IRS Forms 2025 are essential documents that individuals and businesses may need to fill out and submit to the Internal Revenue Service. These forms contain important information related to taxes, income, deductions, and credits. It is crucial to accurately complete these forms to ensure compliance with tax laws and regulations.

Having access to printable versions of IRS Forms 2025 can make the process of filing taxes much easier. Instead of having to request physical copies or visit an IRS office, individuals can simply download and print the forms from the comfort of their own homes. This convenience can save time and hassle for taxpayers.

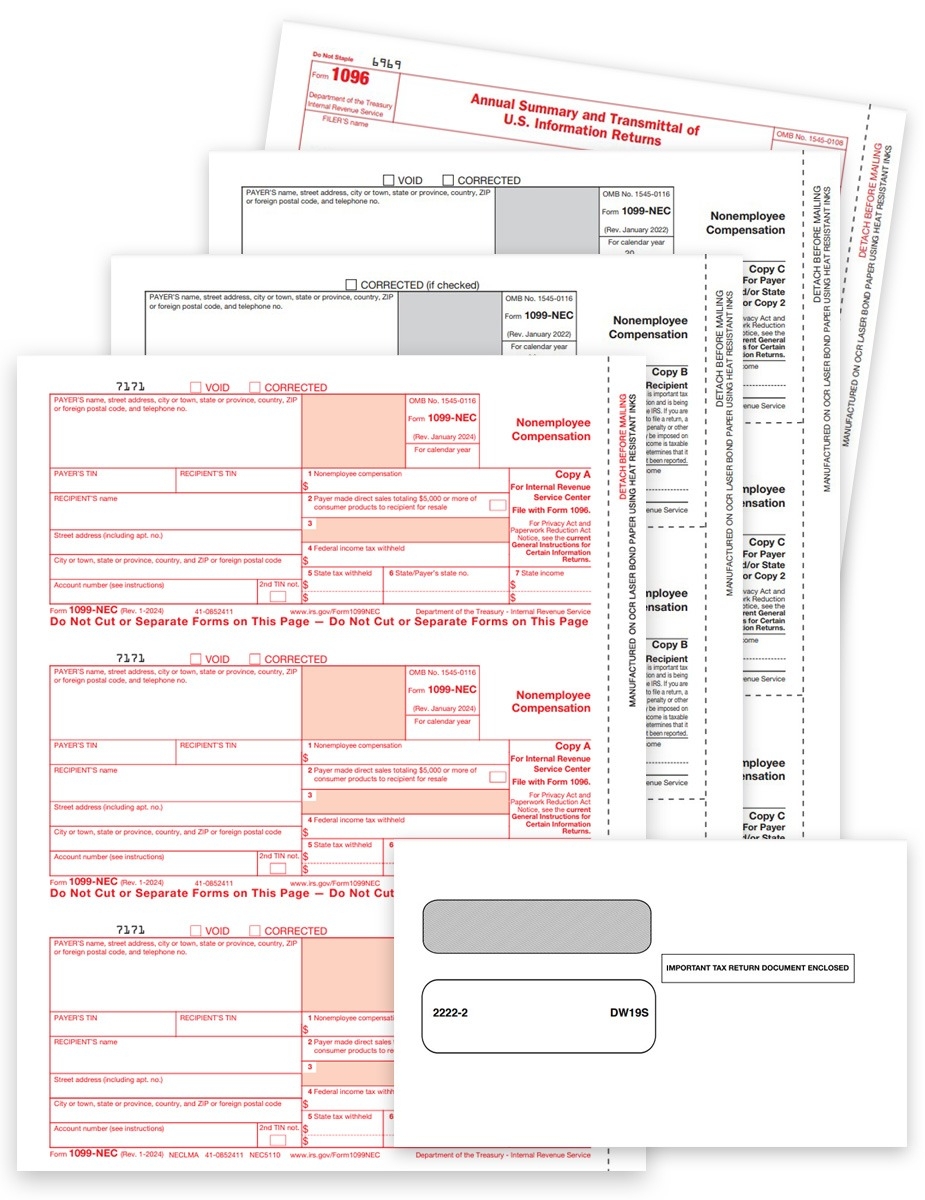

When it comes to IRS Forms 2025, there are several different types that may be required depending on an individual’s or business’s financial situation. These forms may include Form 1040 for individual income tax returns, Form 1120 for corporate tax returns, or Form 941 for employer’s quarterly federal tax returns. Each form serves a specific purpose and must be completed accurately.

One of the benefits of using printable IRS Forms 2025 is the ability to fill them out electronically before printing. Many of these forms are now available in PDF format, allowing taxpayers to enter information directly into the document using a computer or mobile device. This can help reduce errors and streamline the filing process.

It is important to note that IRS Forms 2025 must be submitted by the deadline specified by the IRS. Failure to file these forms on time or provide accurate information could result in penalties or fines. By utilizing printable versions of these forms, individuals and businesses can stay organized and ensure that their tax obligations are met in a timely manner.

In conclusion, IRS Forms 2025 are essential documents that play a crucial role in the tax-filing process. By making use of printable versions of these forms, taxpayers can simplify the task of reporting their financial information to the IRS. It is recommended to carefully review the instructions for each form and seek assistance from a tax professional if needed to ensure compliance with tax laws.