As we approach tax season, it’s important to be prepared with all the necessary forms to accurately report your income. One such form is the IRS 1099 Form, which is used to report various types of income other than wages, salaries, and tips. For the year 2025, the IRS has updated the format of the 1099 Form to ensure compliance with current tax laws and regulations.

Whether you are a freelancer, independent contractor, or receive income from investments, you may be required to report this income on a 1099 Form. The IRS 1099 Form 2025 Printable is now available for download on the IRS website, making it easier for taxpayers to access and fill out the form accurately.

When filling out the IRS 1099 Form 2025 Printable, be sure to carefully review all instructions and guidelines provided by the IRS. You will need to accurately report your income, including any deductions or expenses related to that income. Any errors or omissions on the form could result in penalties or audits by the IRS, so it’s important to be thorough in your reporting.

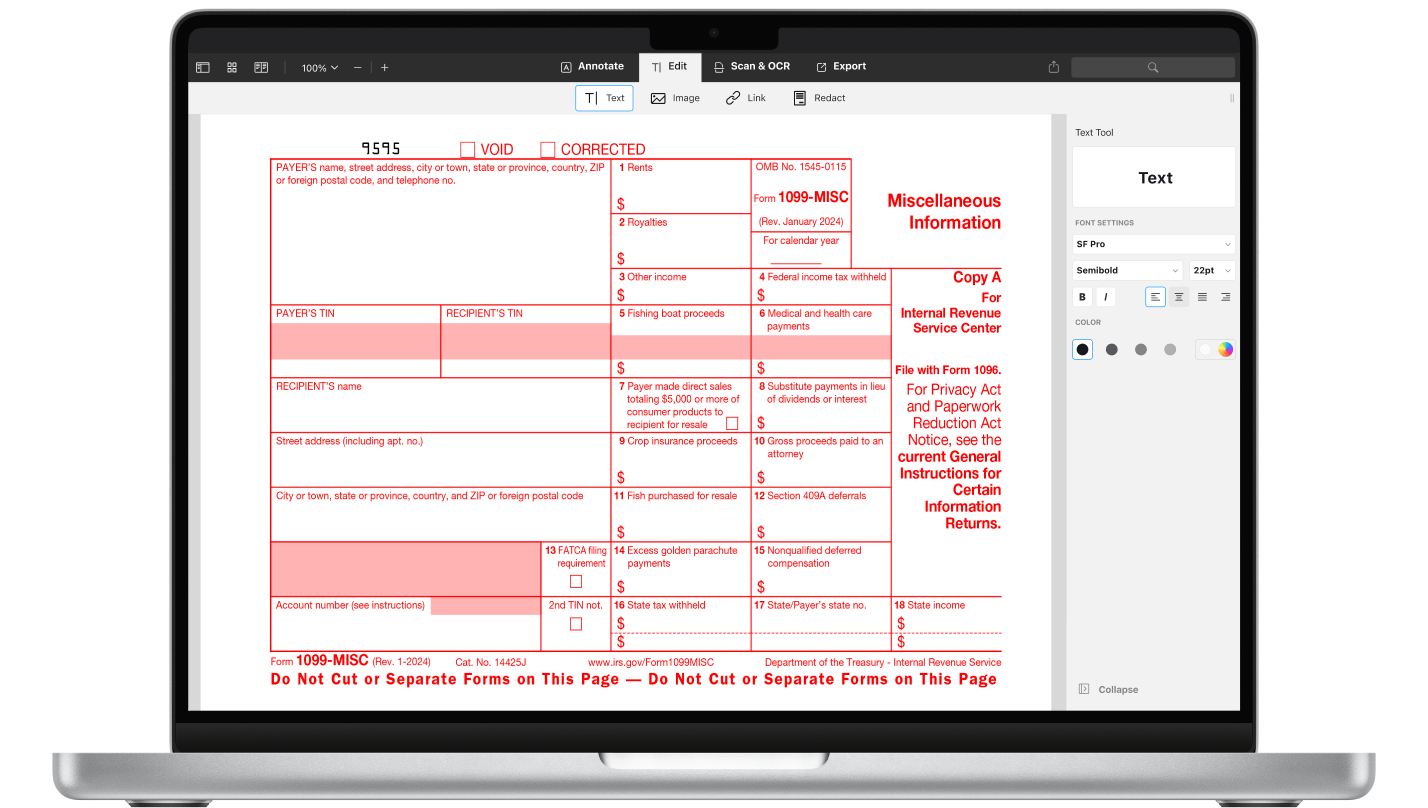

It’s also important to note that certain types of income may require specific 1099 forms, such as the 1099-MISC for miscellaneous income or the 1099-DIV for dividends and distributions. Be sure to use the correct form for the type of income you are reporting to ensure compliance with IRS regulations.

Overall, the IRS 1099 Form 2025 Printable is a valuable tool for taxpayers to accurately report their non-wage income and ensure compliance with tax laws. By being diligent in filling out the form and reviewing all instructions provided, you can avoid potential penalties and ensure a smooth tax filing process.

As tax season approaches, be sure to download the IRS 1099 Form 2025 Printable from the IRS website and start preparing your income reporting. By staying organized and thorough in your reporting, you can make the tax filing process as smooth as possible.