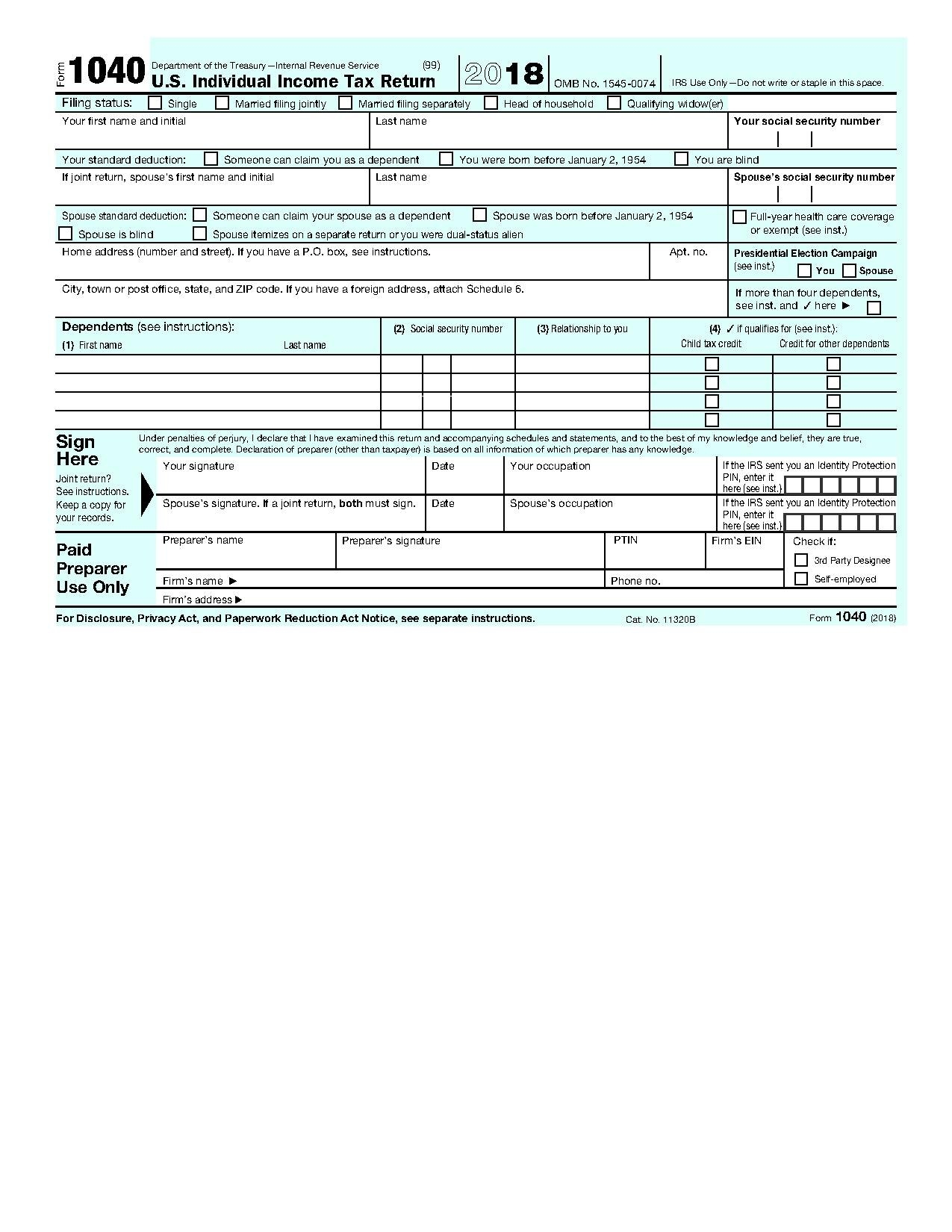

As the tax season approaches, many individuals are starting to gather their documents and prepare to file their taxes. One of the key forms that taxpayers will need to fill out is the IRS 1040 form. This form is used to report an individual’s income and determine how much tax they owe or how much of a refund they are entitled to.

For the year 2024, the IRS has made available the printable version of the 1040 form on their website. This form can be easily downloaded and printed out, making it convenient for taxpayers to fill out and submit their tax returns.

When filling out the 2024 IRS 1040 form, taxpayers will need to provide information such as their income, deductions, and credits. It is important to carefully review the instructions provided with the form to ensure that all information is reported accurately.

In addition to the 1040 form, taxpayers may also need to fill out additional schedules and forms depending on their individual tax situation. These forms can also be found on the IRS website and should be submitted along with the 1040 form.

Once the 2024 IRS 1040 form is completed, taxpayers can either file their taxes electronically or mail the form to the IRS. It is important to meet the deadline for filing taxes, which is typically April 15th, unless an extension has been granted.

In conclusion, the 2024 IRS 1040 form printable is a vital document for taxpayers to report their income and taxes owed. By carefully filling out this form and any additional schedules, individuals can ensure that they are in compliance with tax laws and avoid any penalties or fines. Be sure to download the form from the IRS website and start preparing your taxes today!