Alabama residents who are required to file income taxes can utilize Form 40 to report their earnings and determine the amount of tax owed to the state. This form is essential for individuals who earn income within the state of Alabama and must comply with state tax laws.

Form 40 is a comprehensive document that allows taxpayers to report their income, deductions, and credits in order to calculate their tax liability. This form is available for download online in a printable format, making it easy for taxpayers to fill out and submit to the Alabama Department of Revenue.

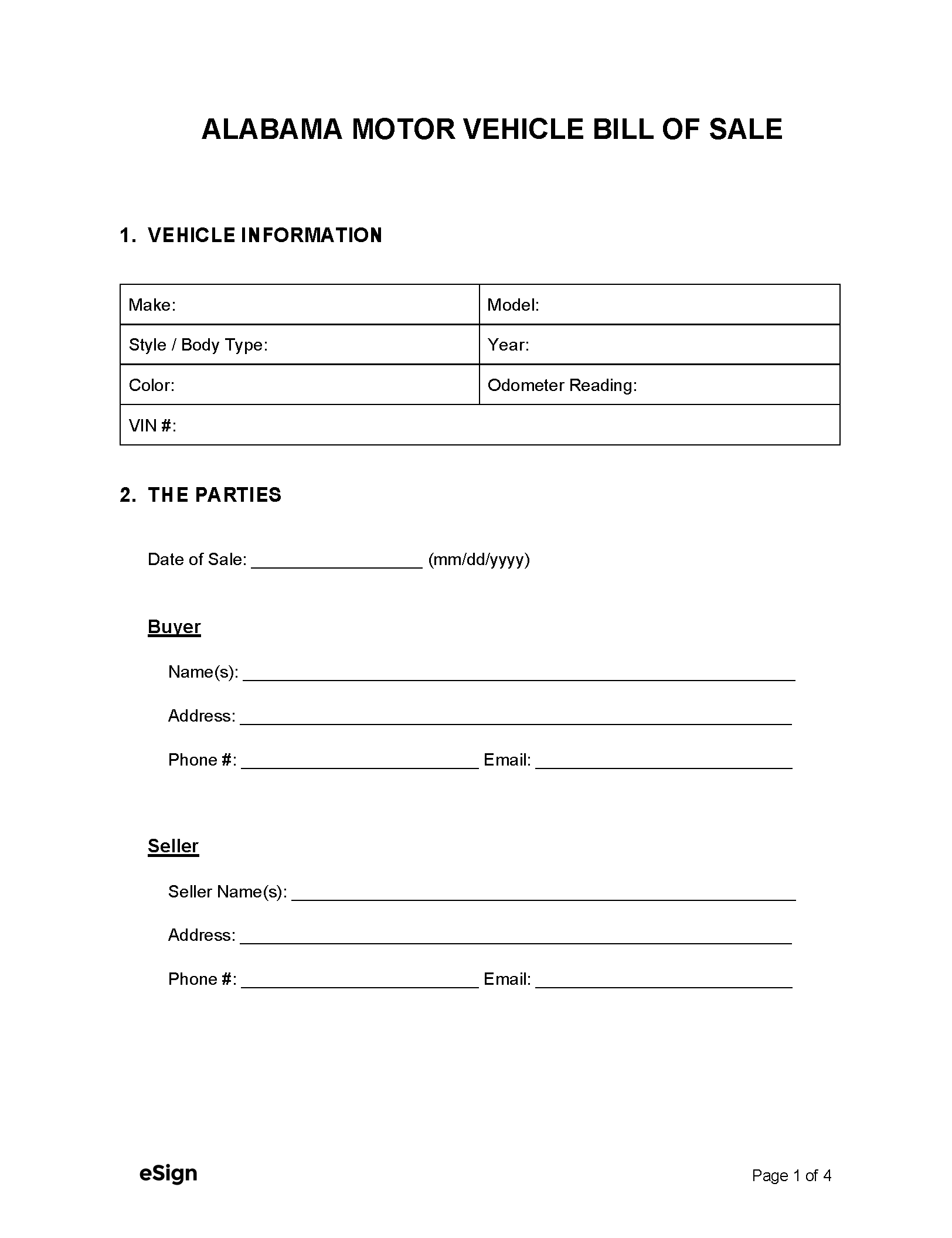

Alabama Income Tax Form 40 Printable

Alabama Income Tax Form 40 Printable

When filling out Form 40, taxpayers must provide information such as their personal details, income sources, deductions, and any tax credits they may be eligible for. It is important to accurately report all income and expenses to ensure compliance with state tax laws and avoid any potential penalties or audits.

After completing Form 40, taxpayers must sign and date the document before submitting it to the Alabama Department of Revenue. It is recommended to keep a copy of the form for your records in case of any discrepancies or questions from the tax authorities.

Using the Alabama Income Tax Form 40 Printable is a convenient way for residents to fulfill their tax obligations and ensure that they are in compliance with state tax laws. By accurately reporting their income and deductions, taxpayers can avoid potential issues with the tax authorities and enjoy peace of mind knowing that their taxes are filed correctly.

In conclusion, Alabama residents can utilize Form 40 to report their income and calculate their tax liability to the state. By using the printable version of this form, taxpayers can easily fill it out and submit it to the Alabama Department of Revenue. It is important to accurately report all income and deductions to avoid any potential penalties or audits. Make sure to keep a copy of the completed form for your records and stay compliant with state tax laws.