As we approach tax season, it’s important to make sure you have all the necessary forms to report your income accurately. One such form that may be required for certain individuals or businesses is the 1099 NEC form. This form is used to report nonemployee compensation, such as freelance income, to the IRS. Having a blank 1099 NEC form for the year 2020 is essential for those who need to report this type of income.

One of the easiest ways to obtain a blank 1099 NEC form for 2020 is to download it from the IRS website. The form is typically available in a printable format, making it easy to fill out by hand or input into tax software. It’s important to ensure that you are using the correct version of the form for the specific tax year, in this case, 2020.

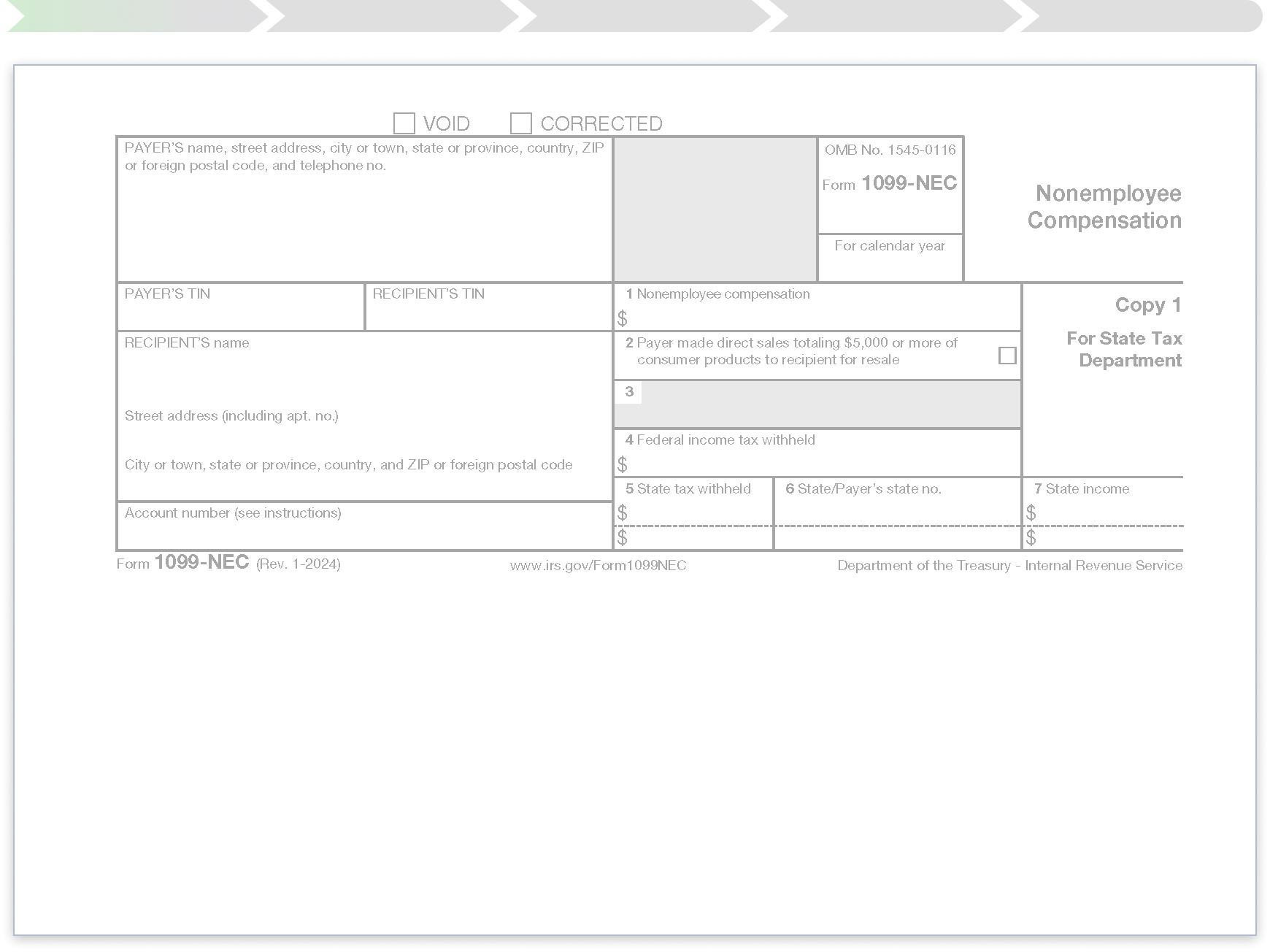

Blank 1099 Nec Form 2020 Printable

Blank 1099 Nec Form 2020 Printable

When filling out the blank 1099 NEC form, be sure to include all necessary information, such as your name, address, and taxpayer identification number. You will also need to report the amount of nonemployee compensation you received during the tax year. Double-checking your entries for accuracy is crucial to avoid any potential issues with the IRS.

For those who may have multiple nonemployee compensation sources, it’s important to have a separate 1099 NEC form for each payer. This ensures that each source of income is reported accurately and can help avoid any confusion or discrepancies when filing your taxes. Keeping organized records of your income sources can make the process of filling out these forms much smoother.

Once you have completed your blank 1099 NEC form for 2020, be sure to submit it to the IRS by the appropriate deadline. This form is typically due in late January or early February, so it’s important to stay on top of your tax obligations to avoid any penalties or fines. Consulting with a tax professional can also help ensure that you are filing your taxes correctly and taking advantage of any deductions or credits that may apply to your situation.

In conclusion, having a blank 1099 NEC form for the year 2020 is essential for those who need to report nonemployee compensation to the IRS. By following the proper procedures for filling out and submitting this form, you can ensure that your taxes are filed accurately and on time. Be sure to stay organized and seek assistance if needed to make the tax-filing process as smooth as possible.

Quickly Access and Print Blank 1099 Nec Form 2020 Printable

Payroll printable are ideal for businesses that prefer paper documentation or need hard copies for staff files. Most forms include fields for staff name, date range, total earnings, taxes, and net pay—making them both comprehensive and practical.

Start simplifying your payroll process today with a trusted printable payroll template. Save time, reduce errors, and maintain clear records—all while keeping your payroll records clear.

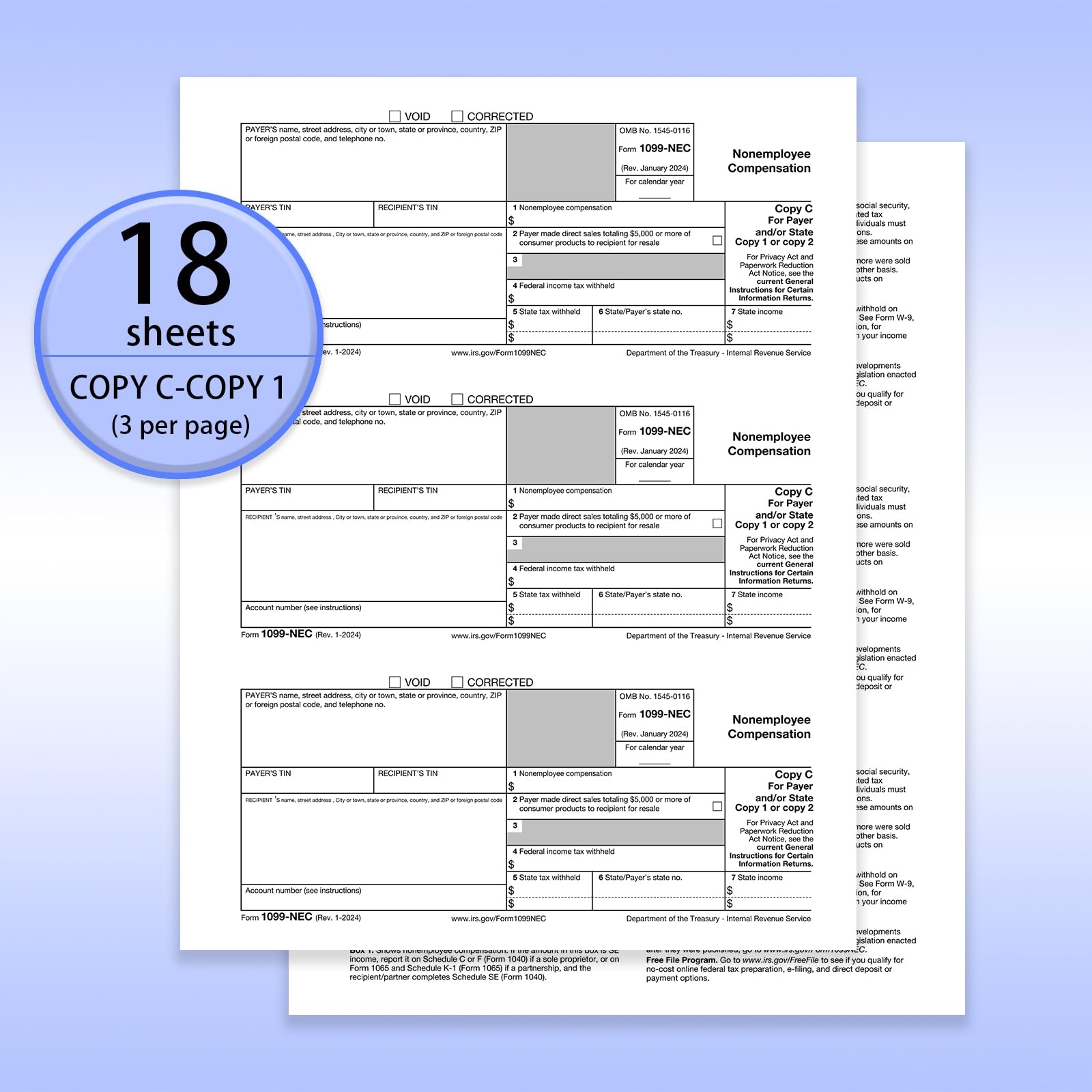

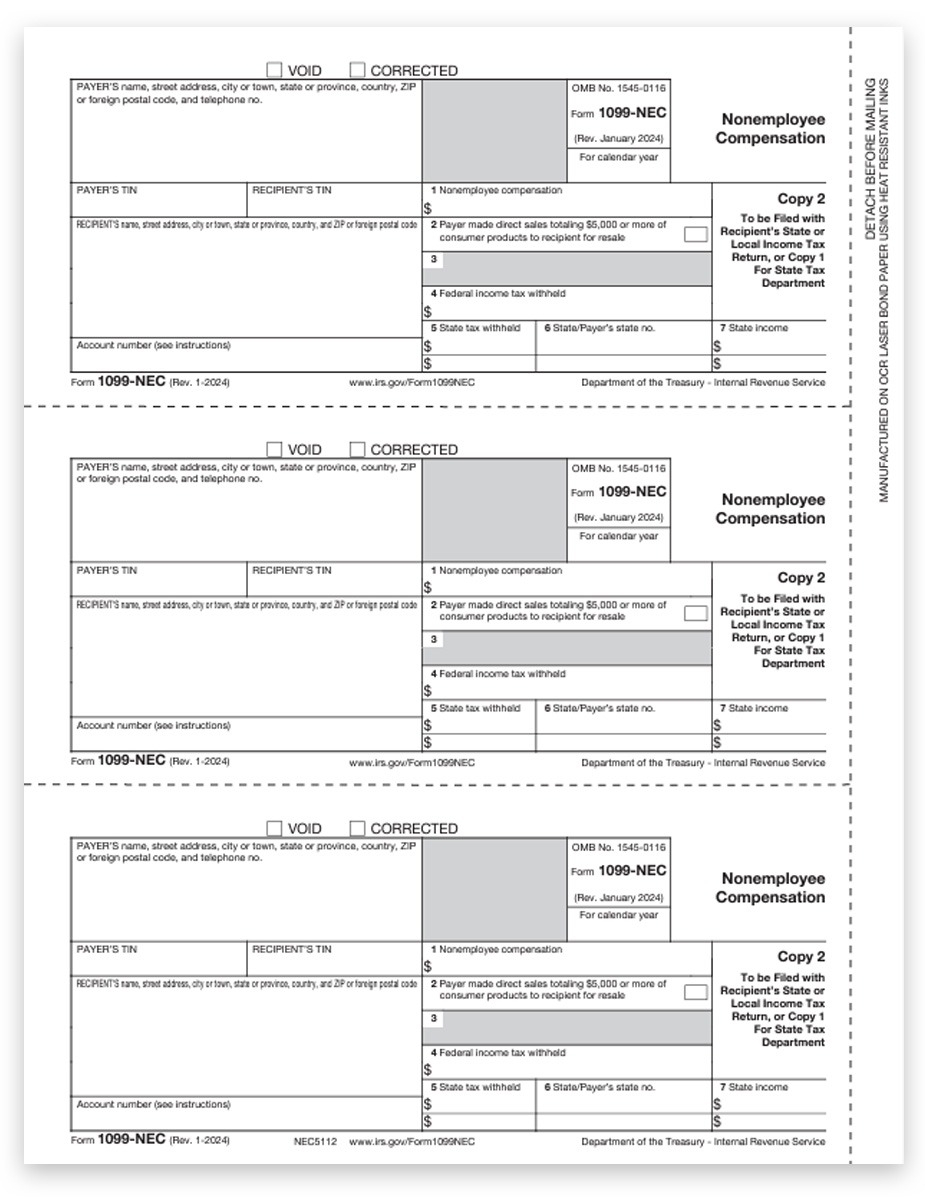

Amazon 1099 NEC Forms 2024 4 Part Tax Forms Kit With 25 Self Seal Envelopes 25 Vendor Kit Of Laser Forms Compatible With QuickBooks And

Amazon 1099 NEC Forms 2024 4 Part Tax Forms Kit With 25 Self Seal Envelopes 25 Vendor Kit Of Laser Forms Compatible With QuickBooks And

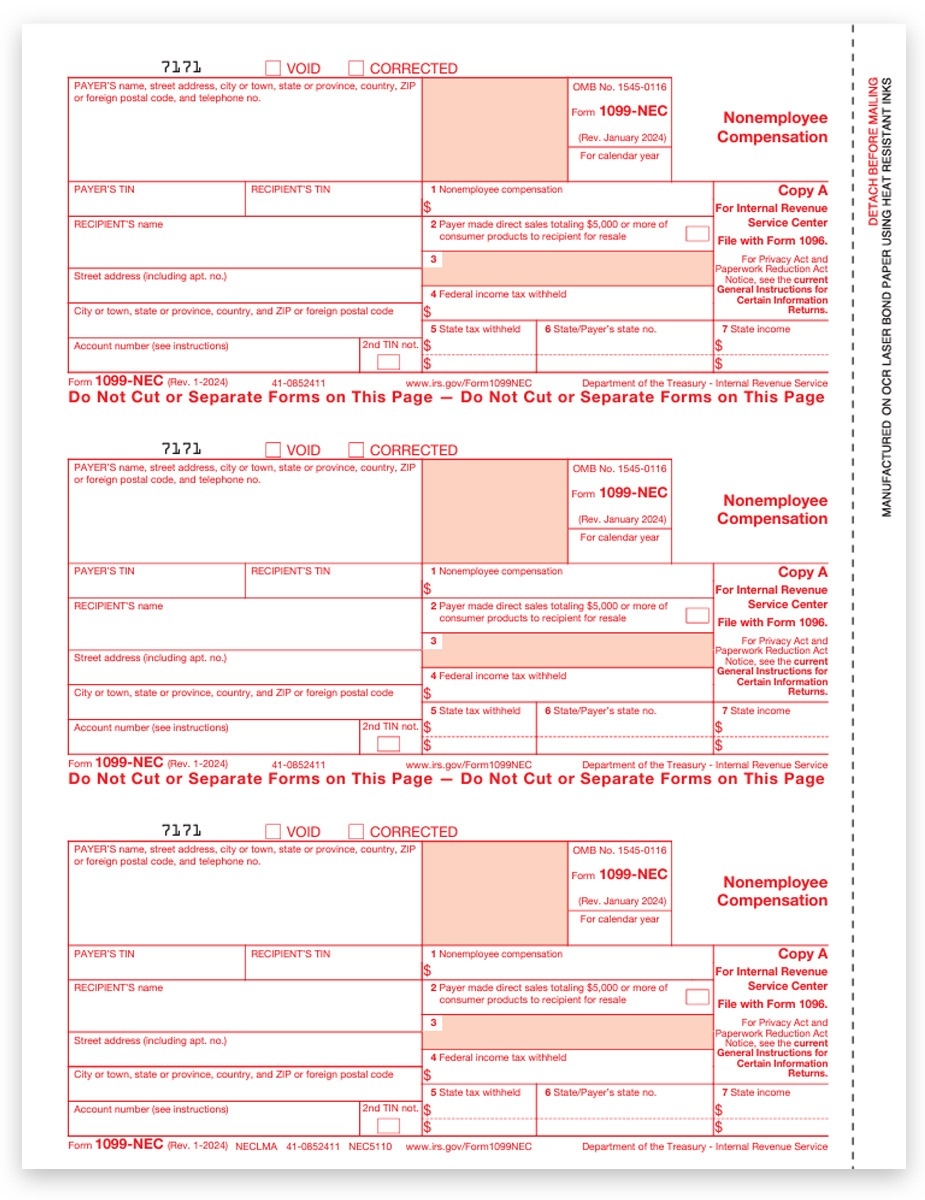

1099 NEC Forms Copy A For IRS Federal DiscountTaxForms

1099 NEC Forms Copy A For IRS Federal DiscountTaxForms

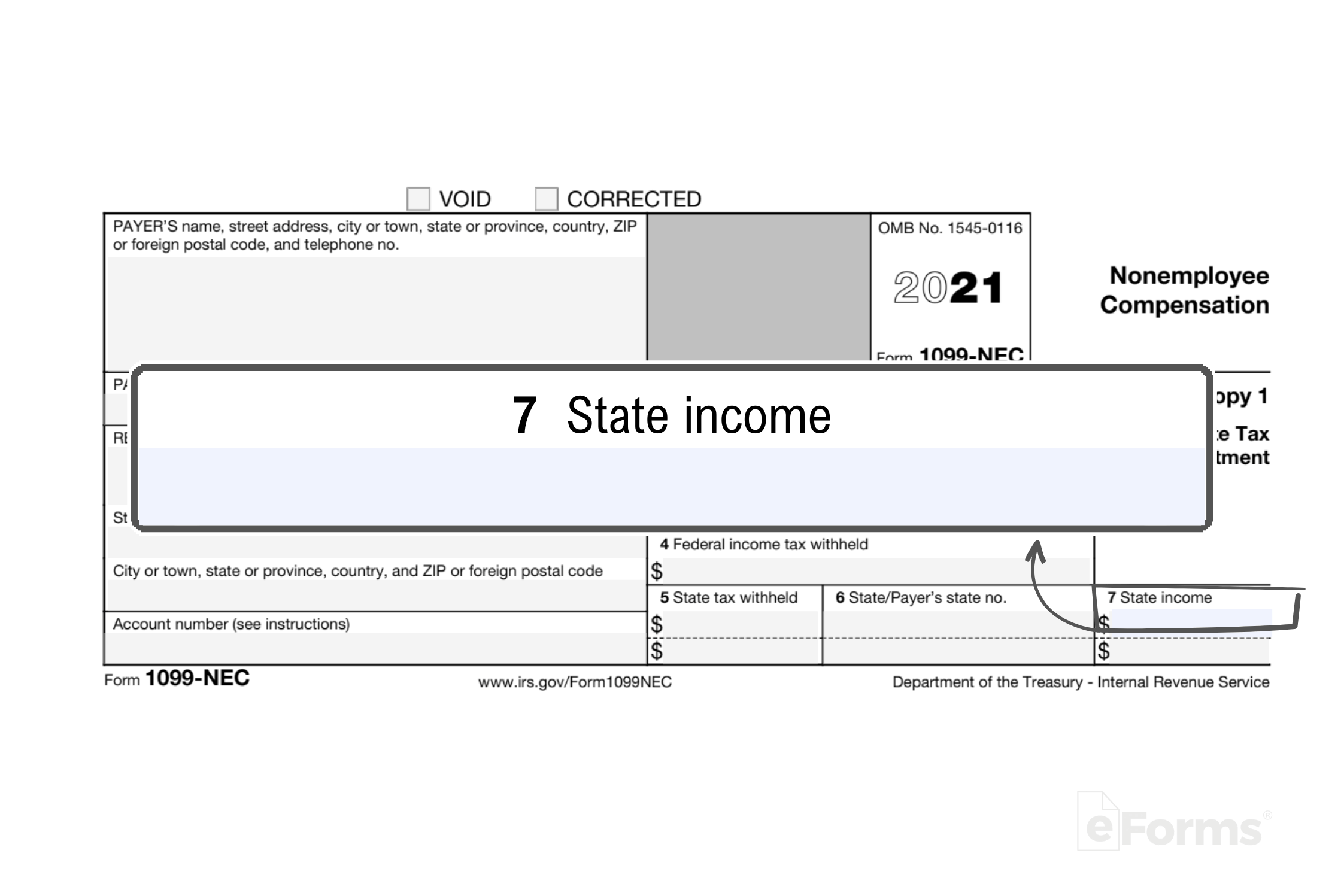

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

1099 NEC Forms Copy 2 For Payer DiscountTaxForms

1099 NEC Forms Copy 2 For Payer DiscountTaxForms

Handling employee payments doesn’t have to be overwhelming. A printable payroll template offers a fast, reliable, and user-friendly method for tracking wages, work time, and withholdings—without the need for complex software.

Whether you’re a small business owner, HR professional, or independent contractor, using apayroll printable helps ensure compliance with regulations. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.