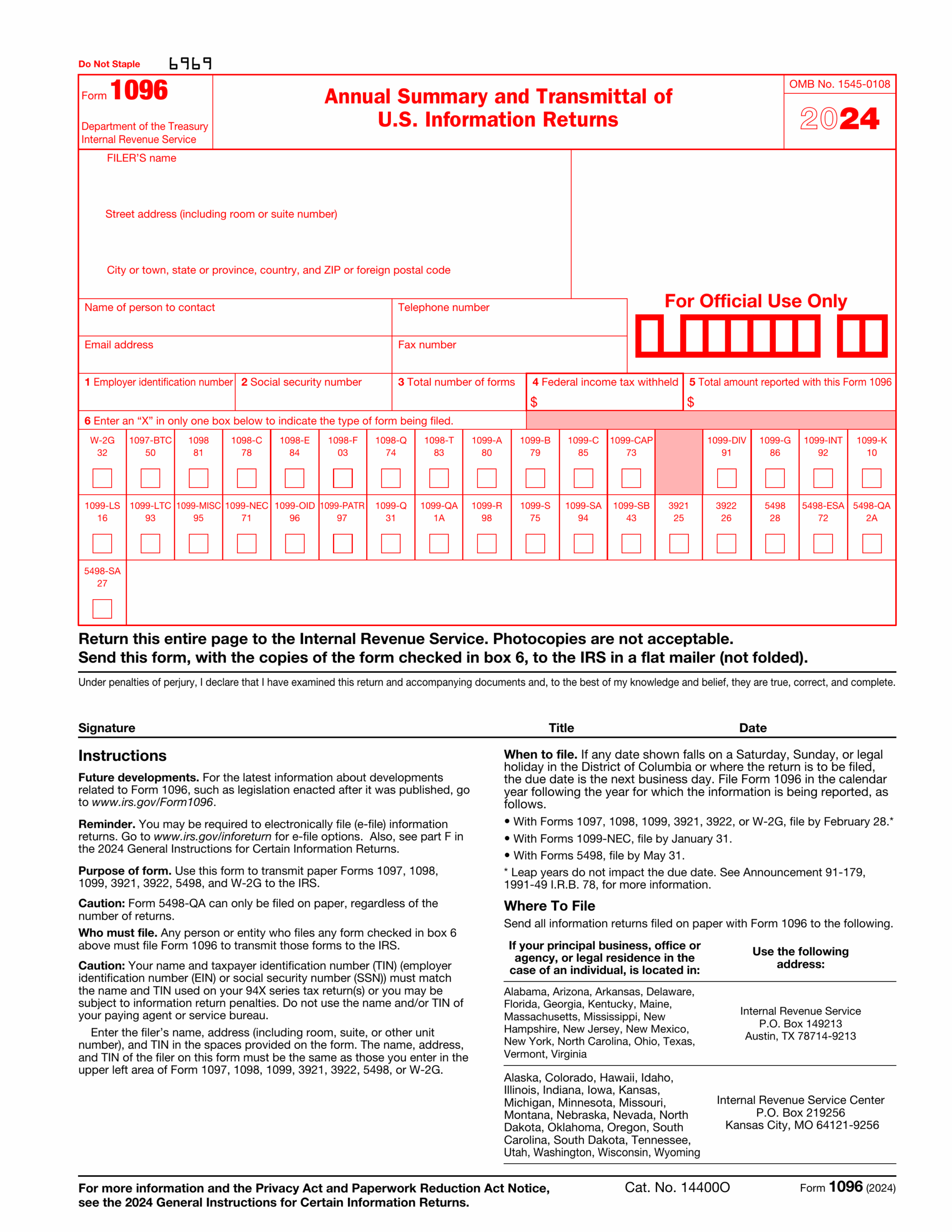

Filing taxes can be a daunting task, but having the right forms and resources can make the process much easier. One important form to be aware of is the IRS Form 1096, which is used to summarize and transmit forms 1099, such as 1099-NEC, 1099-MISC, and others, to the IRS. For the year 2025, it is essential to have the most up-to-date version of this form to ensure accurate and timely reporting.

IRS Form 1096 for 2025 is a crucial document for businesses and individuals who have paid non-employee compensation, dividends, interest income, or other types of income that require a 1099 form to be issued. This form serves as a cover sheet that must be submitted along with the corresponding 1099 forms to the IRS. It includes important information such as the total number of forms being submitted, the total amount of income reported, and the taxpayer identification number of the filer.

Irs Form 1096 For 2025 Printable

Irs Form 1096 For 2025 Printable

When completing IRS Form 1096 for 2025, it is important to ensure that all information is accurate and up-to-date. Any errors or discrepancies could result in penalties or delays in processing. The form can be filled out electronically or manually, depending on the preference of the filer. Additionally, it is essential to follow the instructions provided by the IRS to avoid any potential issues.

For those looking to download and print IRS Form 1096 for 2025, the form is readily available on the IRS website. It can be easily accessed and printed for free, making it convenient for filers to complete their tax reporting requirements. Having a printable version of the form allows individuals and businesses to keep organized records and ensure compliance with IRS regulations.

In conclusion, IRS Form 1096 for 2025 is a necessary document for reporting various types of income to the IRS. By understanding the purpose of this form and ensuring its accurate completion, filers can avoid potential penalties and ensure a smooth tax filing process. With the availability of printable versions of the form, individuals and businesses can easily access and submit the necessary documentation to fulfill their tax obligations.

Get and Print Irs Form 1096 For 2025 Printable

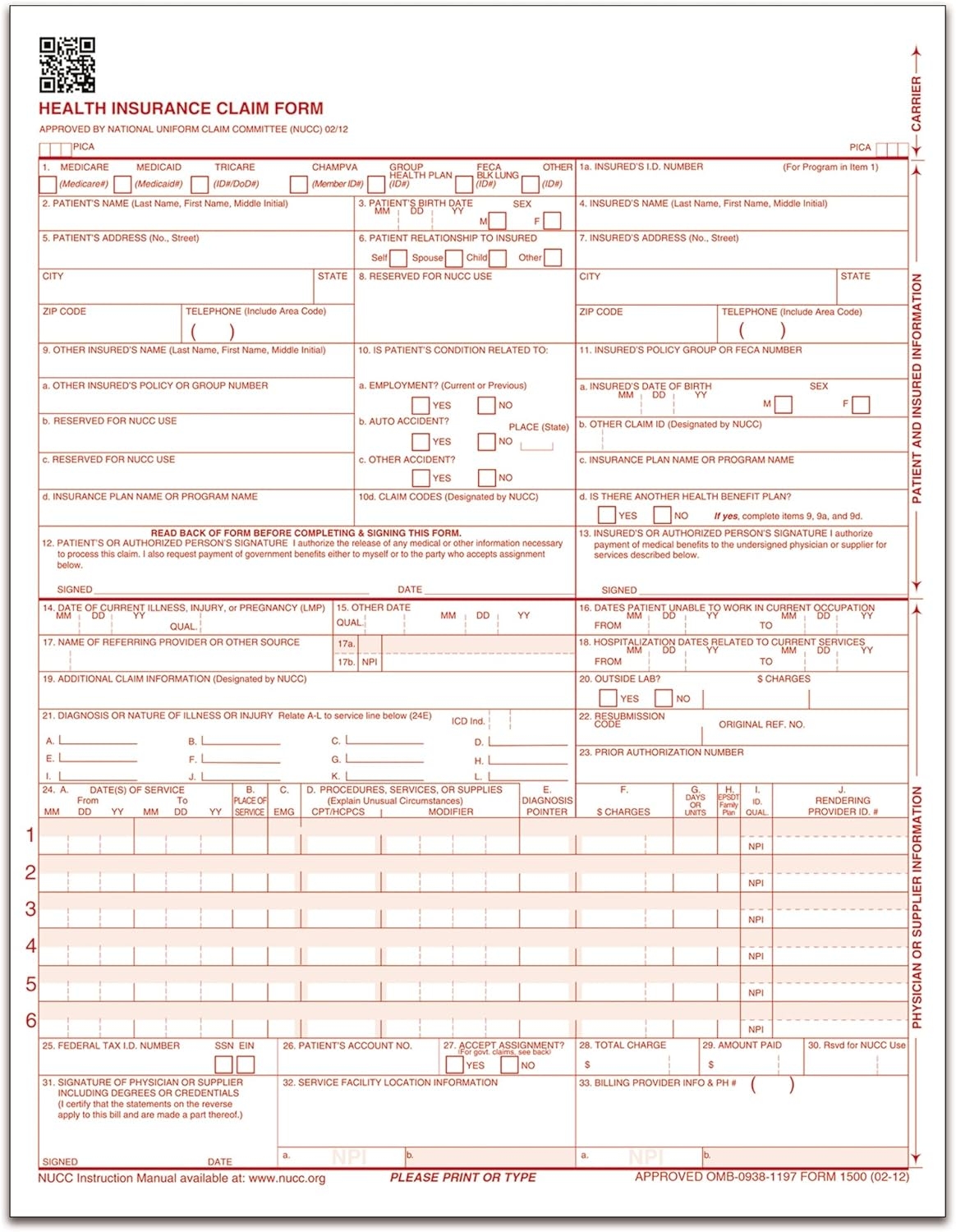

Payroll printable are ideal for companies that prefer non-digital systems or need hard copies for audit purposes. Most forms include fields for employee name, date range, total earnings, taxes, and final salary—making them both comprehensive and practical.

Take control of your payment tracking today with a trusted printable payroll form. Save time, reduce errors, and maintain clear records—all while keeping your financial logs organized.

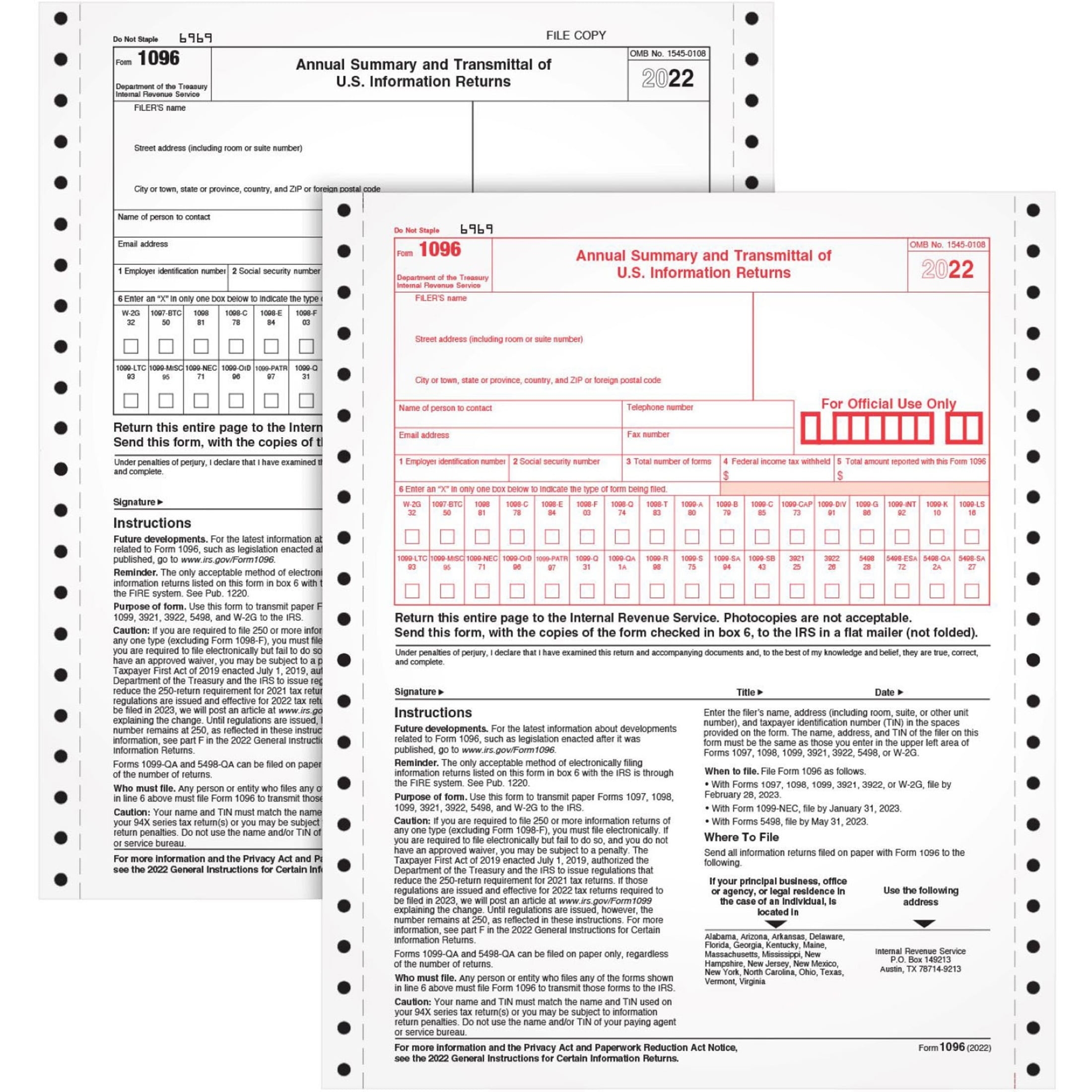

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

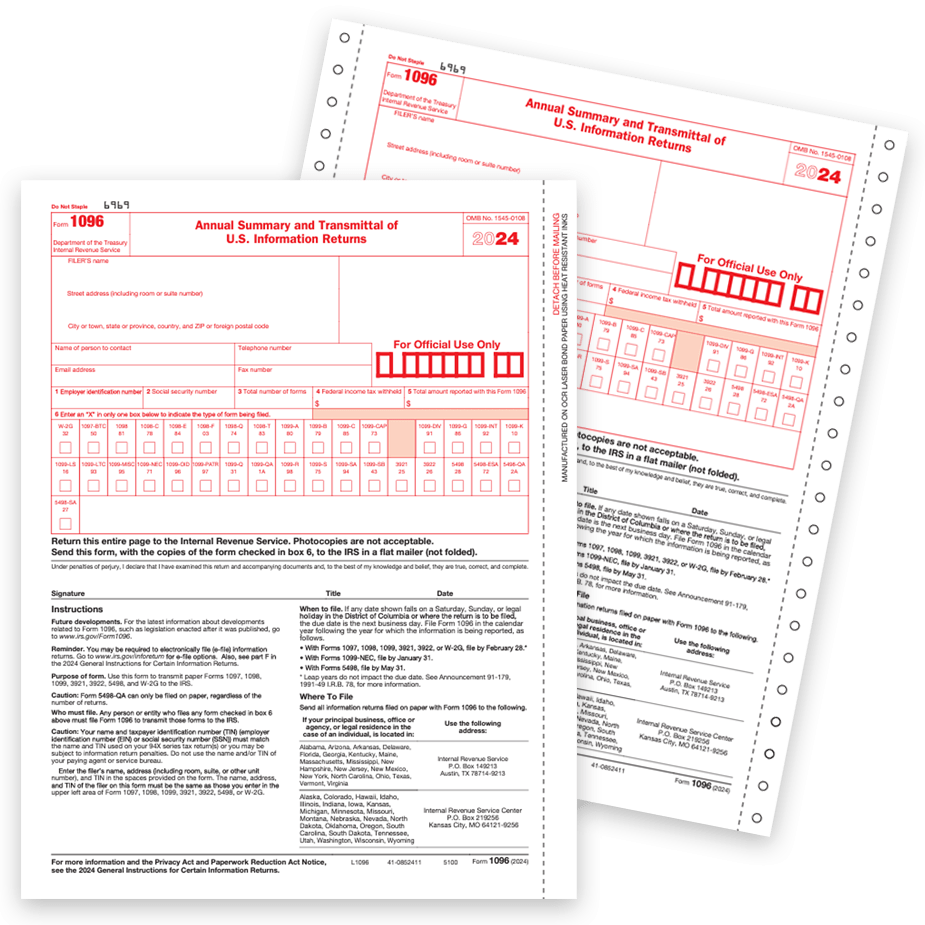

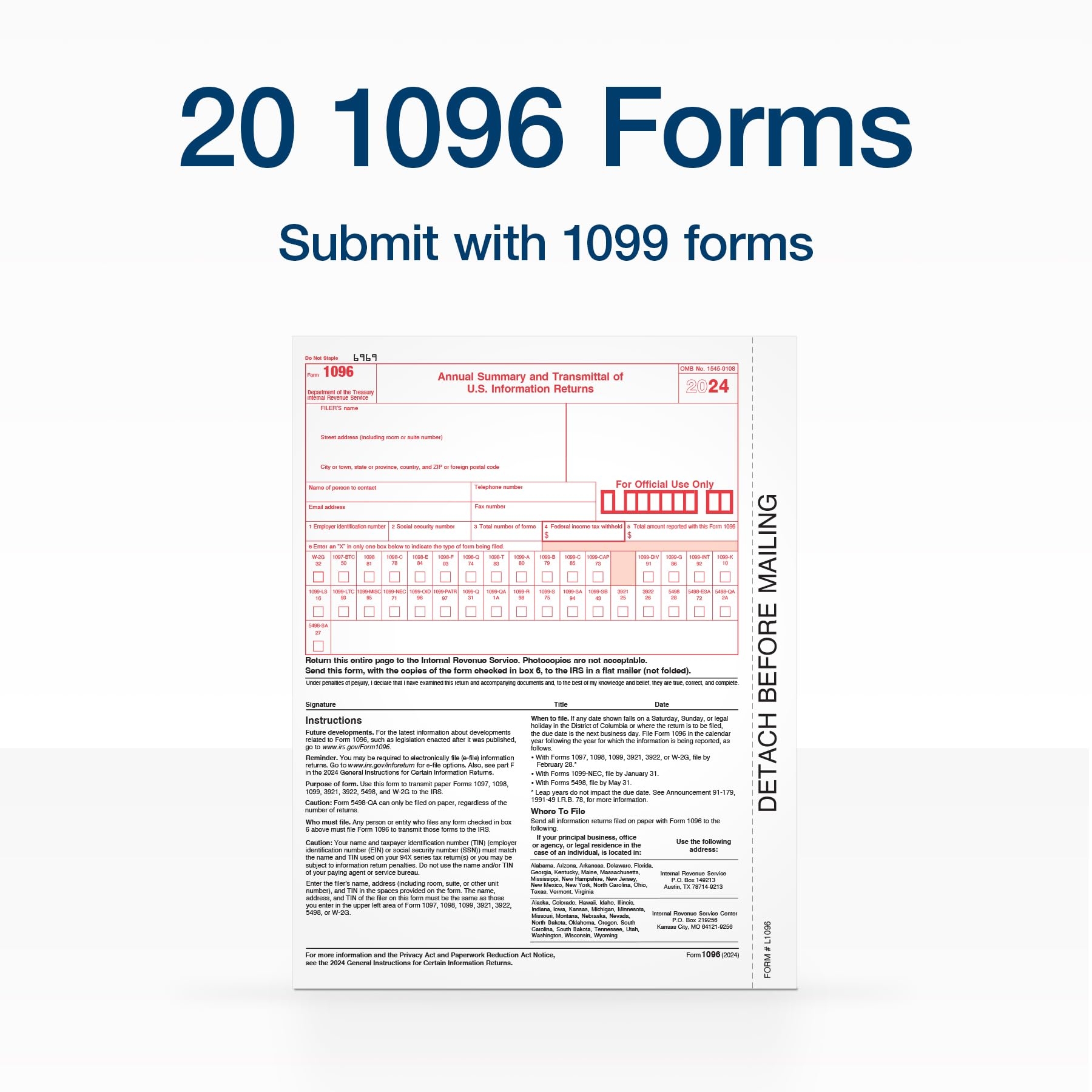

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

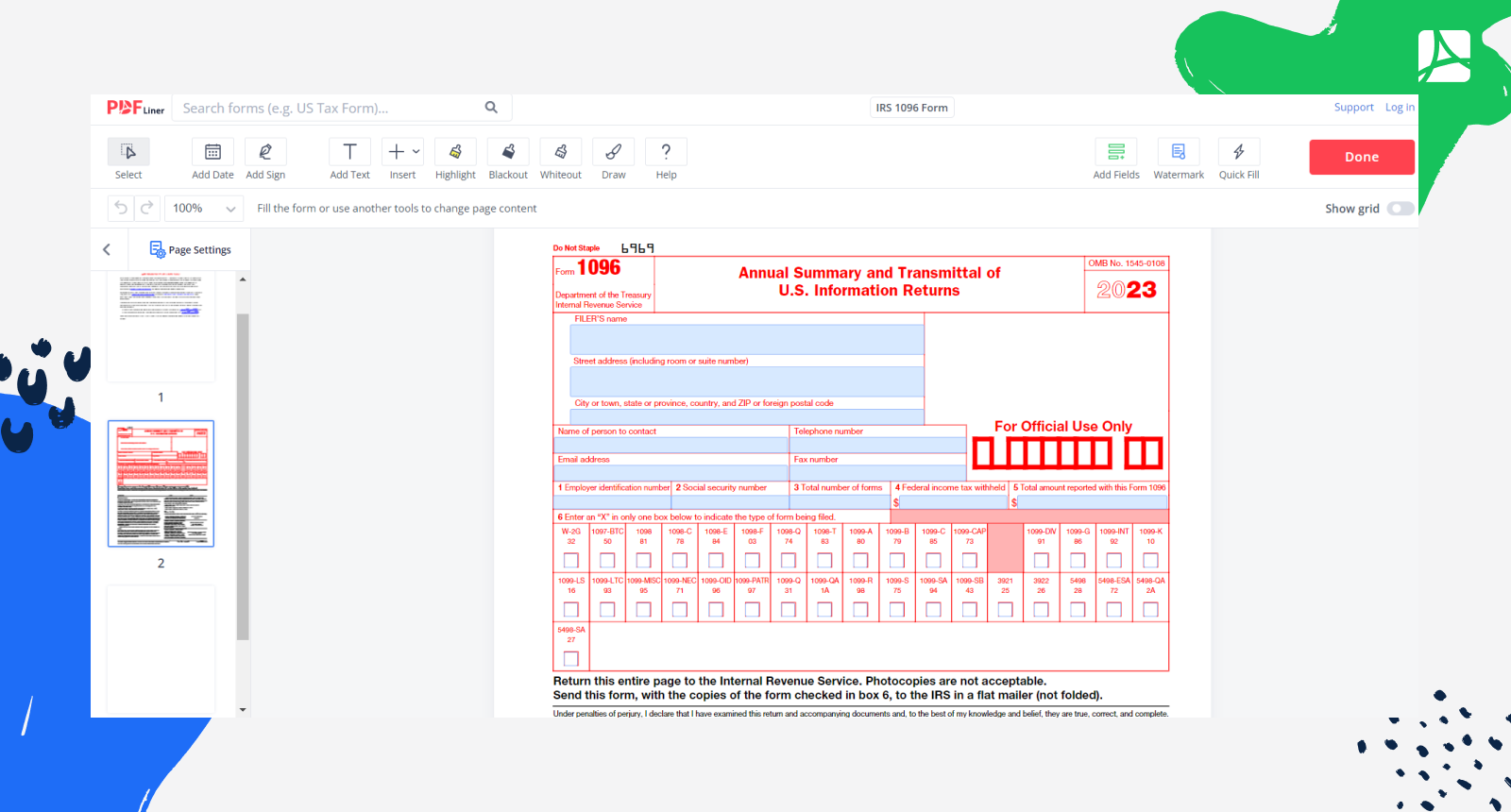

Form 1096 2024 2025 Fill Edit And Download PDF Guru

Form 1096 2024 2025 Fill Edit And Download PDF Guru

Managing payroll tasks doesn’t have to be difficult. A payroll printable offers a speedy, reliable, and easy-to-use method for tracking employee pay, work time, and deductions—without the need for digital systems.

Whether you’re a startup founder, payroll manager, or independent contractor, using aprintable payroll helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.