Managing your finances can be a daunting task, especially when it comes to keeping track of your expenses and transactions. One useful tool that can help you stay organized is a checking account register. This simple document allows you to record all of your deposits, withdrawals, and other transactions, helping you to keep a close eye on your financial health.

While many banks offer online tools to help you track your spending, some people prefer the old-fashioned method of using a paper register. Having a physical record of your transactions can be helpful in case of any discrepancies or errors, and it can also help you budget more effectively.

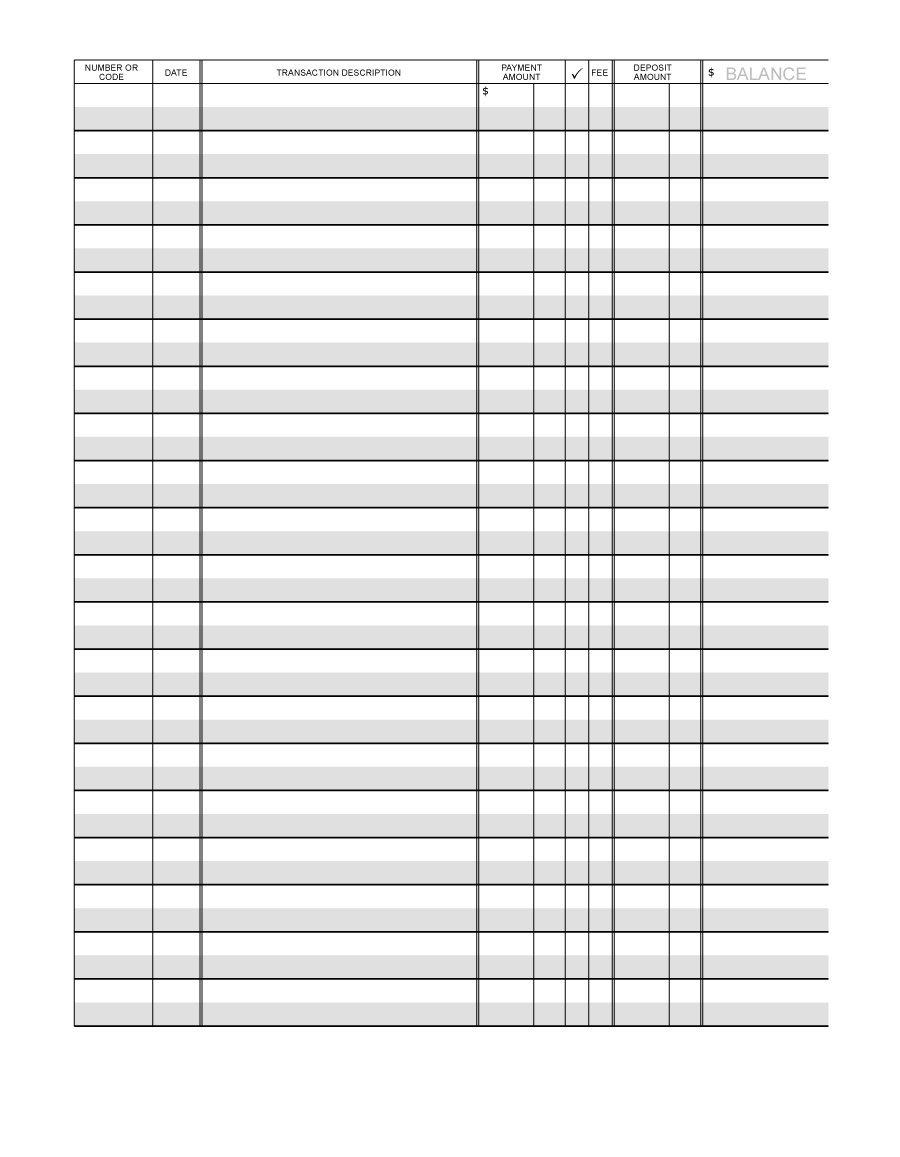

Checking Account Register Printable

Checking Account Register Printable

Handling employee payments doesn’t have to be overwhelming. A printable payroll template offers a fast, reliable, and easy-to-use method for tracking wages, hours, and deductions—without the need for complex software.

Manage Finances Efficiently with a Checking Account Register Printable – Straightforward & Reliable Tool!

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll form helps ensure compliance with regulations. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.

Using a checking account register printable is a convenient way to keep track of your finances without relying on technology. You can easily print out multiple copies and carry them with you wherever you go, ensuring that you always have a record of your transactions on hand.

To use a checking account register printable, simply fill in the details of each transaction as it occurs. This includes the date, description of the transaction, amount, and whether it was a deposit or withdrawal. You can also keep track of your account balance by updating it with each transaction, making it easy to see where your money is going.

Another benefit of using a checking account register printable is that it can help you identify any patterns in your spending. By seeing all of your transactions laid out in front of you, you may be able to pinpoint areas where you can cut back and save money. This can be especially useful for those who are trying to stick to a budget or save for a specific goal.

In conclusion, a checking account register printable is a valuable tool for anyone looking to take control of their finances. By keeping a detailed record of your transactions, you can better track your spending, identify areas for improvement, and stay on top of your financial goals. Consider using a printable register to help you stay organized and make smarter financial decisions.