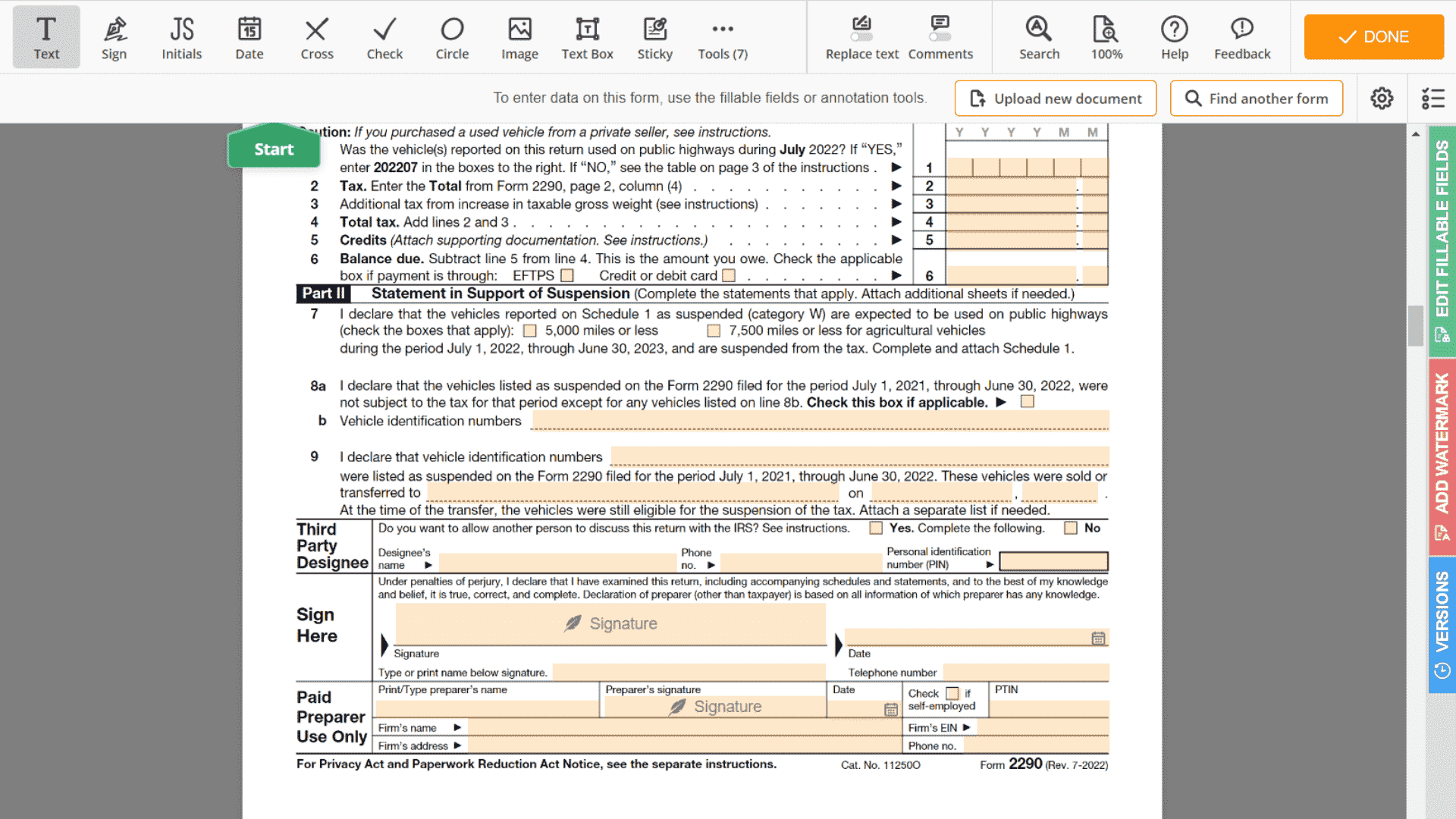

When it comes to filing taxes as a truck owner or operator, one of the important forms to be aware of is the IRS Form 2290. This form is used to report and pay the heavy highway vehicle use tax, which is required for vehicles that weigh 55,000 pounds or more. For the year 2025, truck owners can easily access and fill out the IRS 2290 Form 2025 printable version online.

By using the IRS 2290 Form 2025 printable, truck owners can conveniently fill out the necessary information and submit it to the IRS without any hassle. This form allows for a smooth and efficient process of reporting and paying the heavy highway vehicle use tax, ensuring compliance with IRS regulations and avoiding any penalties or fines.

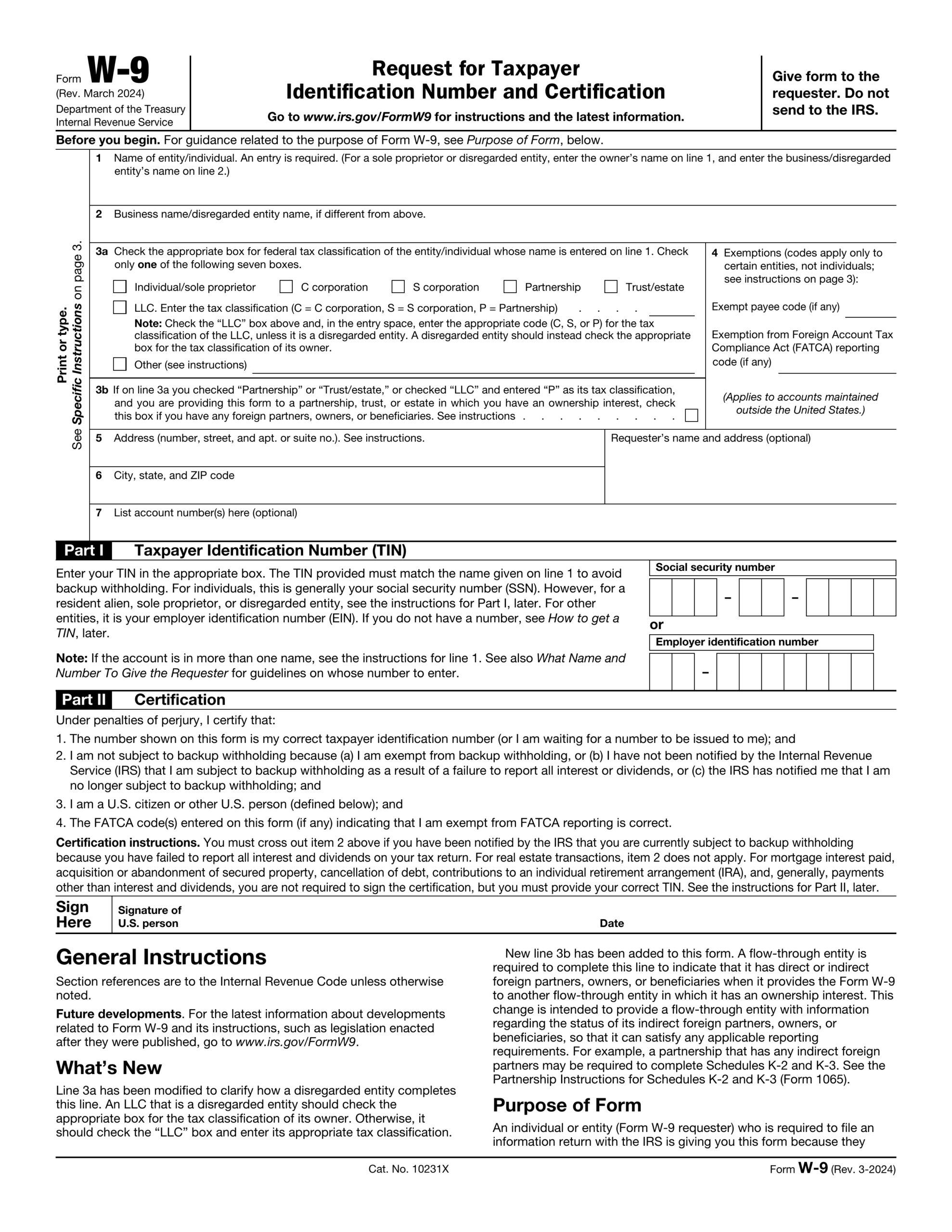

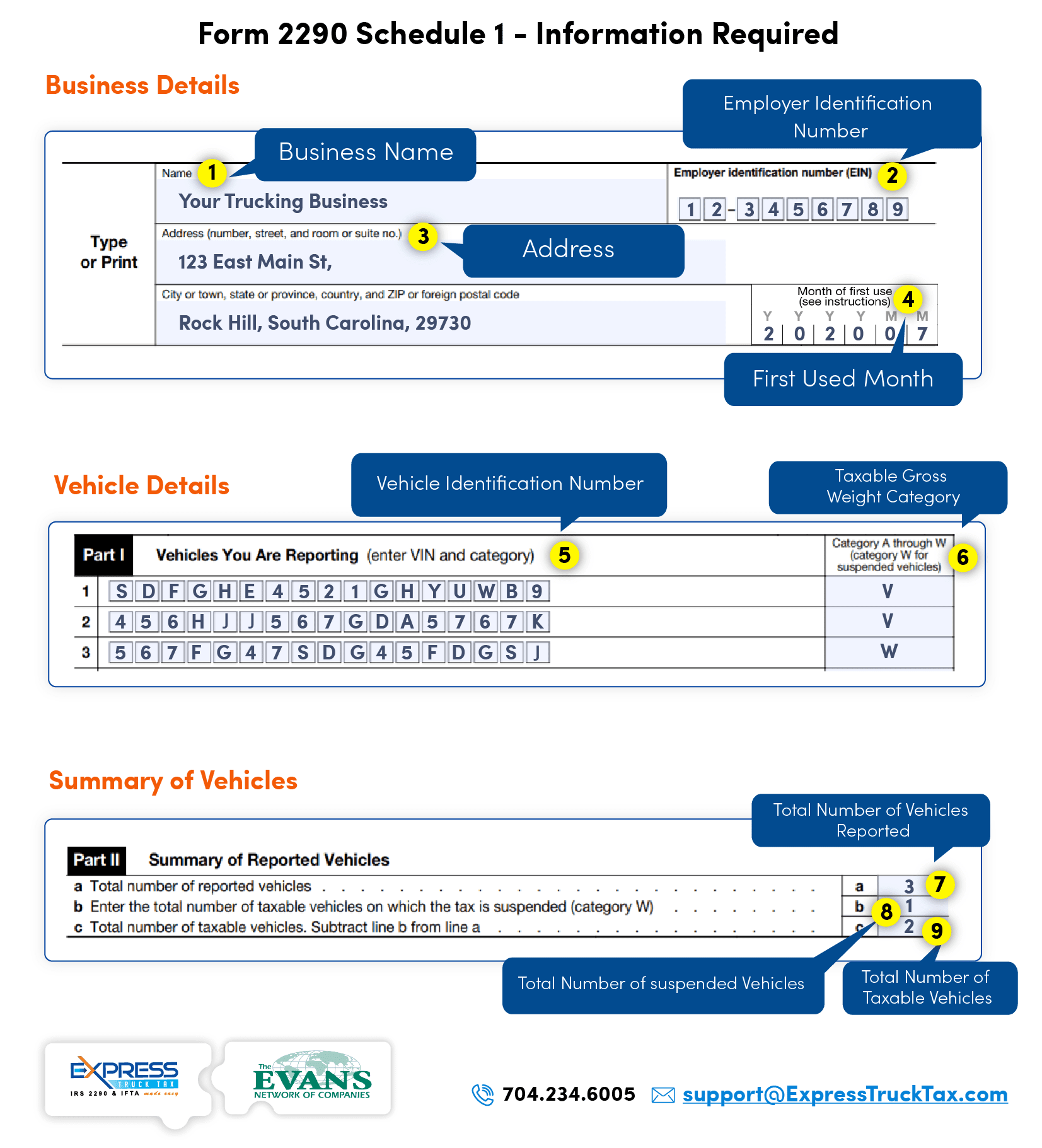

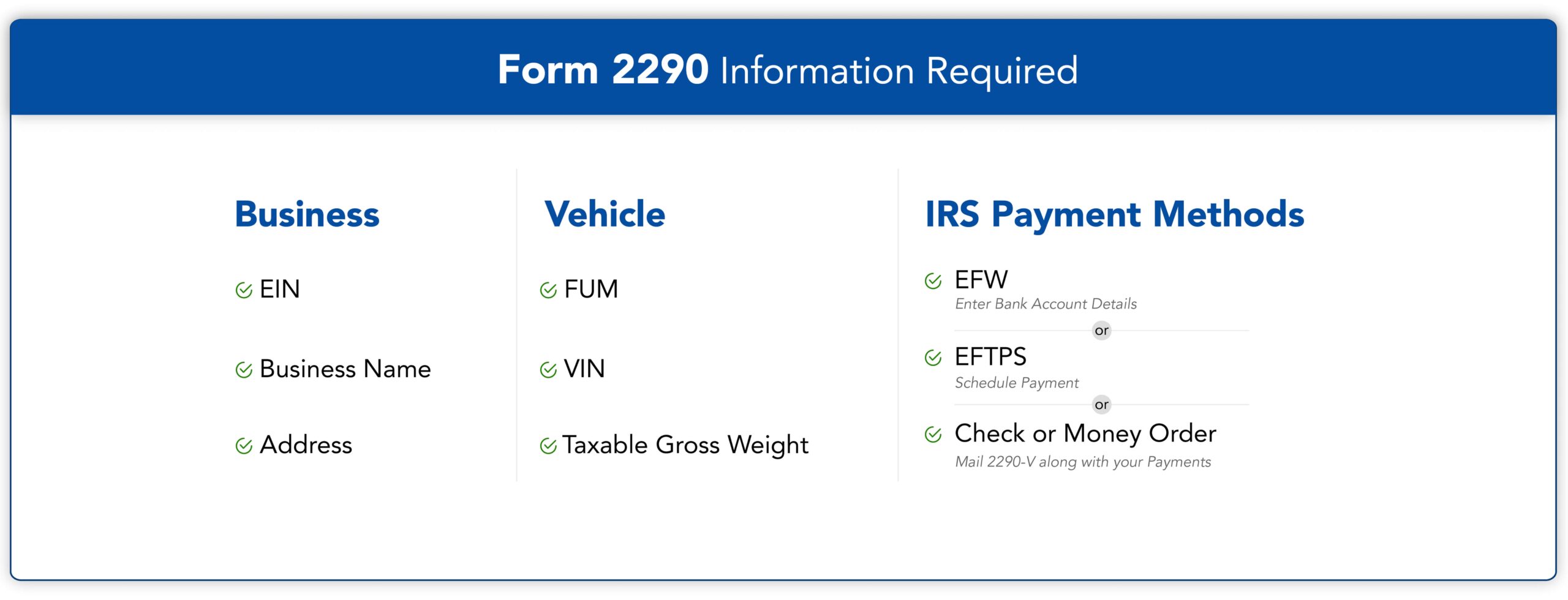

When filling out the IRS 2290 Form 2025 printable, truck owners will need to provide details such as the vehicle identification number (VIN), taxable gross weight of the vehicle, and the first use month of the vehicle. It is important to double-check all information entered on the form to ensure accuracy and avoid any delays in processing.

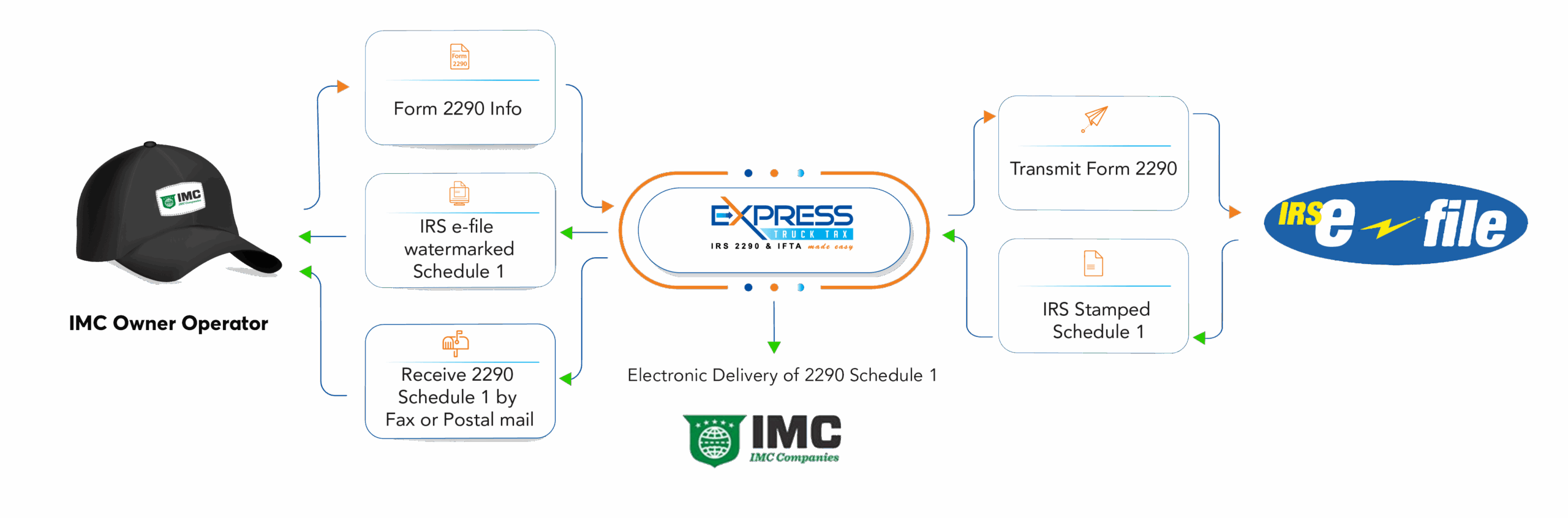

Once the IRS 2290 Form 2025 printable is completed, truck owners can submit it to the IRS either electronically or by mail. Electronic filing is the preferred method as it is faster, more secure, and provides an instant confirmation of receipt. However, for those who prefer to mail in their form, be sure to send it to the correct address provided by the IRS.

In conclusion, the IRS 2290 Form 2025 printable is a convenient and efficient way for truck owners to report and pay the heavy highway vehicle use tax. By using this form, truck owners can ensure compliance with IRS regulations and avoid any penalties or fines. It is important to fill out the form accurately and submit it in a timely manner to avoid any delays in processing. Truck owners can access the IRS 2290 Form 2025 printable online and take the necessary steps to fulfill their tax obligations.

Easily Download and Print Irs 2290 Form 2025 Printable

Payroll printable are ideal for teams that prefer paper documentation or need physical copies for employee records. Most forms include fields for employee name, pay period, total earnings, taxes, and net pay—making them both comprehensive and practical.

Take control of your payroll process today with a trusted payroll template. Save time, minimize mistakes, and stay organized—all while keeping your financial logs organized.

The Evans 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

The Evans 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

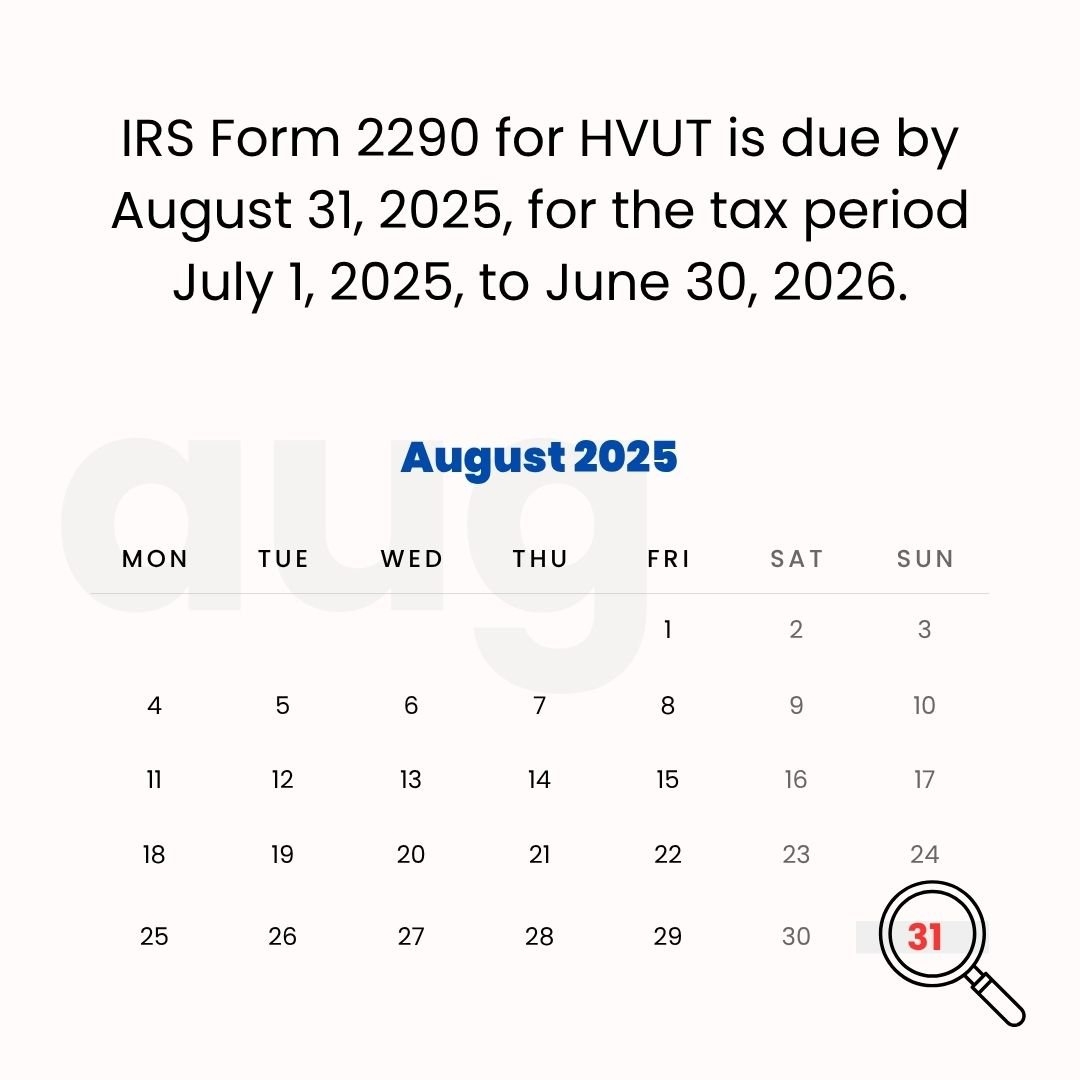

IRS Form 2290 Due Date For 2023 2024 Tax Period

IRS Form 2290 Due Date For 2023 2024 Tax Period

IMC 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

IMC 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

Irs 2290 Form 2021 Printable Form

Irs 2290 Form 2021 Printable Form

IRS 2290 Form E Filing 2025 Instant Approval Truck2290

IRS 2290 Form E Filing 2025 Instant Approval Truck2290

Handling employee payments doesn’t have to be complicated. A payroll template offers a fast, reliable, and user-friendly method for tracking wages, hours, and deductions—without the need for digital systems.

Whether you’re a freelancer, HR professional, or independent contractor, using aIrs 2290 Form 2025 Printable helps ensure proper documentation. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.