When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the IRS Form 1099. This form is used to report various types of income, such as freelance earnings, interest payments, and dividends. It is crucial to accurately fill out and submit this form to ensure compliance with tax laws and regulations.

For those who prefer to handle their taxes on their own, printable IRS Form 1099 can be a convenient option. These forms can be easily accessed and downloaded from the IRS website, allowing individuals and businesses to fill them out at their own pace and convenience. This can be especially helpful for those who may not have access to tax preparation software or prefer to do things manually.

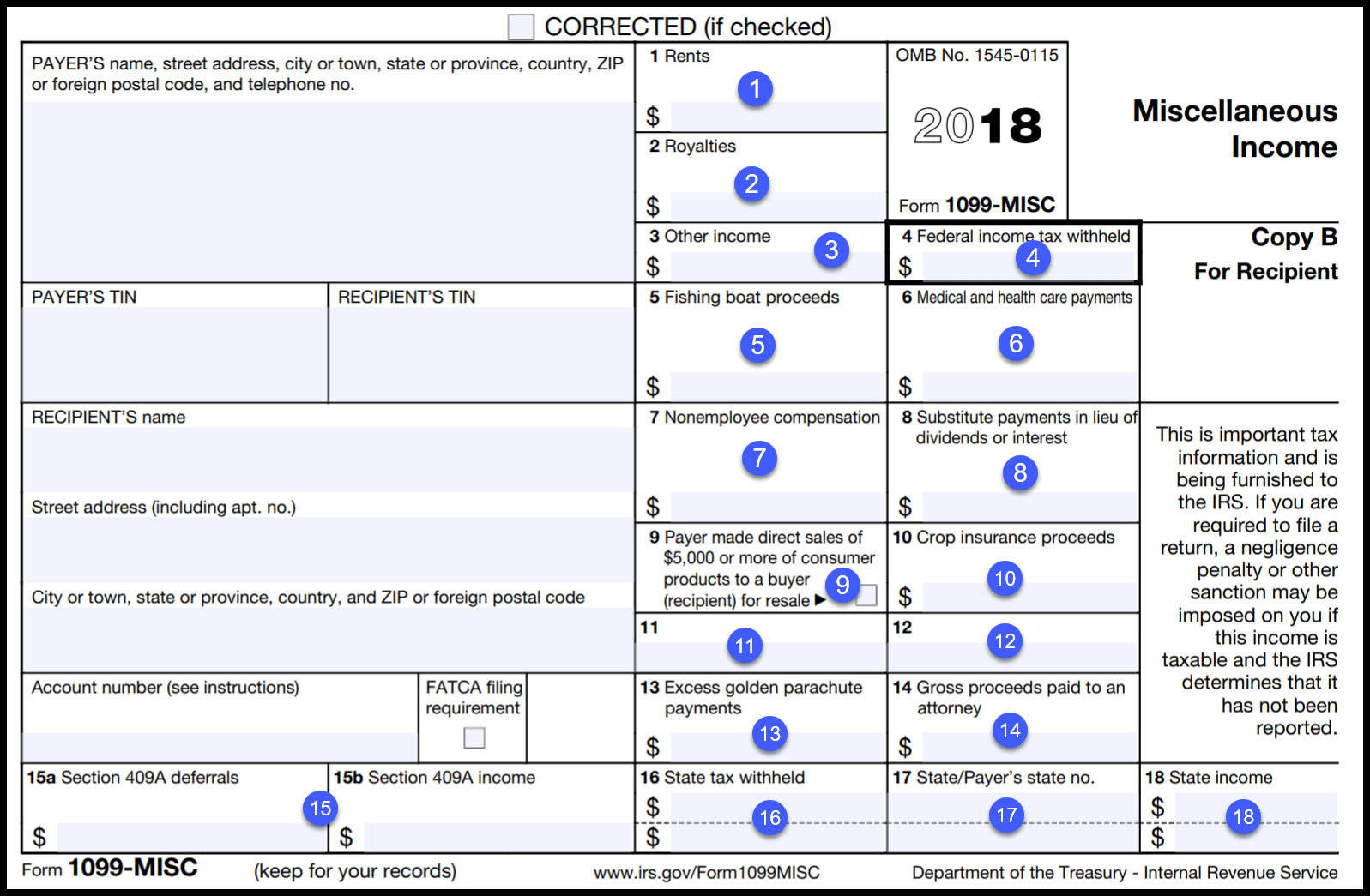

Printable IRS Form 1099 comes in various versions, depending on the type of income being reported. For example, there are specific forms for income from self-employment, interest and dividends, real estate transactions, and more. It is important to use the correct form to accurately report income and avoid any potential penalties or audits from the IRS.

When filling out printable IRS Form 1099, individuals and businesses will need to gather all the necessary information, such as the payer’s name and address, the recipient’s name and Social Security number, and the amount of income received. It is essential to double-check all information before submitting the form to ensure accuracy and prevent any potential errors.

Once the printable IRS Form 1099 is filled out completely and accurately, it can be submitted to the IRS either electronically or through the mail. It is important to keep a copy of the form for your records and to provide a copy to the recipient of the income as well. By following these steps and using printable IRS Form 1099, individuals and businesses can stay organized and compliant during tax season.

In conclusion, printable IRS Form 1099 is a valuable tool for reporting various types of income to the IRS. By accessing and using these forms, individuals and businesses can accurately report income and avoid any potential issues with the IRS. Remember to gather all necessary information, fill out the form accurately, and submit it on time to ensure compliance with tax laws.