As we approach tax season in 2025, it’s important to familiarize yourself with the necessary forms for filing your taxes. One of these forms is the IRS Form 1098, which is used to report certain types of payments, such as mortgage interest, to the IRS. Understanding how to properly fill out and submit this form is crucial to ensure compliance with tax laws and avoid any penalties.

IRS Form 1098 for 2025 is a vital document for homeowners and individuals who have paid mortgage interest, student loan interest, or received certain types of income. This form provides important information to the IRS about the amounts paid or received throughout the tax year. It is essential to accurately report this information to avoid any discrepancies in your tax return.

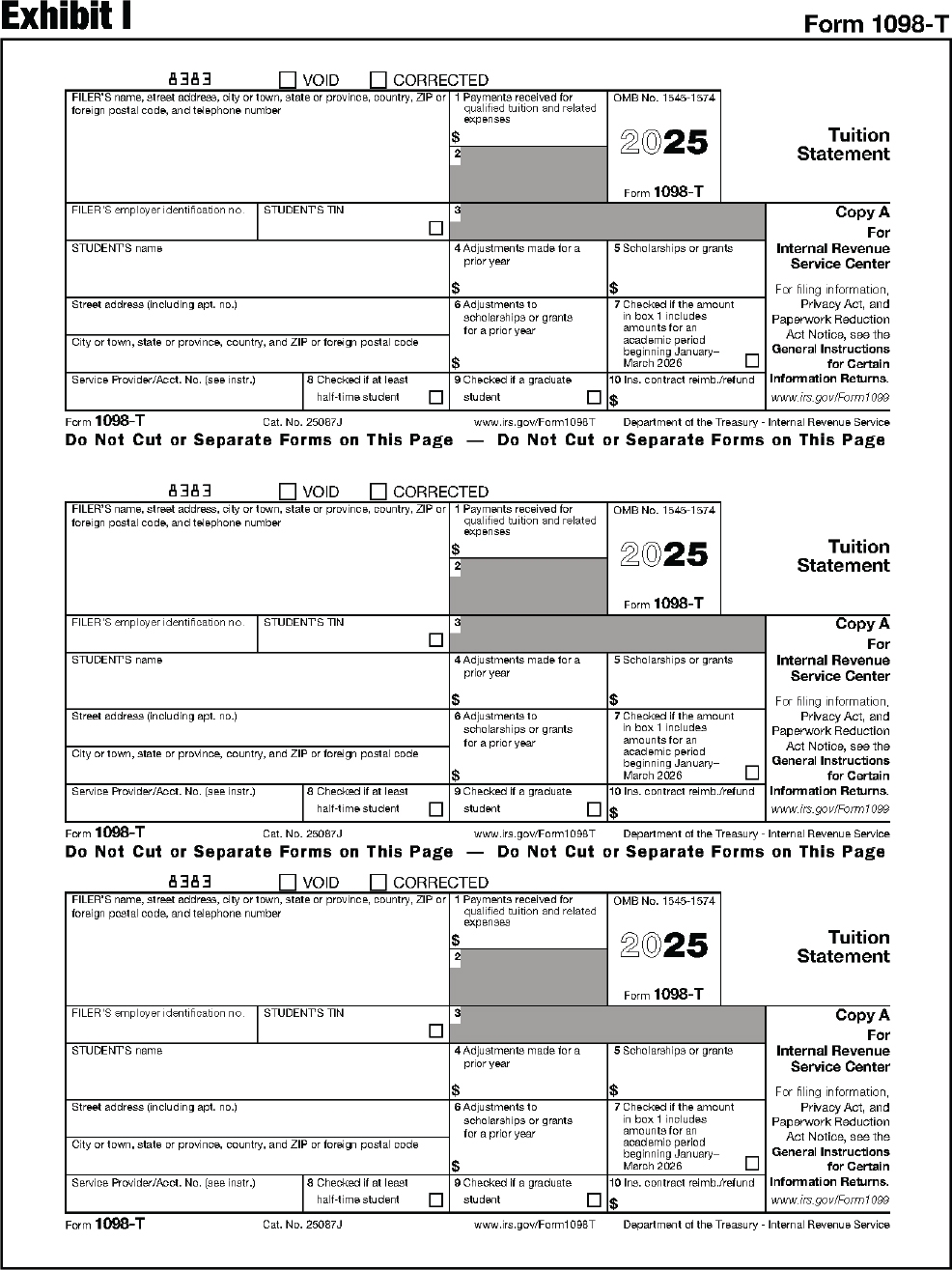

Irs Form 1098 For 2025 Printable

Irs Form 1098 For 2025 Printable

When filling out IRS Form 1098 for 2025, you will need to provide details about the lender or payee, the amount of interest paid or received, and other relevant information. It is important to carefully review the form and ensure that all the information is accurate before submitting it to the IRS. You can easily access and print the form from the IRS website or through tax preparation software.

It is crucial to file IRS Form 1098 by the deadline to avoid any penalties or fines. The deadline for submitting this form is typically at the end of January for the previous tax year. Failure to file or inaccurately reporting information on the form can result in penalties from the IRS. Make sure to review the instructions for the form carefully and seek help from a tax professional if needed.

Overall, IRS Form 1098 for 2025 is a key document for reporting certain types of payments to the IRS. By understanding how to properly fill out and submit this form, you can ensure compliance with tax laws and avoid any potential issues with your tax return. Take the time to review the form and seek assistance if necessary to ensure a smooth tax filing process.

Get ahead of your tax preparation by downloading and printing IRS Form 1098 for 2025 today. Remember to accurately report all relevant information to avoid any penalties or fines from the IRS. Stay informed and proactive in your tax filing process to ensure a hassle-free experience.