As a business owner, it is crucial to stay compliant with the Canada Revenue Agency (CRA) when it comes to payroll remittance. Failing to do so can result in penalties and fines that can be detrimental to your business. One way to ensure that you are accurately reporting and remitting your payroll taxes is by using the CRA Payroll Remittance Form Printable.

By utilizing this form, you can easily keep track of your payroll deductions, contributions, and remittances. This will help you avoid any discrepancies or errors when it comes to reporting your payroll taxes to the CRA. Additionally, having a printable form on hand can make the process more efficient and organized for your business.

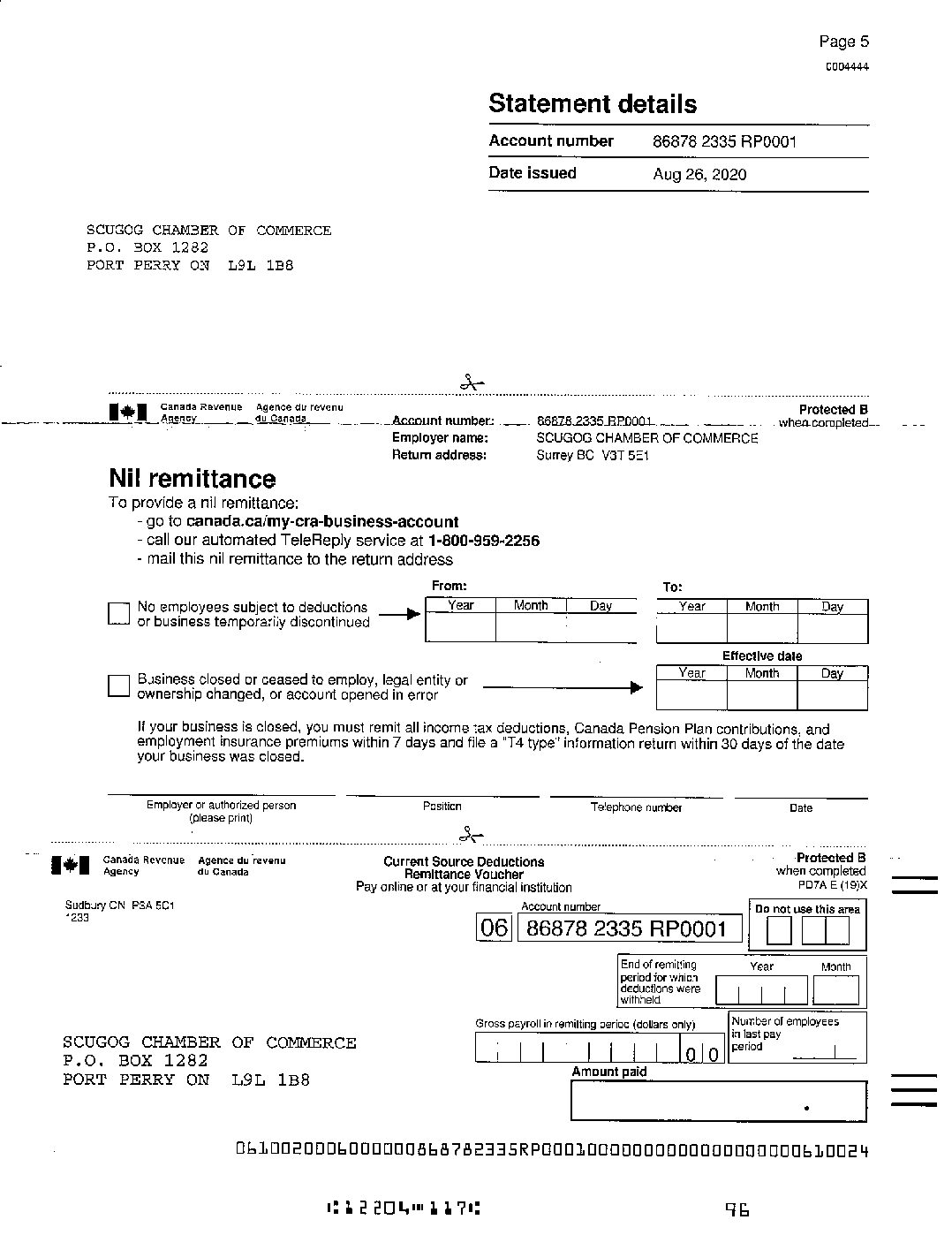

Cra Payroll Remittance Form Printable

Cra Payroll Remittance Form Printable

Handling staff wages doesn’t have to be difficult. A printable payroll template offers a fast, reliable, and easy-to-use method for tracking wages, work time, and deductions—without the need for complex software.

Stay Organized with a Payroll Printable – Easy & Reliable Tool!

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll template helps ensure proper documentation. Simply get the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.

CRA Payroll Remittance Form Printable

The CRA Payroll Remittance Form Printable is a valuable tool for businesses of all sizes. This form allows you to input your payroll information, such as employee wages, deductions, and employer contributions. You can then calculate the total amount owing to the CRA and submit your remittance accordingly.

Having a printable form also gives you the convenience of being able to fill it out at your own pace and refer back to it as needed. This can be especially helpful during tax season when you may have a higher volume of payroll information to report. By using the CRA Payroll Remittance Form Printable, you can ensure that your payroll taxes are accurately reported and remitted to the CRA.

In conclusion, the CRA Payroll Remittance Form Printable is an essential tool for businesses to stay compliant with the CRA and accurately report their payroll taxes. By utilizing this form, you can streamline the process of calculating and remitting your payroll deductions, contributions, and taxes. Make sure to download and use the CRA Payroll Remittance Form Printable to help keep your business on track with its payroll obligations.