As tax season approaches, many individuals and businesses are preparing to file their taxes. One important form that may be required is the 1099 form issued by the Internal Revenue Service (IRS). This form is used to report various types of income, such as freelance earnings, rental income, and more.

It is essential to accurately report all sources of income to the IRS to avoid penalties and fines. The 1099 form can be downloaded and printed directly from the IRS website, making it convenient for taxpayers to access and fill out.

1099 Form IRS Printable

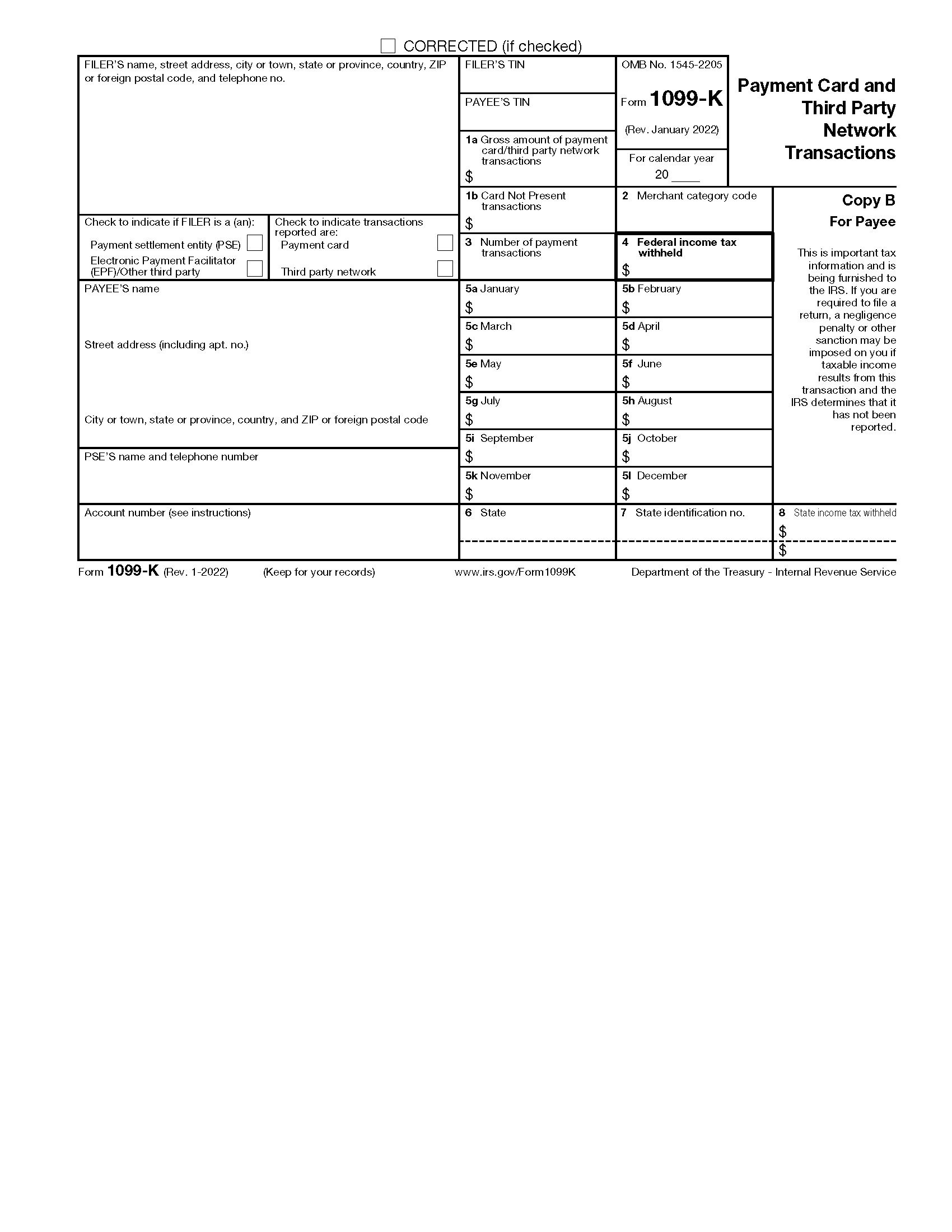

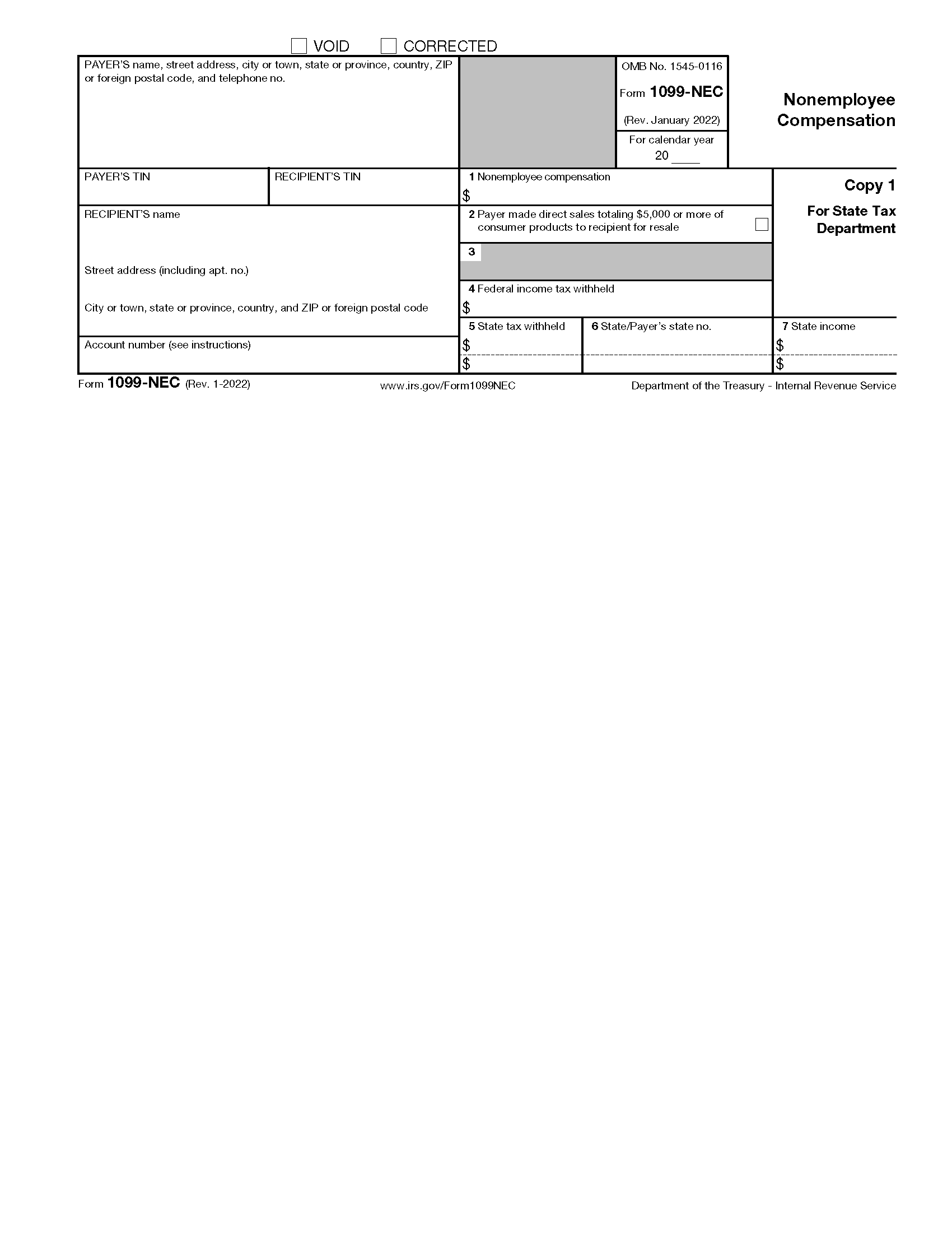

The 1099 form is commonly used to report income earned from sources other than regular employment. This includes income from freelance work, rental properties, dividends, and more. It is crucial for individuals and businesses to accurately report this income to the IRS to ensure compliance with tax laws.

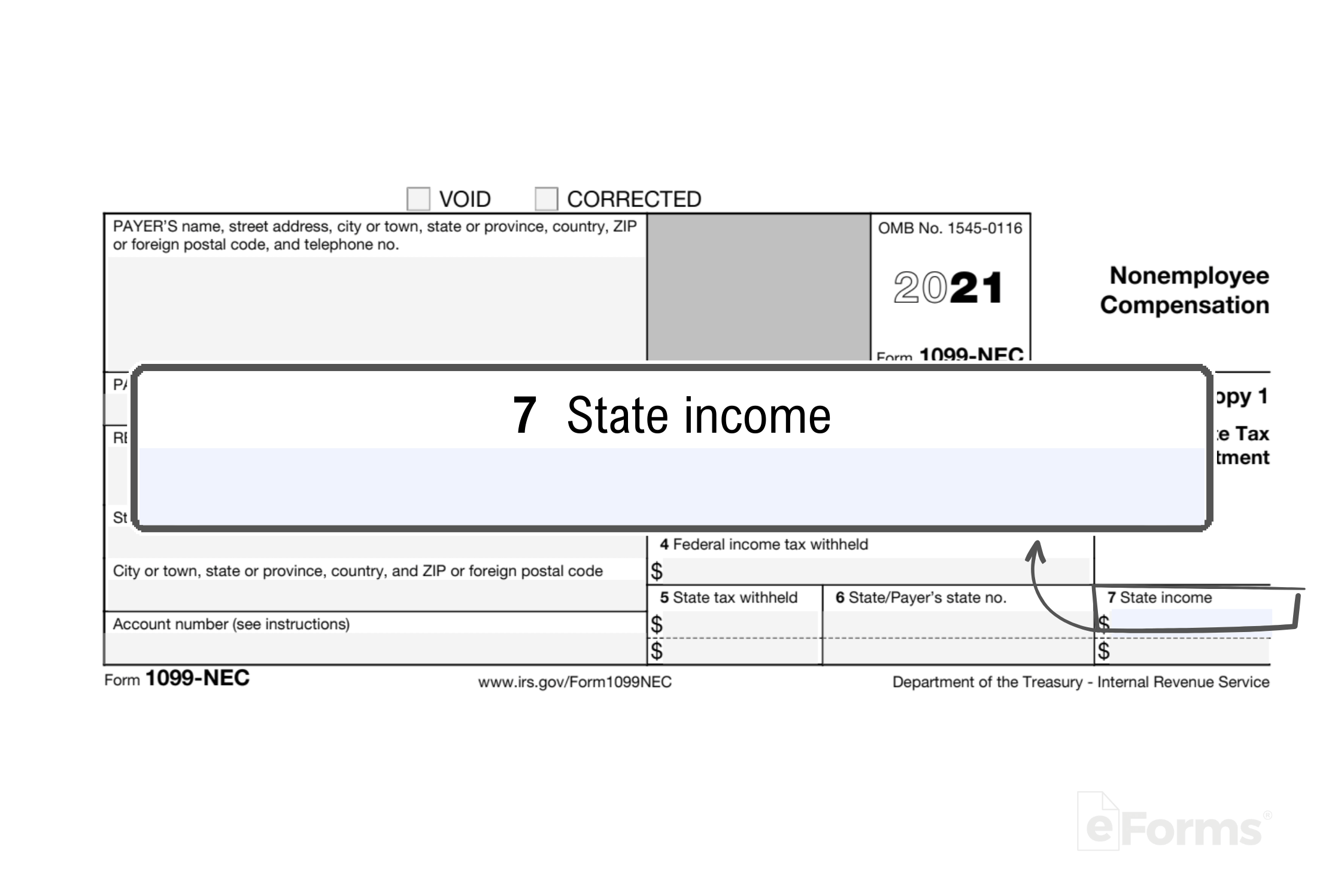

When filling out the 1099 form, taxpayers will need to provide information such as their name, address, social security number, and the amount of income earned from each source. This information is used by the IRS to verify income and ensure that taxes are paid accordingly.

Once the 1099 form is completed, it can be submitted to the IRS either electronically or by mail. Taxpayers should keep a copy of the form for their records and ensure that it is submitted by the deadline to avoid any penalties or fines.

Overall, the 1099 form is an essential tool for reporting various types of income to the IRS. By accurately filling out and submitting this form, taxpayers can ensure compliance with tax laws and avoid any potential issues with the IRS.

As tax season approaches, it is important for individuals and businesses to familiarize themselves with the 1099 form and ensure that all sources of income are accurately reported. By utilizing the printable form provided by the IRS, taxpayers can easily fill out and submit this important document to meet their tax obligations.

In conclusion, the 1099 form is an essential tool for reporting income to the IRS. By utilizing the printable form provided by the IRS, taxpayers can ensure compliance with tax laws and avoid any potential penalties or fines. It is important to accurately report all sources of income to the IRS to maintain good standing with the tax authorities.

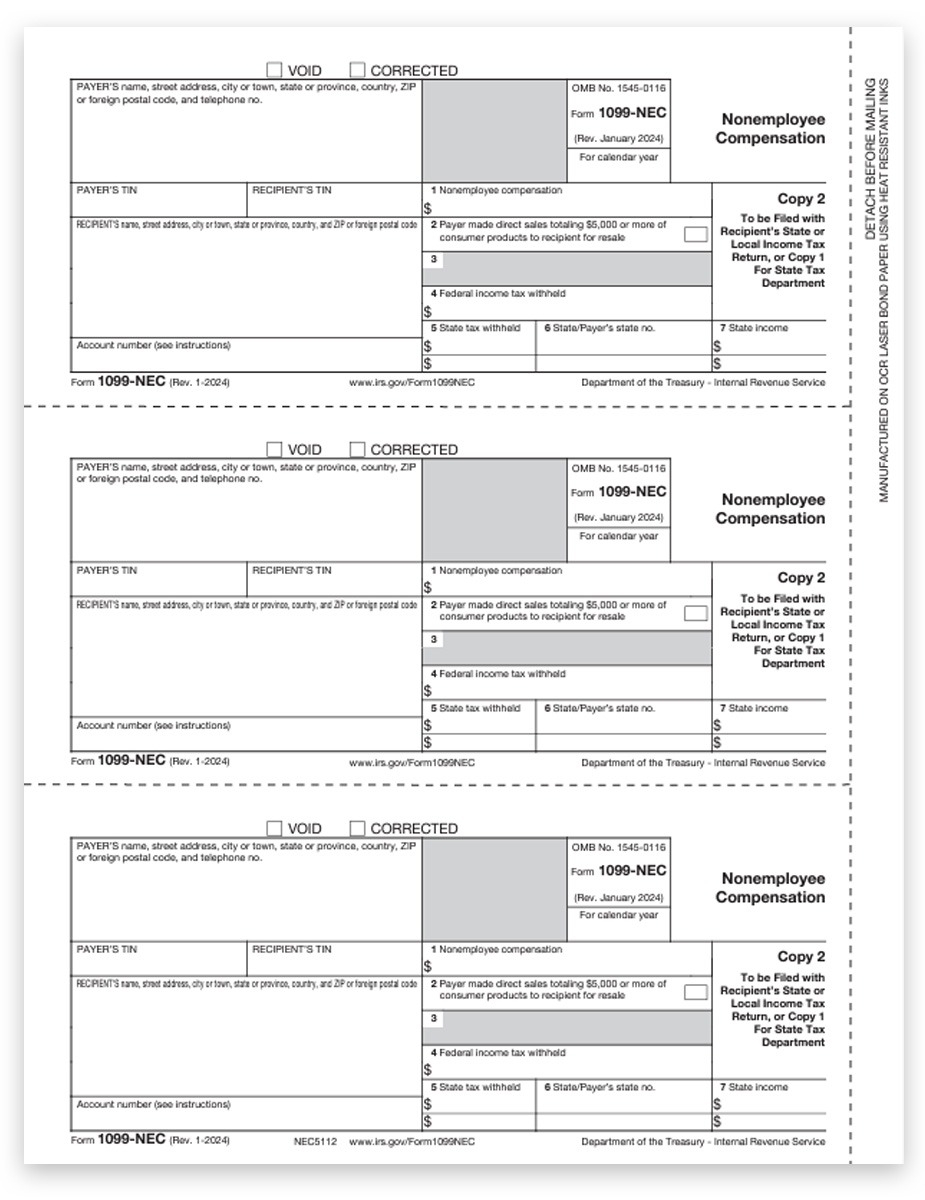

Easily Download and Print 1099 Form Irs Printable

1099 Form Irs Printable are ideal for teams that prefer physical records or need hard copies for employee records. Most forms include fields for staff name, date range, total earnings, withholdings, and final salary—making them both comprehensive and user-friendly.

Take control of your payroll system today with a trusted printable payroll template. Save time, minimize mistakes, and stay organized—all while keeping your payroll records clear.

Where Can I Get 1099 Forms 2024 1099 NEC And 1099 Misc 4 Part Tax Forms Irs 1099 Form 2024

Where Can I Get 1099 Forms 2024 1099 NEC And 1099 Misc 4 Part Tax Forms Irs 1099 Form 2024

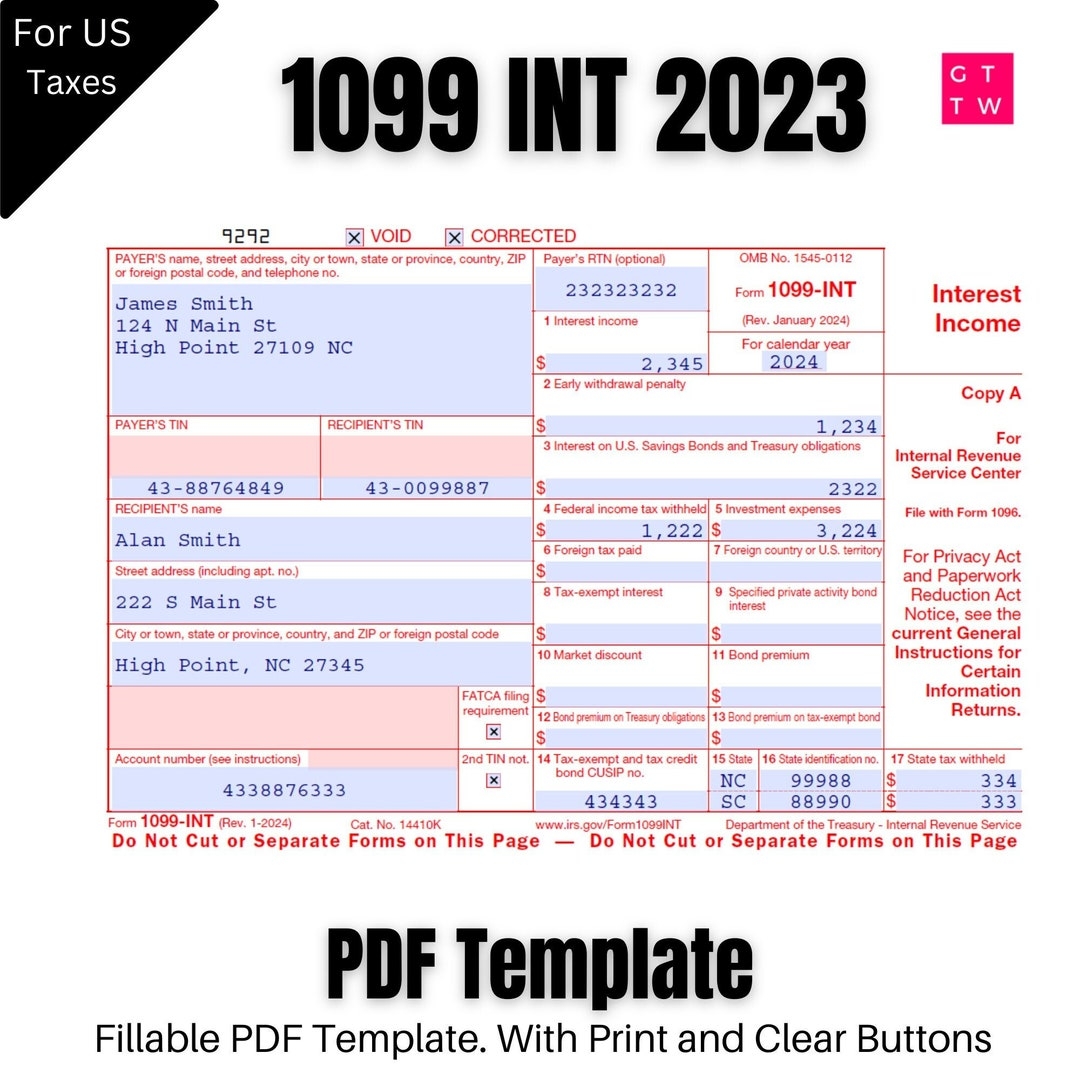

1099 INT Form PDF Template 2024 2023 With Print And Clear Buttons Etsy

1099 INT Form PDF Template 2024 2023 With Print And Clear Buttons Etsy

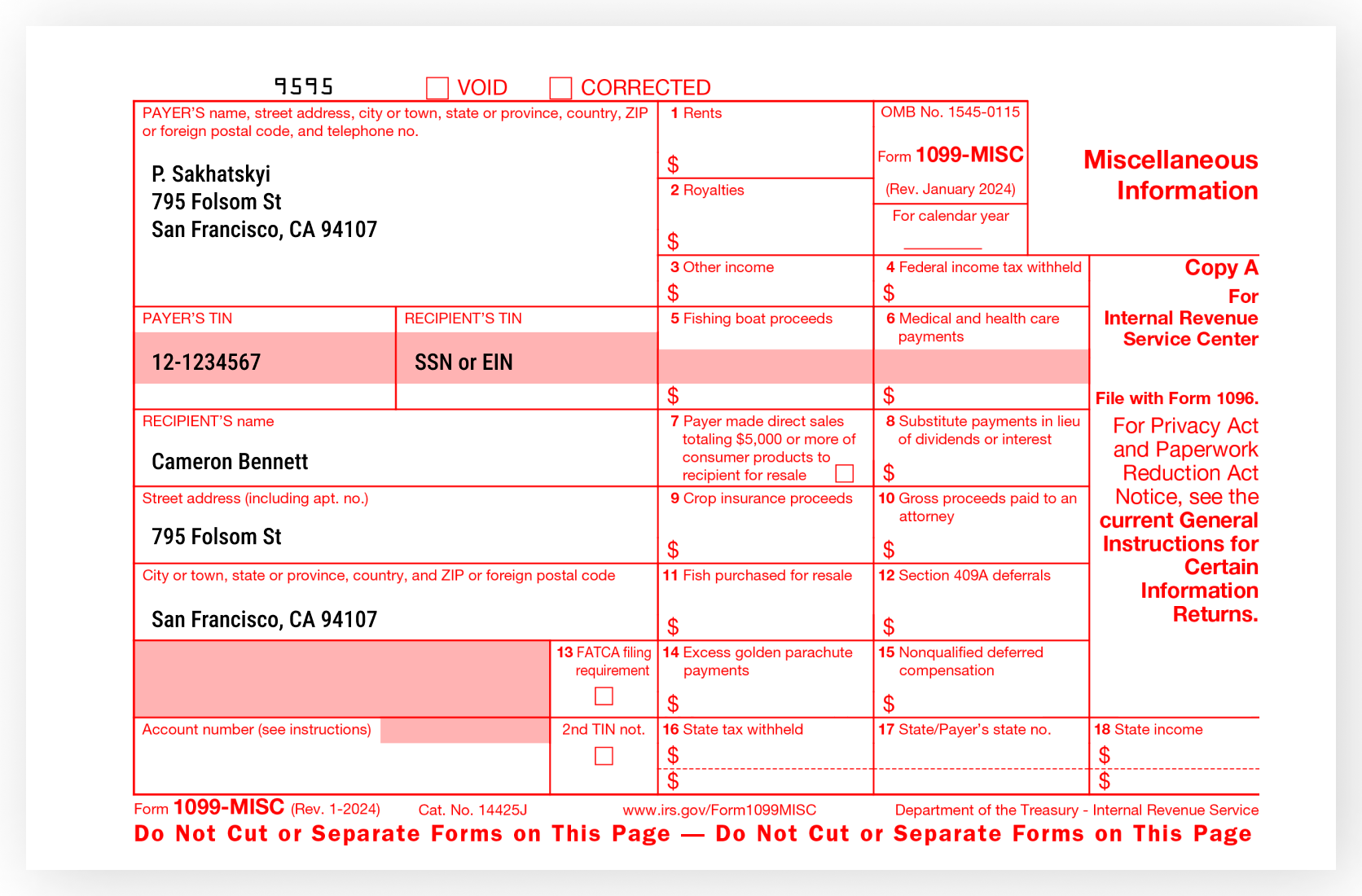

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

Processing employee payments doesn’t have to be overwhelming. A 1099 Form Irs Printable offers a quick, dependable, and straightforward method for tracking employee pay, shifts, and deductions—without the need for complex software.

Whether you’re a small business owner, payroll manager, or independent contractor, using a1099 Form Irs Printable helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and complete it by hand or type directly into the file before printing.