When it comes to tax forms, the W-9 is one of the most commonly used documents. The IRS W-9 form is used by businesses to request taxpayer identification numbers from individuals or companies they plan to pay for services rendered. It is essential for both the payer and the payee to have this form on file to ensure accurate reporting to the IRS.

One of the main reasons why the W-9 form is so important is that it helps businesses comply with IRS reporting requirements. By collecting this information from vendors, businesses can accurately report payments made to the IRS and avoid penalties for non-compliance. Additionally, having a completed W-9 form on file can help businesses verify the identity of their vendors and prevent potential fraud.

For individuals or companies that receive payments for services rendered, filling out a W-9 form is a necessary step to ensure they are properly reported to the IRS. By providing their taxpayer identification number and other relevant information on the form, payees can help businesses accurately report their income and avoid potential tax issues down the line.

Fortunately, the IRS provides a printable version of the W-9 form on their website, making it easy for both businesses and individuals to access and fill out the necessary information. This printable form can be downloaded, completed, and submitted to payers to ensure that all necessary information is on file for tax reporting purposes.

In conclusion, the IRS W-9 printable form is a crucial document for businesses and individuals alike when it comes to reporting income and ensuring compliance with IRS regulations. By accurately completing and submitting this form, both payers and payees can help avoid potential tax issues and ensure that all necessary information is on file for reporting purposes.

Save and Print Irs W9 Printable Form

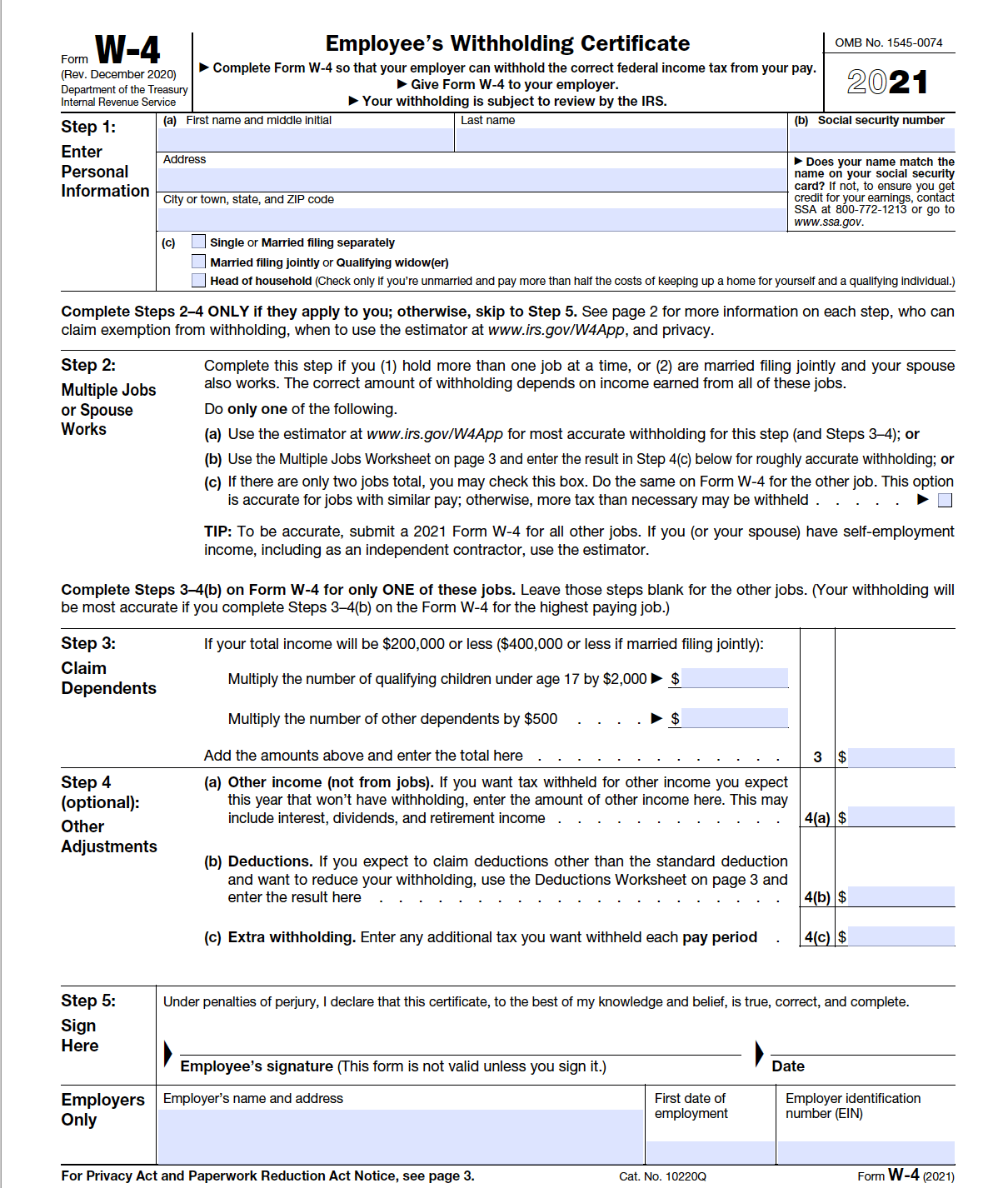

Payroll template are ideal for companies that prefer physical records or need physical copies for employee records. Most forms include fields for staff name, date range, total earnings, withholdings, and net pay—making them both complete and user-friendly.

Start simplifying your payroll process today with a trusted payroll printable. Save time, minimize mistakes, and stay organized—all while keeping your financial logs professional.

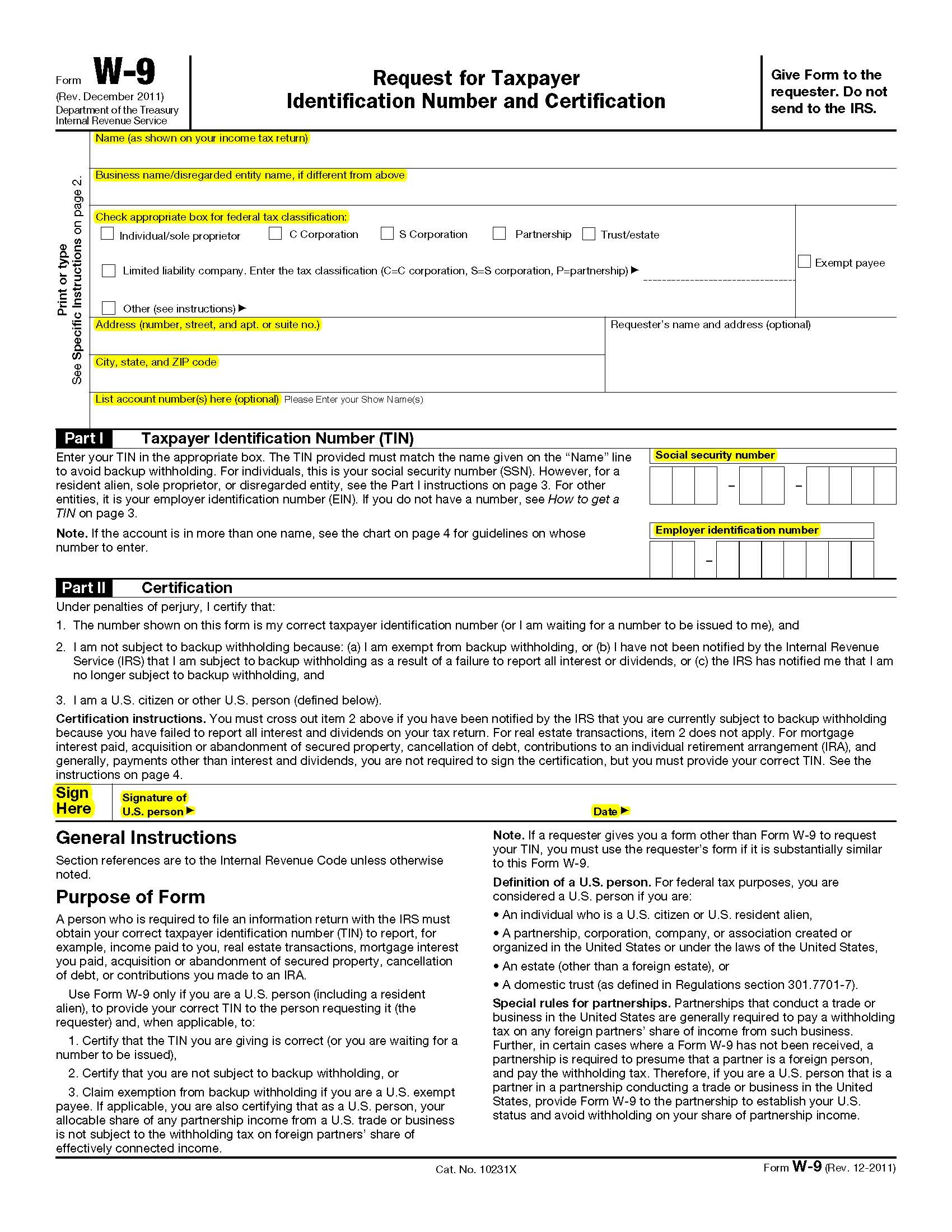

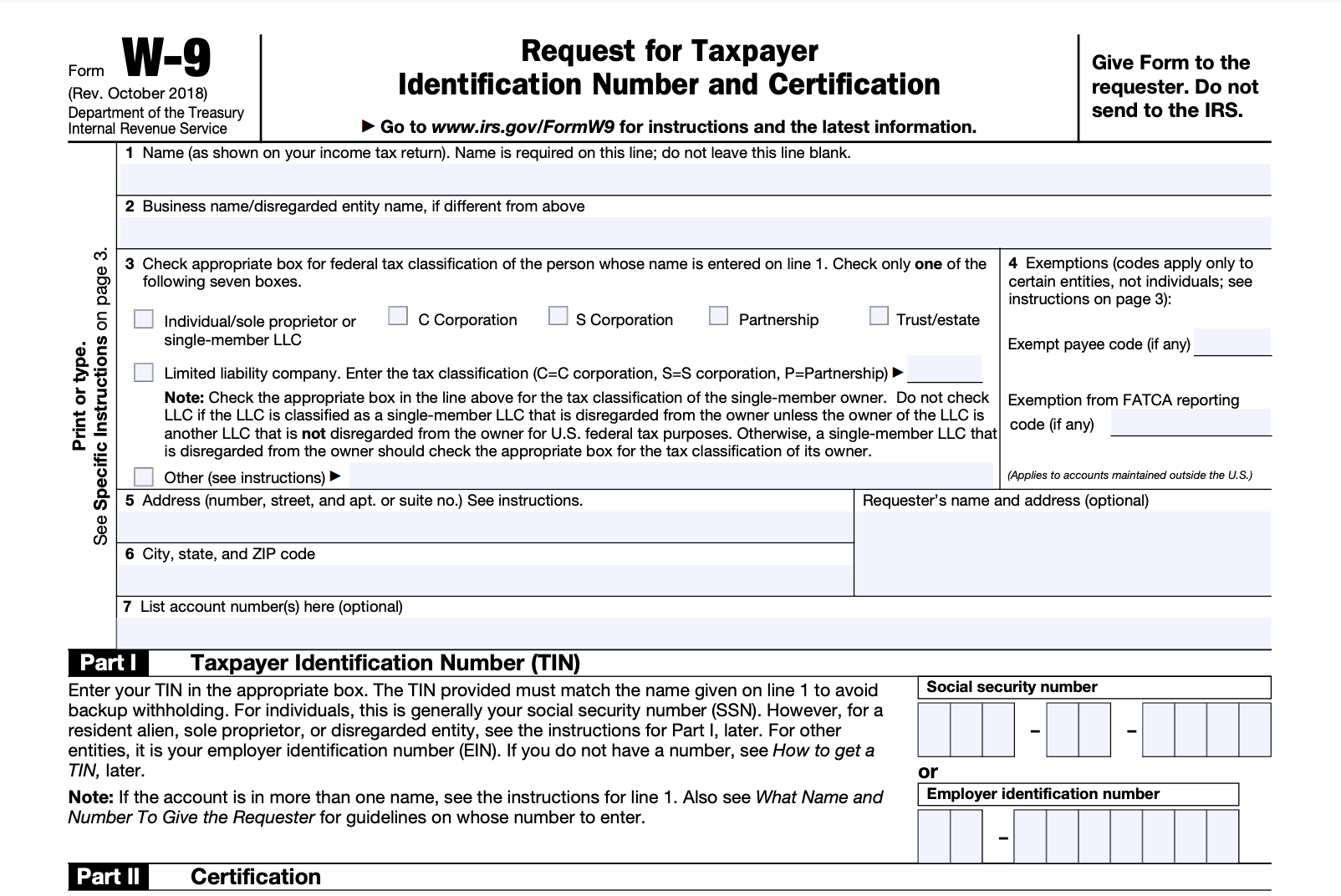

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

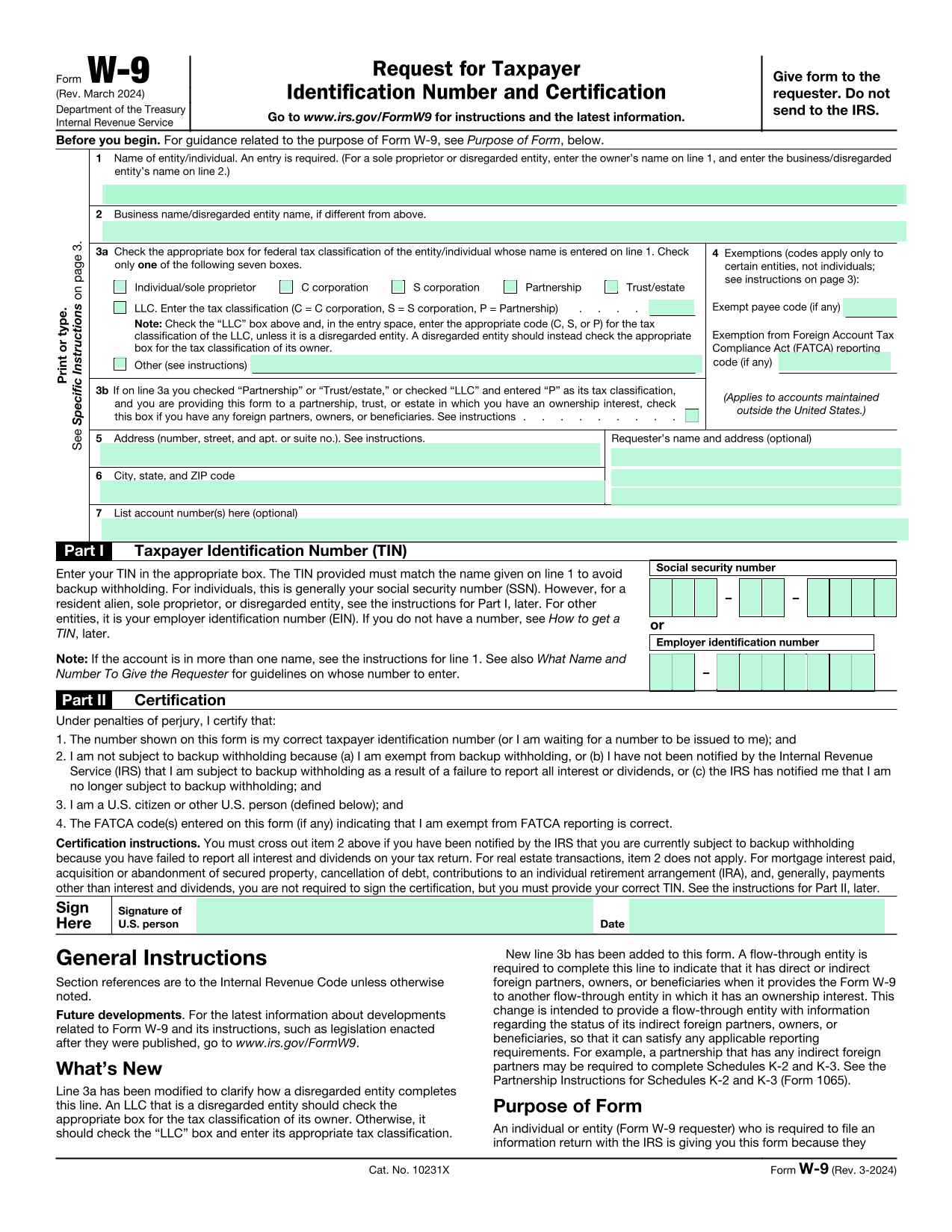

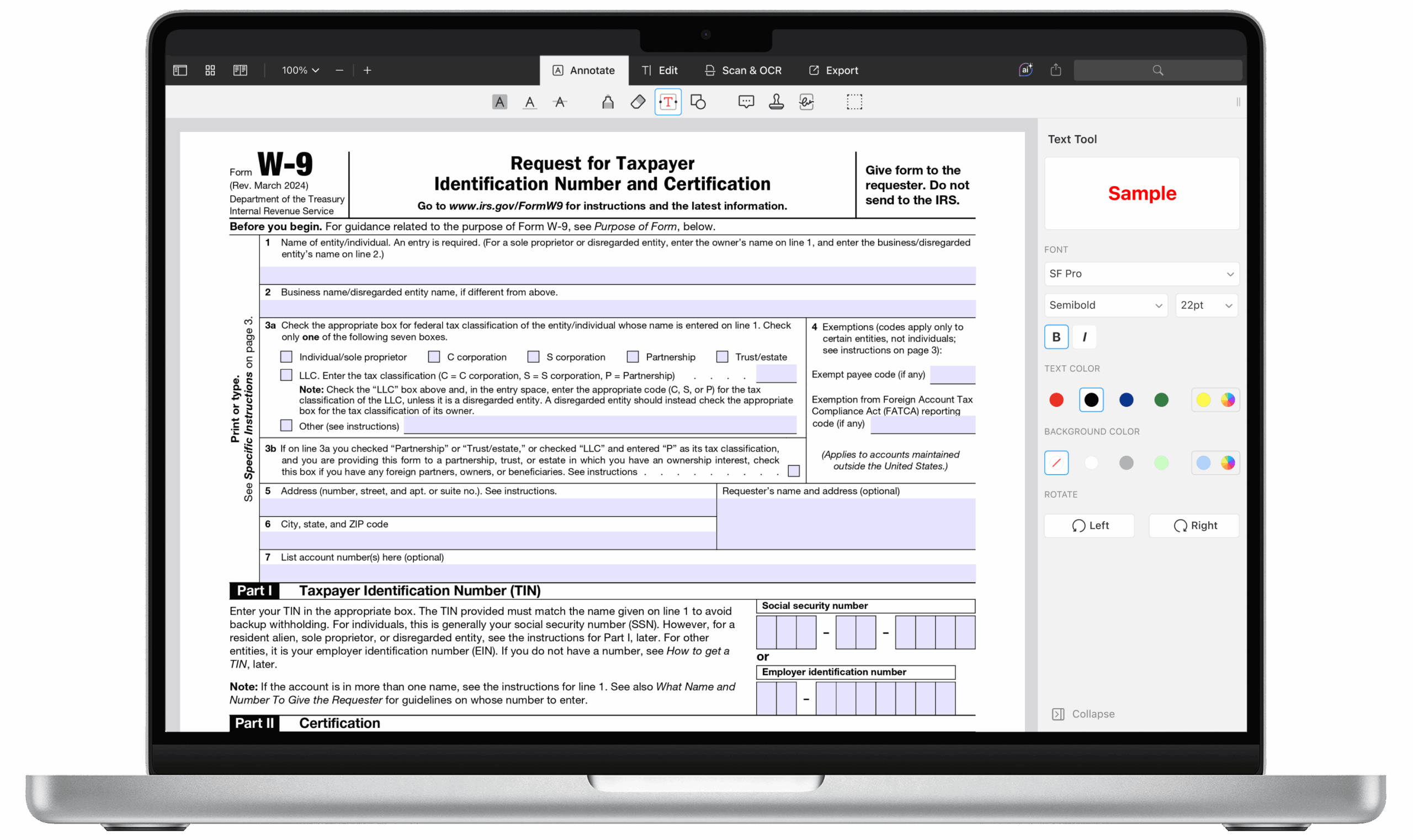

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

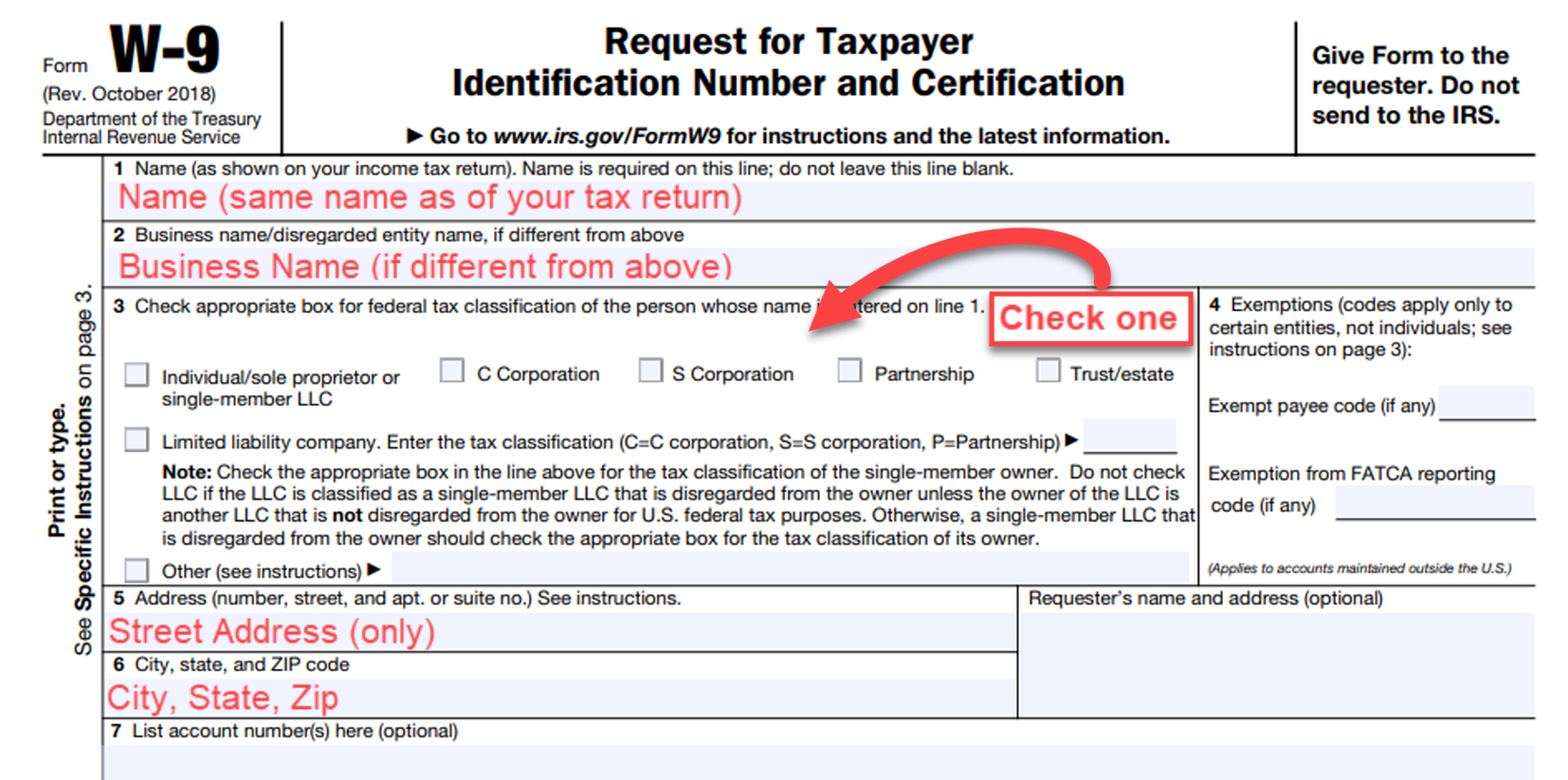

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

Processing staff wages doesn’t have to be complicated. A printable payroll offers a fast, accurate, and straightforward method for tracking salaries, work time, and withholdings—without the need for complicated tools.

Whether you’re a startup founder, administrator, or sole proprietor, using aIrs W9 Printable Form helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.