive payments, eliminating the need for paper checks and reducing the risk of lost or stolen payments.