As tax season approaches, it’s important for businesses and individuals to have the necessary forms ready to report income and expenses. One such form is the 1099 form, which is used to report various types of income, such as freelance earnings, rental income, and more. Having a blank 1099 form ready to fill out can make the process much smoother and more efficient.

For the year 2022, having a printable blank 1099 form can save time and hassle when it comes to reporting income to the IRS. Whether you are a business owner or an individual who needs to report income, having the form readily available can help ensure that you meet the tax filing deadline and avoid any penalties.

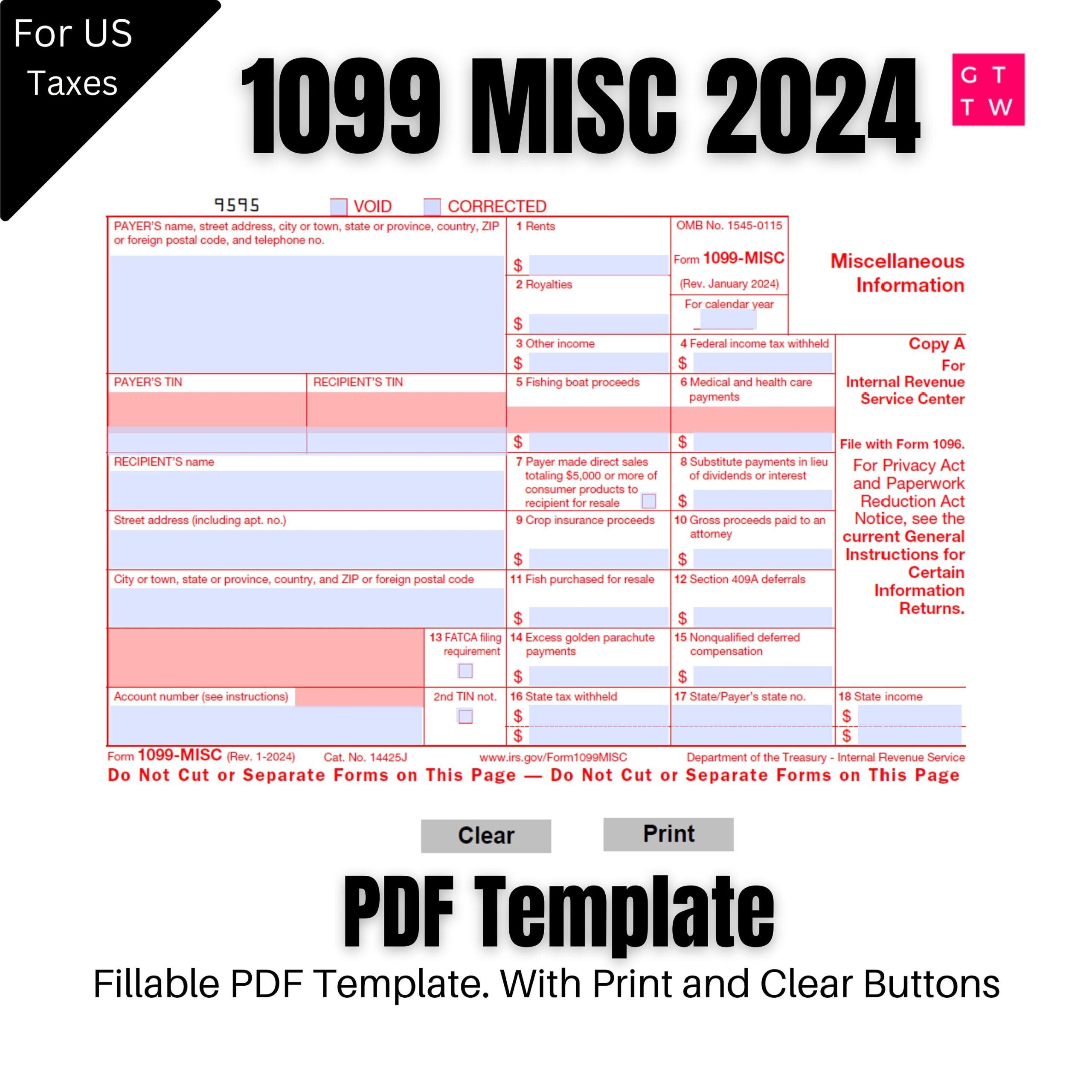

Blank 1099 Form 2022 Printable

Blank 1099 Form 2022 Printable

It’s important to fill out the 1099 form accurately and completely to avoid any issues with the IRS. The form requires information such as the recipient’s name, address, taxpayer identification number, and the amount of income received. Having a blank form that is easy to read and fill out can help prevent any mistakes that could lead to delays or penalties.

By using a printable blank 1099 form for the year 2022, you can stay organized and on top of your tax reporting requirements. Whether you are a business owner who needs to report payments to contractors or a freelancer who needs to report income from multiple sources, having the form ready to fill out can make the process much simpler.

Overall, having a blank 1099 form for the year 2022 printable can help streamline the tax reporting process and ensure that you meet all necessary requirements. By being prepared and having the form readily available, you can avoid any last-minute stress and potential issues with the IRS. Make sure to download and print a blank 1099 form today to stay ahead of the tax filing deadline.