The IRS 2025 tax forms are essential documents that taxpayers need to fill out and submit to the Internal Revenue Service (IRS) every year. These forms provide information about an individual’s income, deductions, and credits, which determine how much tax they owe or are owed in return. It is crucial for taxpayers to accurately complete these forms to avoid any penalties or interest.

With the advancement of technology, the IRS has made it easier for taxpayers to access and file their tax forms online. However, there are still individuals who prefer to fill out their tax forms manually. For those individuals, having printable versions of IRS 2025 tax forms is essential.

IRS 2025 Tax Forms Printable

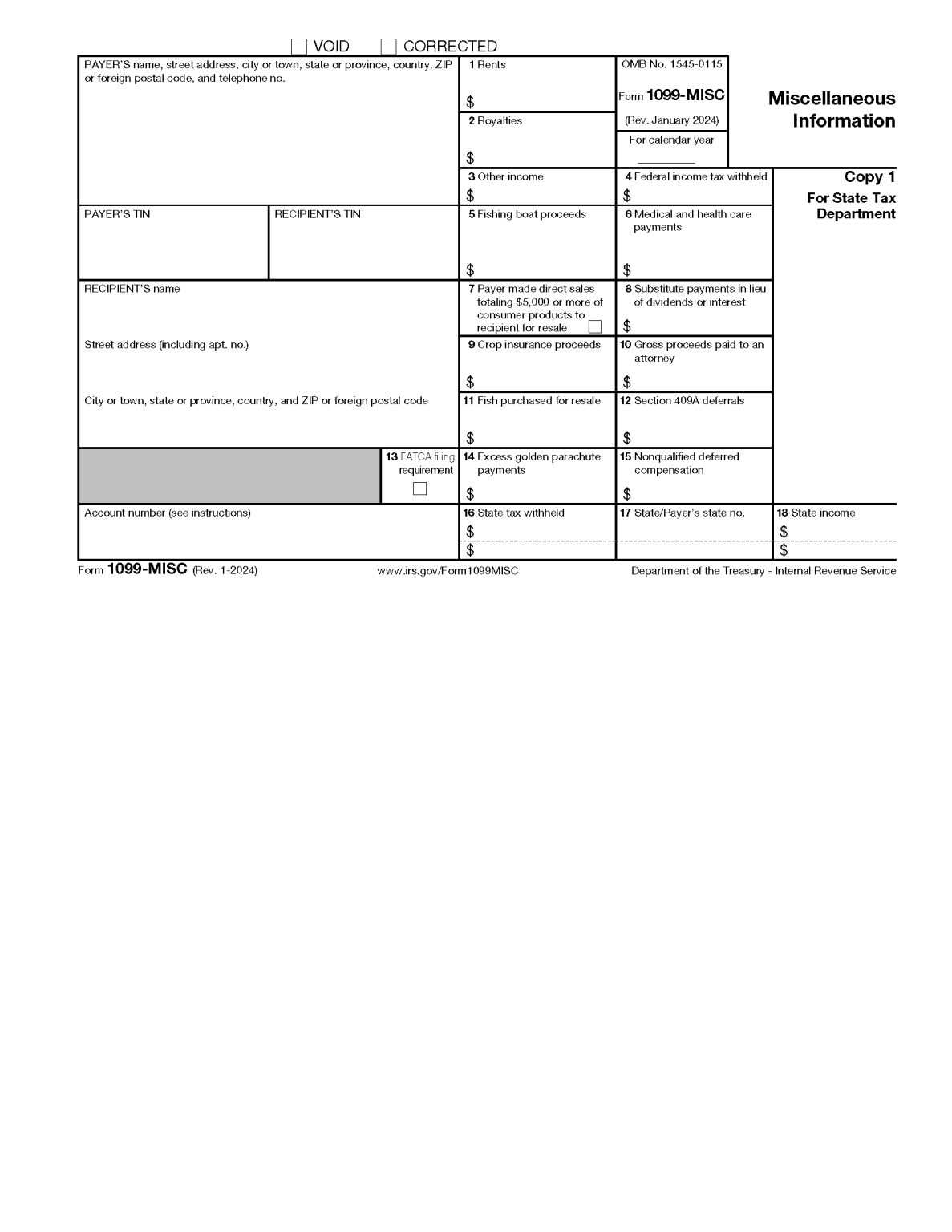

There are various IRS 2025 tax forms that taxpayers may need to fill out, depending on their financial situation. Some common forms include Form 1040, which is used for individual tax returns, and Form 1099, which reports income from sources other than wages, such as freelance work or investments.

These forms can be easily found on the IRS website, where they are available for download and printing. Taxpayers can also visit their local IRS office to pick up physical copies of the forms if needed. Having printable versions of these forms allows individuals to fill them out at their convenience and keep a record of their tax information.

When filling out IRS 2025 tax forms, it is important to double-check all information for accuracy and completeness. Any errors or missing information can result in delays in processing or even audits by the IRS. Taxpayers should also be aware of any changes in tax laws or regulations that may affect how they fill out their forms.

In conclusion, IRS 2025 tax forms printable are essential documents for taxpayers to accurately report their income and deductions to the IRS. By having access to printable versions of these forms, individuals can ensure that they are completing their tax returns correctly and on time. It is crucial to stay informed about any changes in tax laws and regulations to avoid any potential issues with the IRS.