When it comes to tax season, having the necessary forms readily available is essential for both individuals and businesses. One important form that many individuals and businesses need is the 1099 form. This form is used to report various types of income, such as freelance earnings, rental income, and more. Having a blank 1099 form printable can make the process of filling out this form much easier and more convenient.

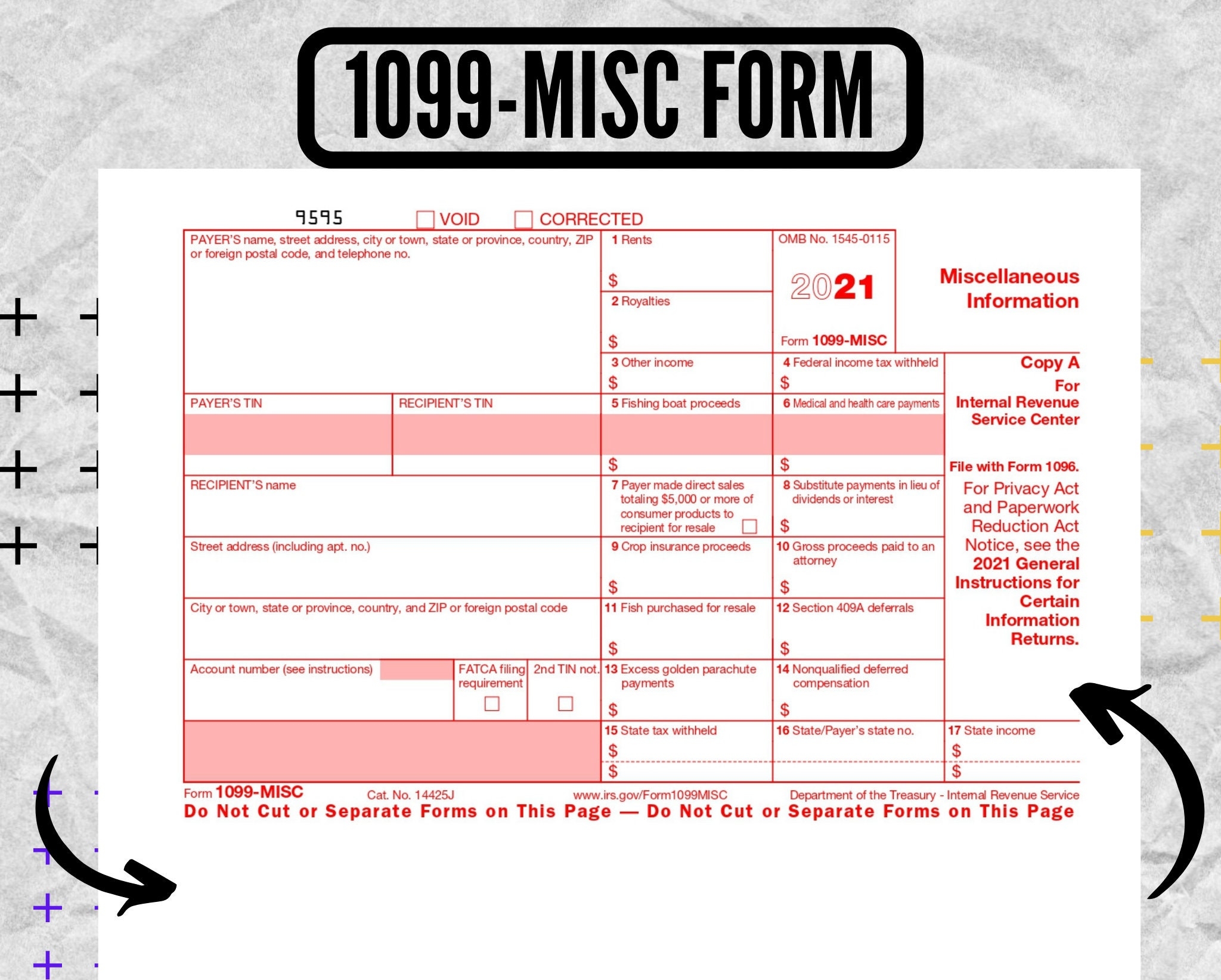

With a blank 1099 form printable, individuals and businesses can easily input the necessary information, such as their name, address, taxpayer identification number, and the amount of income received. This can help ensure that all the required information is accurately reported to the IRS, helping to avoid any potential penalties or issues down the line.

Having a printable version of the 1099 form can also be beneficial for those who prefer to fill out forms by hand rather than electronically. By having a physical copy of the form, individuals and businesses can take their time to carefully review and fill out the form, ensuring that all information is correct before submitting it to the IRS.

Additionally, a blank 1099 form printable can be a useful tool for those who need to provide this form to multiple recipients. For businesses that have multiple contractors or vendors that they need to report income for, having a printable version of the 1099 form can save time and make the process more efficient.

Overall, having access to a blank 1099 form printable can make tax season less stressful and more manageable for individuals and businesses alike. By having this form readily available, individuals and businesses can ensure that they are properly reporting their income and avoiding any potential issues with the IRS.

So, whether you are a freelancer, landlord, or business owner, having a blank 1099 form printable on hand can help simplify the tax reporting process and ensure that you are in compliance with IRS regulations.