IRS Form W9 is a crucial document that businesses use to collect information from vendors or independent contractors they plan to hire. This form is used to gather the contractor’s taxpayer identification number (TIN) and other relevant information for tax reporting purposes.

It’s important to note that Form W9 is not submitted to the IRS. Instead, it is kept on file by the business that requested it in case the IRS needs to verify the information provided by the contractor. The form is also used to generate Form 1099 at the end of the year for tax reporting purposes.

Irs Form W9 Printable

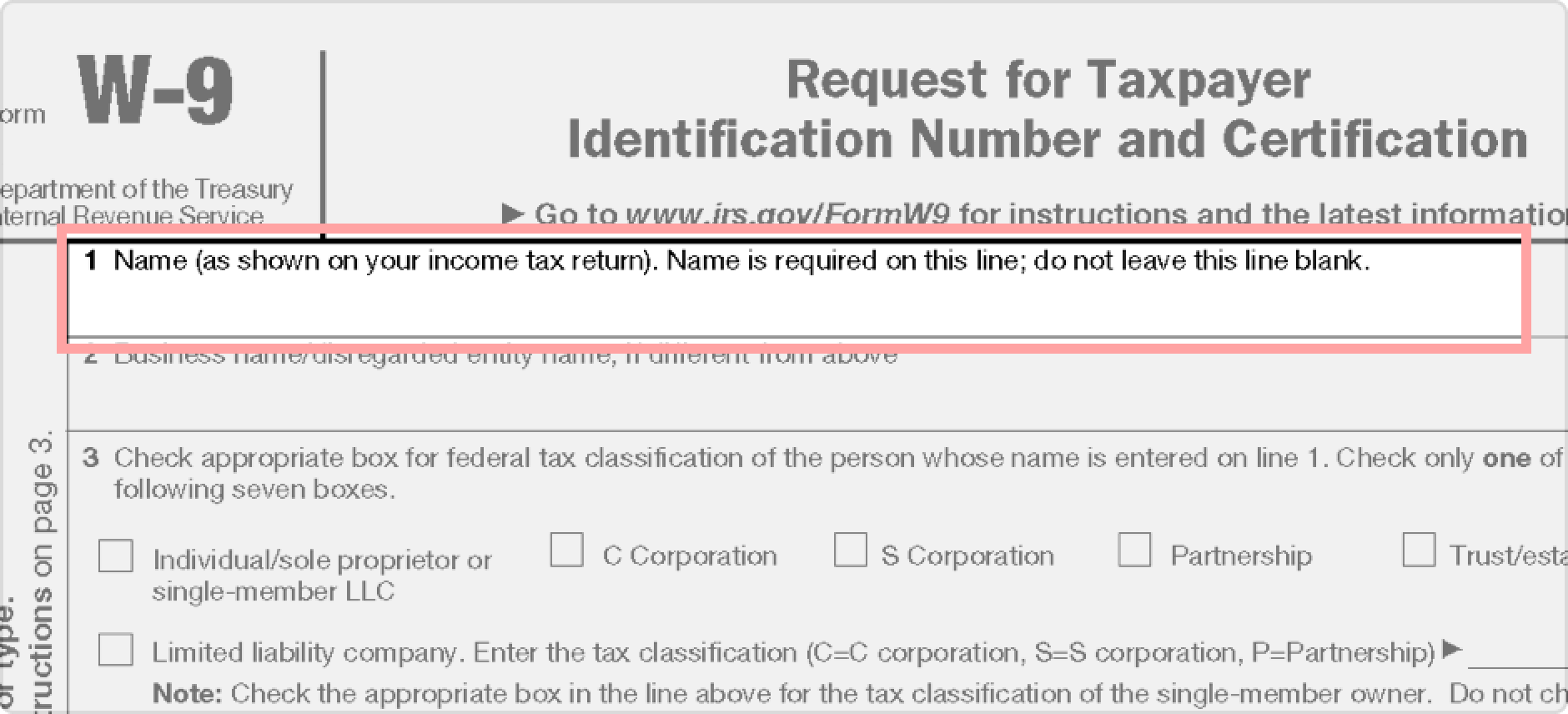

IRS Form W9 is readily available for download on the IRS website. The form is easy to fill out and can be completed electronically or by hand. It requires basic information such as the contractor’s name, business name (if applicable), address, and TIN. The contractor must also certify that the information provided is accurate and that they are not subject to backup withholding.

One important thing to keep in mind when filling out Form W9 is that the information provided must match the contractor’s tax records. Any inconsistencies could lead to issues with tax reporting and potential penalties from the IRS. It’s crucial to double-check all the information before submitting the form to the business requesting it.

Businesses should also make sure to keep all W9 forms on file for at least four years in case of an audit by the IRS. Having accurate and up-to-date information from contractors is essential for tax compliance and reporting purposes. By keeping thorough records, businesses can avoid potential issues down the line.

Overall, IRS Form W9 is a simple yet important document for businesses hiring independent contractors. It helps ensure that accurate information is provided for tax reporting purposes and helps businesses comply with IRS regulations. By understanding the significance of Form W9 and properly completing it, businesses can streamline their tax reporting processes and avoid potential penalties from the IRS.

So, next time you are asked to fill out a Form W9, make sure to do so accurately and promptly to ensure smooth tax reporting for both you and the business you are working with.