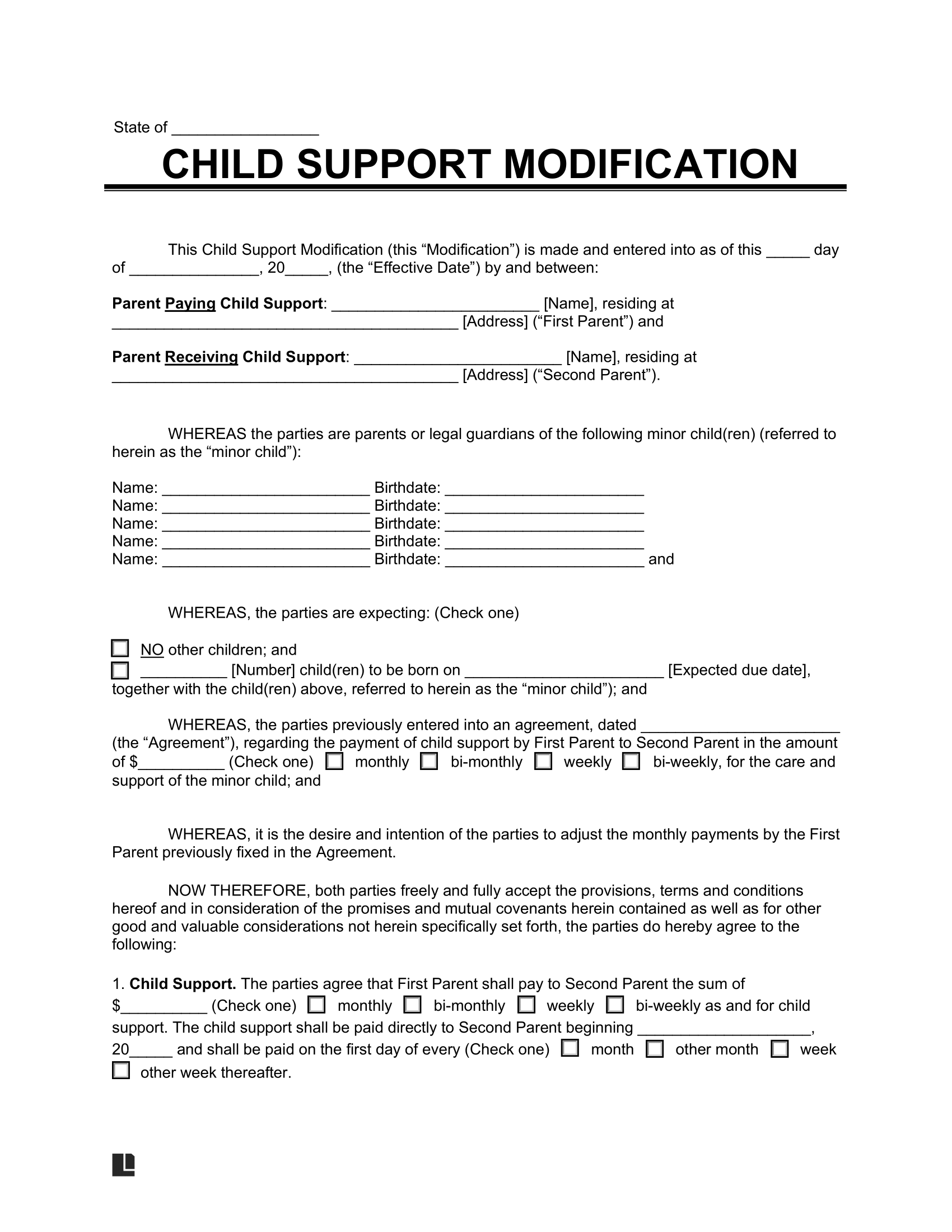

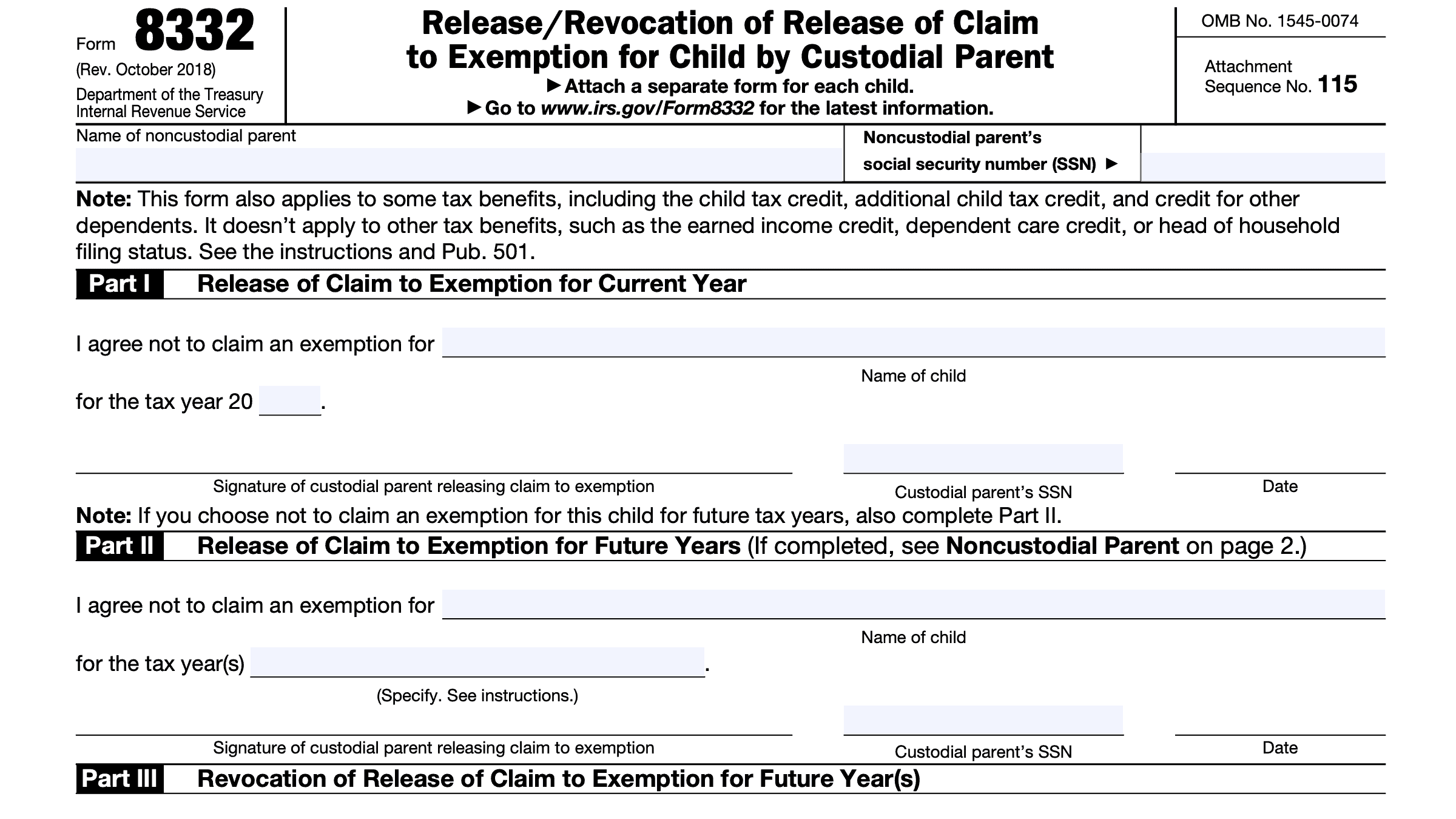

When it comes to claiming dependents on your tax return, IRS Form 8332 is a crucial document that can help you navigate the process. This form is used to release a parent’s claim to their child as a dependent, allowing the other parent to claim the child instead. Understanding how to properly fill out and submit Form 8332 can make a significant difference in your tax return.

Form 8332 is especially important for parents who are divorced or separated and need to determine who can claim the child as a dependent for tax purposes. By completing this form, the custodial parent can release their claim to the child, allowing the non-custodial parent to claim the child on their tax return.

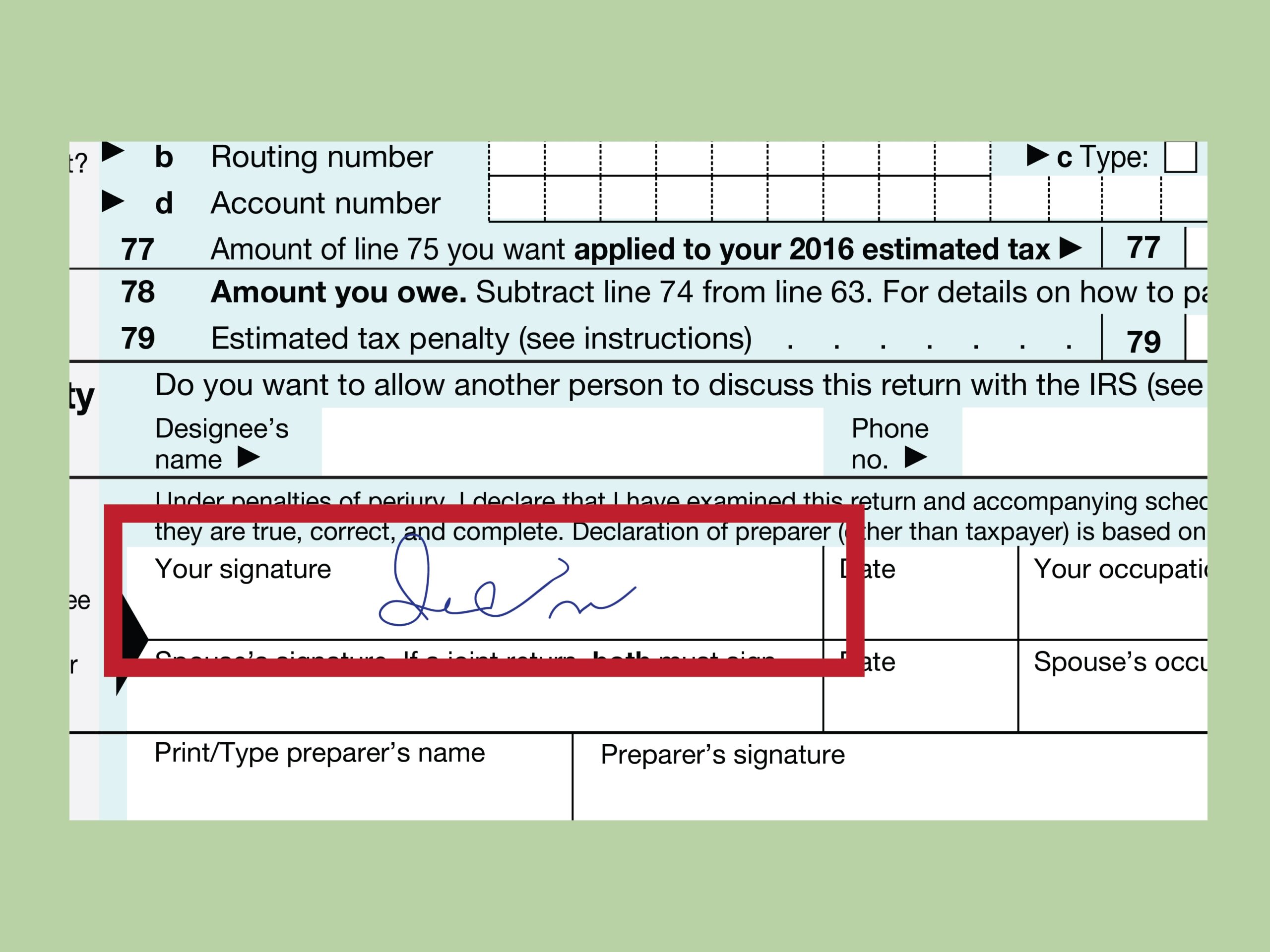

It is essential to note that Form 8332 must be signed by the custodial parent and attached to the non-custodial parent’s tax return for the year in which they are claiming the child as a dependent. Without this form, the IRS may not allow the non-custodial parent to claim the child, leading to potential tax issues.

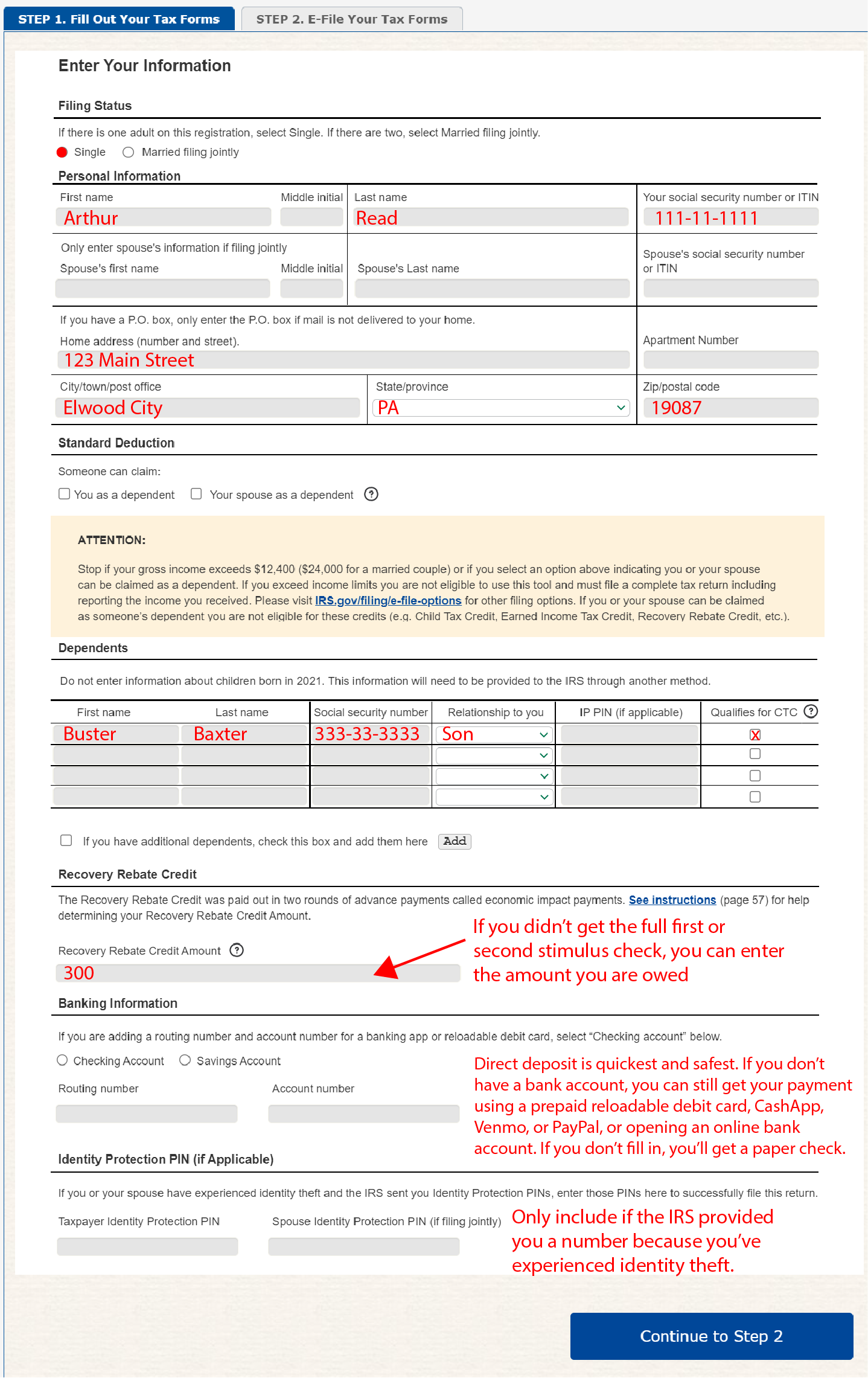

When filling out Form 8332, be sure to provide all necessary information, including the names and social security numbers of both parents and the child. Additionally, indicate the tax year for which the release of claim is being made and any other relevant details. Once the form is completed, both parents must sign and date it to make it valid.

It is important to keep a copy of Form 8332 for your records and to ensure that it is submitted correctly with your tax return. Failure to include this form when claiming a child as a dependent can result in delays in processing your return or even an audit by the IRS.

In conclusion, IRS Form 8332 is a vital document for parents who need to release their claim to a child as a dependent for tax purposes. By understanding how to properly fill out and submit this form, you can avoid potential issues with your tax return and ensure that you are in compliance with IRS regulations. Be sure to consult with a tax professional if you have any questions about Form 8332 or claiming dependents on your tax return.

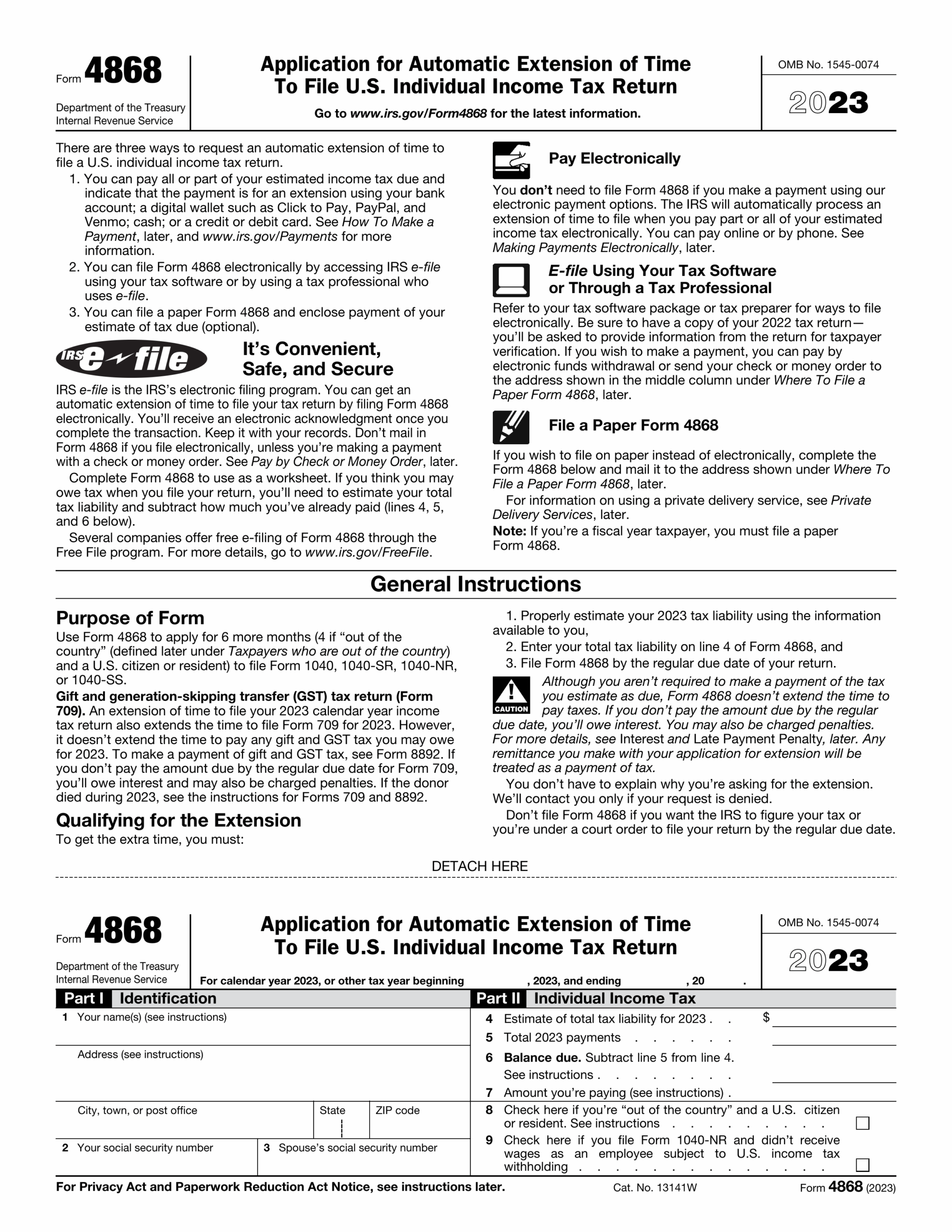

Download and Print Irs Form 8332 Printable

Printable payroll form are ideal for companies that prefer physical records or need physical copies for employee records. Most forms include fields for employee name, date range, total earnings, taxes, and net pay—making them both comprehensive and practical.

Take control of your payment tracking today with a trusted Irs Form 8332 Printable. Save time, reduce errors, and maintain clear records—all while keeping your financial logs organized.

Form For Non Custodial Parent Shop

Form For Non Custodial Parent Shop

Non Custodial Online Parent Tax Rights

Non Custodial Online Parent Tax Rights

How To Fill Out IRS Form 1040 With Pictures WikiHow

How To Fill Out IRS Form 1040 With Pictures WikiHow

Form 8332 For 2024 2025 Fill Edit And Download PDF Guru

Form 8332 For 2024 2025 Fill Edit And Download PDF Guru

IRS Form 8332 Instructions Release Of Child Exemption

IRS Form 8332 Instructions Release Of Child Exemption

Processing staff wages doesn’t have to be overwhelming. A payroll printable offers a quick, dependable, and easy-to-use method for tracking wages, work time, and withholdings—without the need for complex software.

Whether you’re a startup founder, payroll manager, or sole proprietor, using apayroll template helps ensure compliance with regulations. Simply access the template, print it, and complete it by hand or type directly into the file before printing.