When it comes to filing your taxes, the IRS 1040 form is one of the most commonly used forms. It is used by individuals to report their annual income to the IRS and determine how much tax they owe or how much of a refund they are entitled to receive. The form can be complex, but there are resources available to help you navigate through it.

One of the most convenient ways to access the IRS 1040 form is through their website. They offer a printable version of the form that you can fill out and submit either electronically or by mail. This form is updated annually to reflect any changes in tax laws or regulations, so it’s important to use the most current version when filing your taxes.

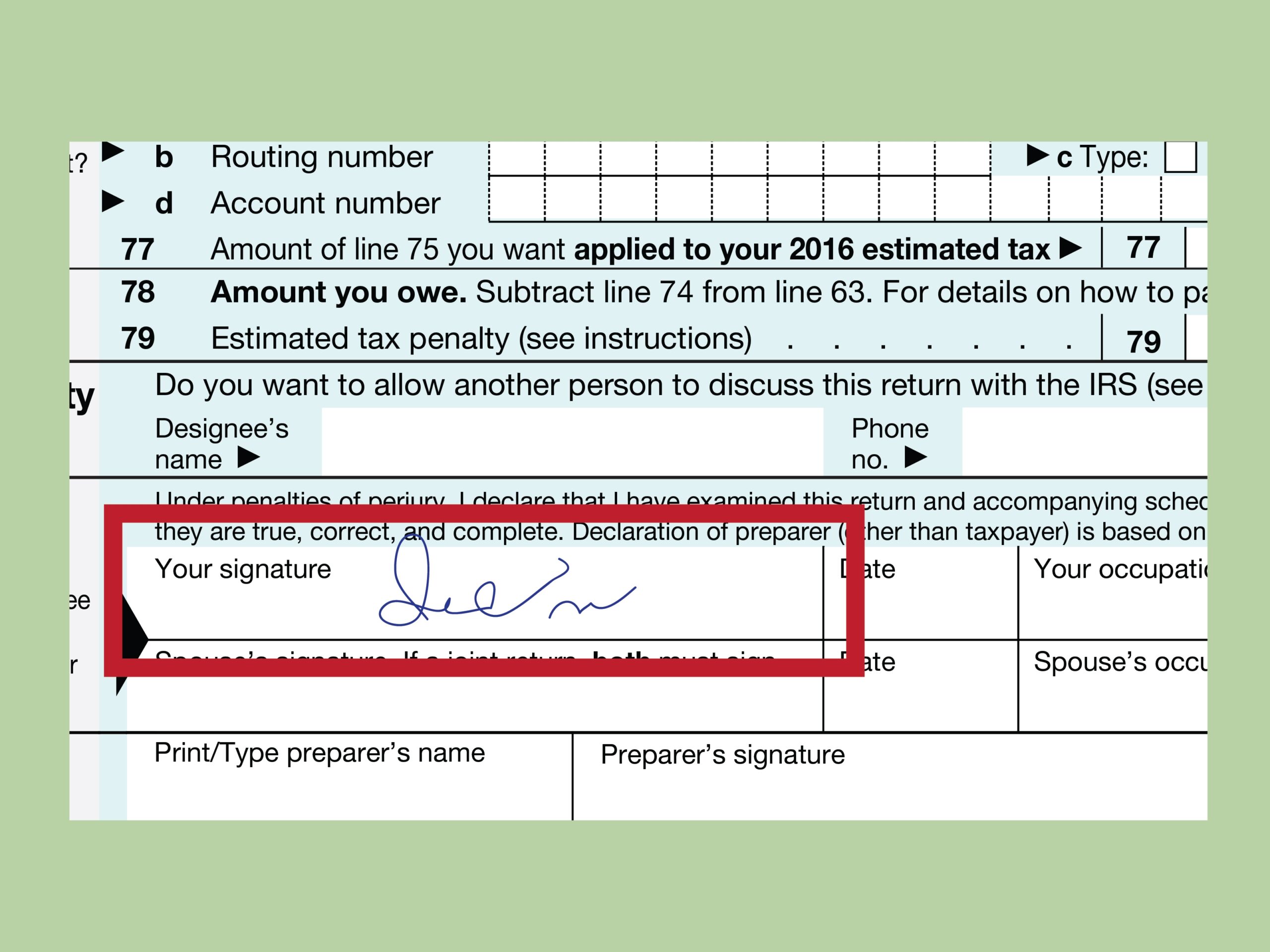

When filling out the IRS 1040 form, you will need to provide information about your income, deductions, credits, and any taxes you have already paid. It’s important to double-check your entries to avoid errors that could delay your refund or result in penalties. If you’re unsure about how to complete any section of the form, the IRS provides instructions and guidance to help you through the process.

Once you have completed the IRS 1040 form, you can submit it electronically using the IRS e-file system or mail it to the address listed on the form. If you are expecting a refund, filing electronically can expedite the process and get your money to you faster. If you owe taxes, you can choose to pay electronically or by check when you submit your form.

Overall, the IRS 1040 form is a crucial document for individuals to report their income and taxes accurately. By utilizing the printable version available on the IRS website and following the instructions provided, you can ensure that your tax return is filed correctly and on time. Remember to keep a copy of your completed form for your records and reach out to the IRS or a tax professional if you have any questions or need assistance.

In conclusion, the IRS 1040 form is a key tool for individuals to fulfill their tax obligations and claim any refunds they are entitled to. By accessing the printable version of the form on the IRS website and following the instructions provided, you can navigate through the process with confidence. Be mindful of deadlines and accuracy to avoid any issues with your tax return. Happy filing!