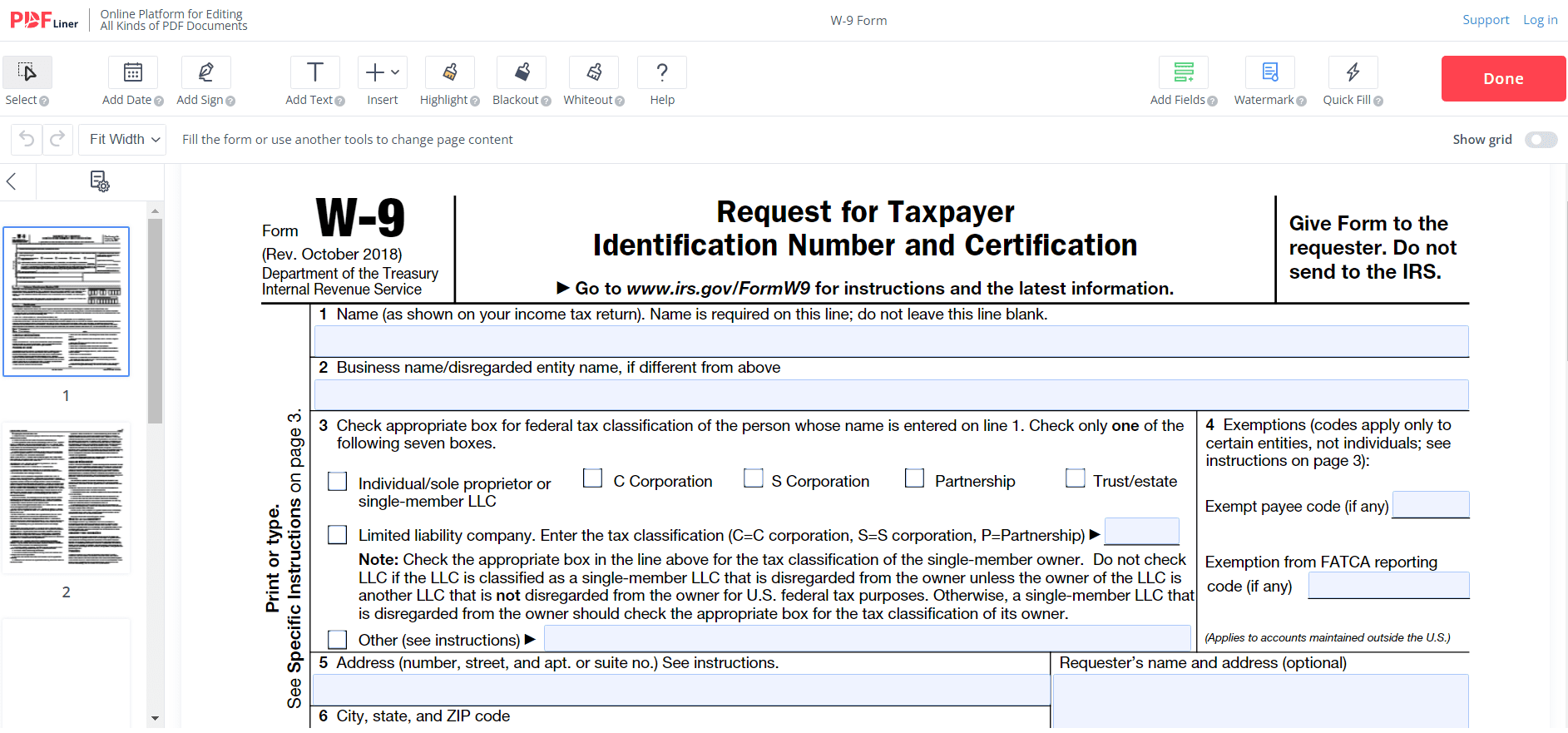

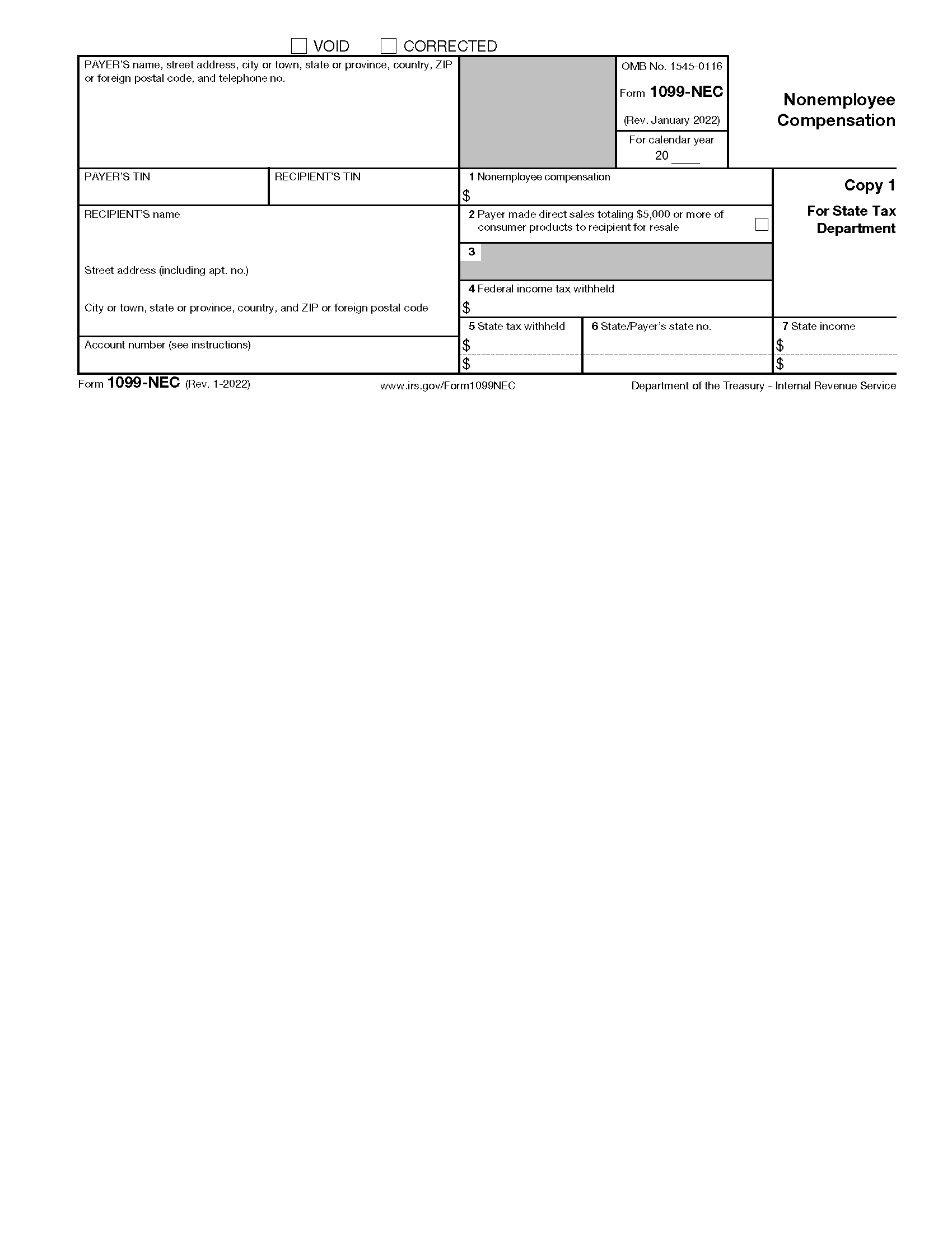

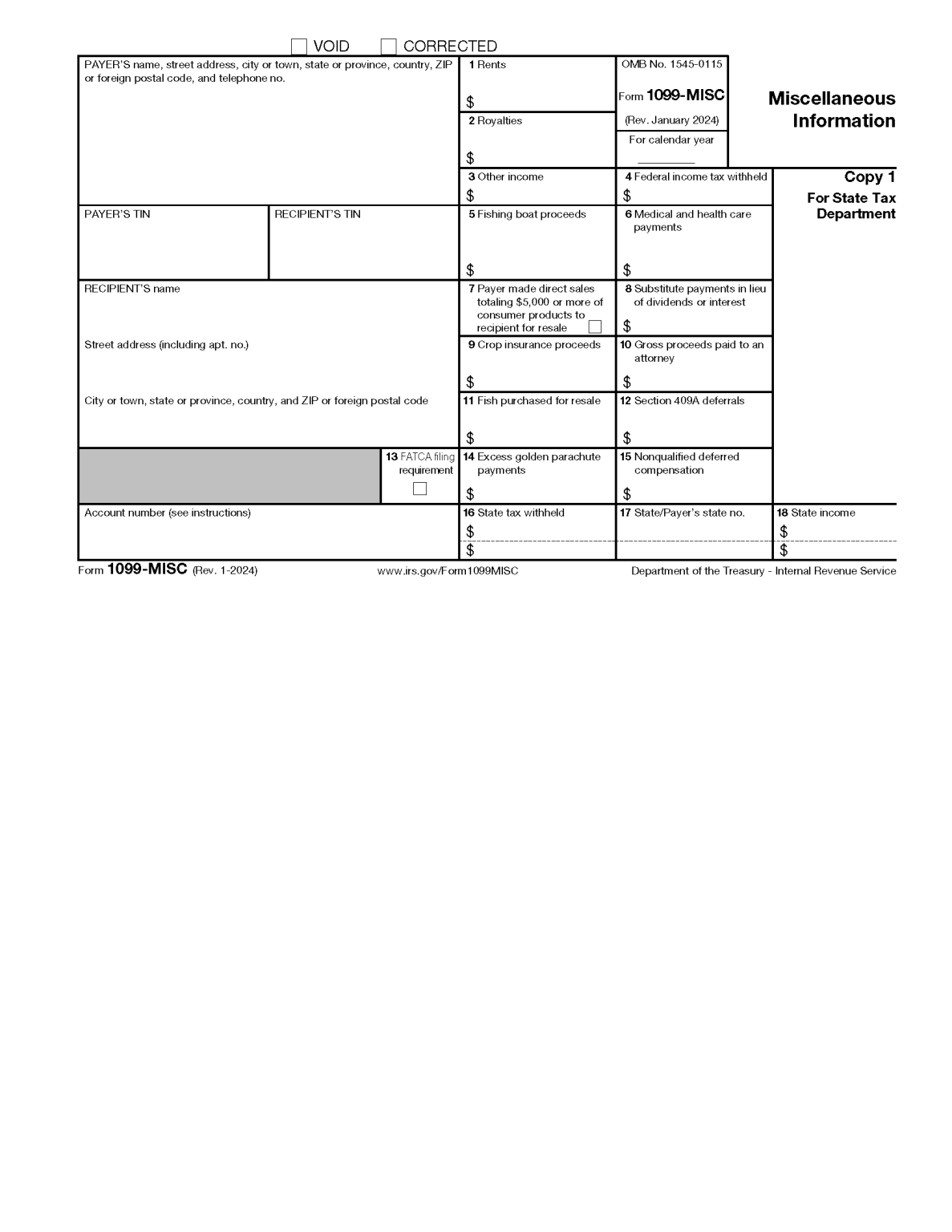

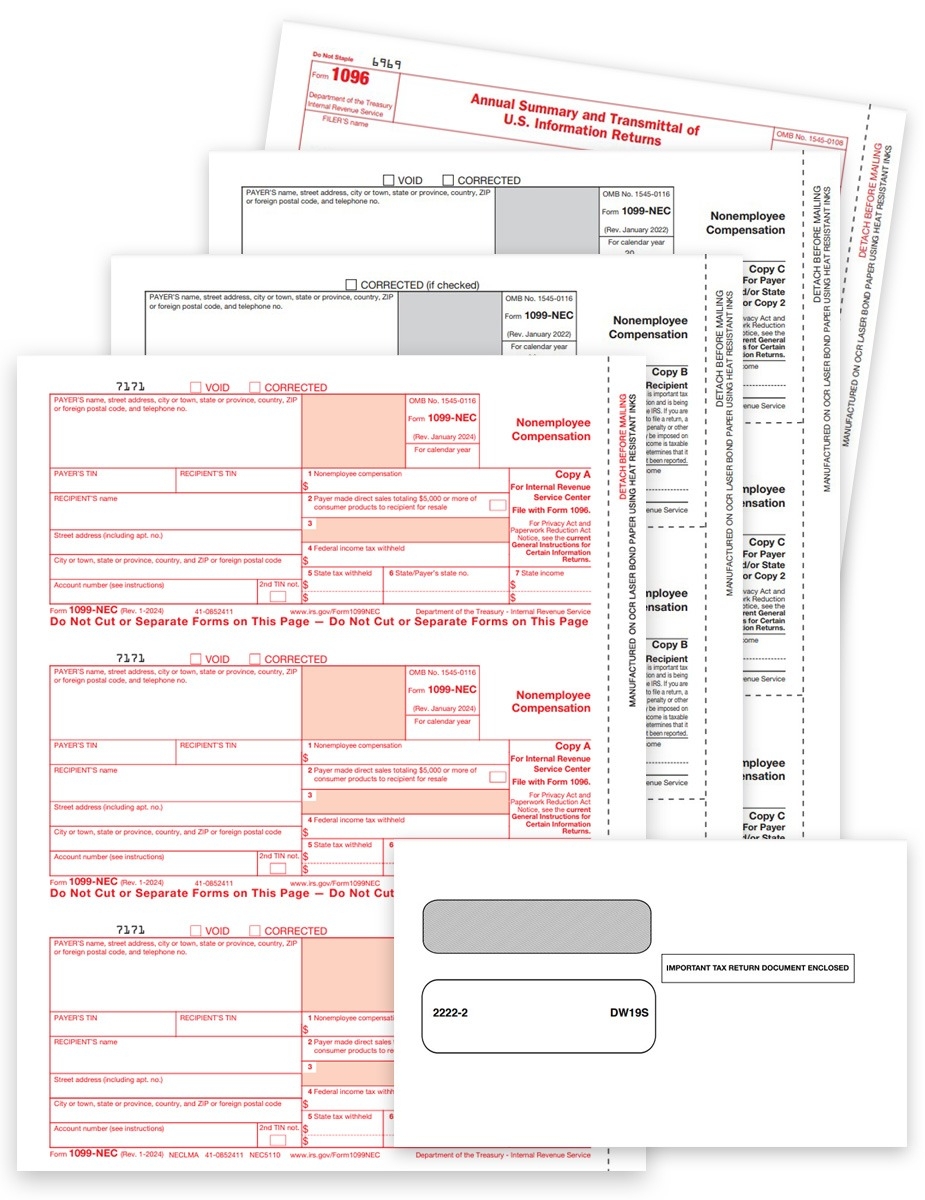

As we approach tax season, it is important to be aware of the various IRS tax forms that will need to be filled out in order to accurately file your taxes. One of the key documents that individuals and businesses will need is the IRS Tax Forms 2025. These forms provide the necessary information for taxpayers to report their income, deductions, and credits to the IRS.

IRS Tax Forms 2025 Printable can be easily accessed online through the IRS website or other tax preparation software. These forms are designed to be user-friendly and straightforward, making it easier for taxpayers to understand and complete their tax filing requirements. It is important to ensure that you have the most up-to-date version of the forms to avoid any errors or delays in processing your tax return.

When filling out the IRS Tax Forms 2025, individuals will need to provide information such as their income, expenses, and any credits or deductions they may be eligible for. It is important to carefully review each section of the form and double-check your entries to ensure accuracy. Failure to report income or deductions correctly could result in penalties or audits by the IRS.

One of the benefits of using IRS Tax Forms 2025 Printable is that they provide clear instructions on how to fill out each section of the form. This can be especially helpful for individuals who are filing their taxes for the first time or have complex tax situations. Additionally, the forms can be saved and printed for your records, making it easier to reference in the future if needed.

In conclusion, IRS Tax Forms 2025 Printable are essential documents for individuals and businesses to accurately report their income and expenses to the IRS. By carefully completing these forms and ensuring accuracy, taxpayers can avoid potential penalties and delays in processing their tax returns. It is important to stay informed about any changes to tax laws and regulations to ensure compliance with the IRS requirements.

Easily Download and Print Irs Tax Forms 2025 Printable

Payroll printable are ideal for businesses that prefer paper documentation or need printed versions for audit purposes. Most forms include fields for employee name, pay period, total earnings, withholdings, and final salary—making them both comprehensive and practical.

Start simplifying your payroll system today with a trusted printable payroll template. Save time, reduce errors, and stay organized—all while keeping your employee payment data professional.

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

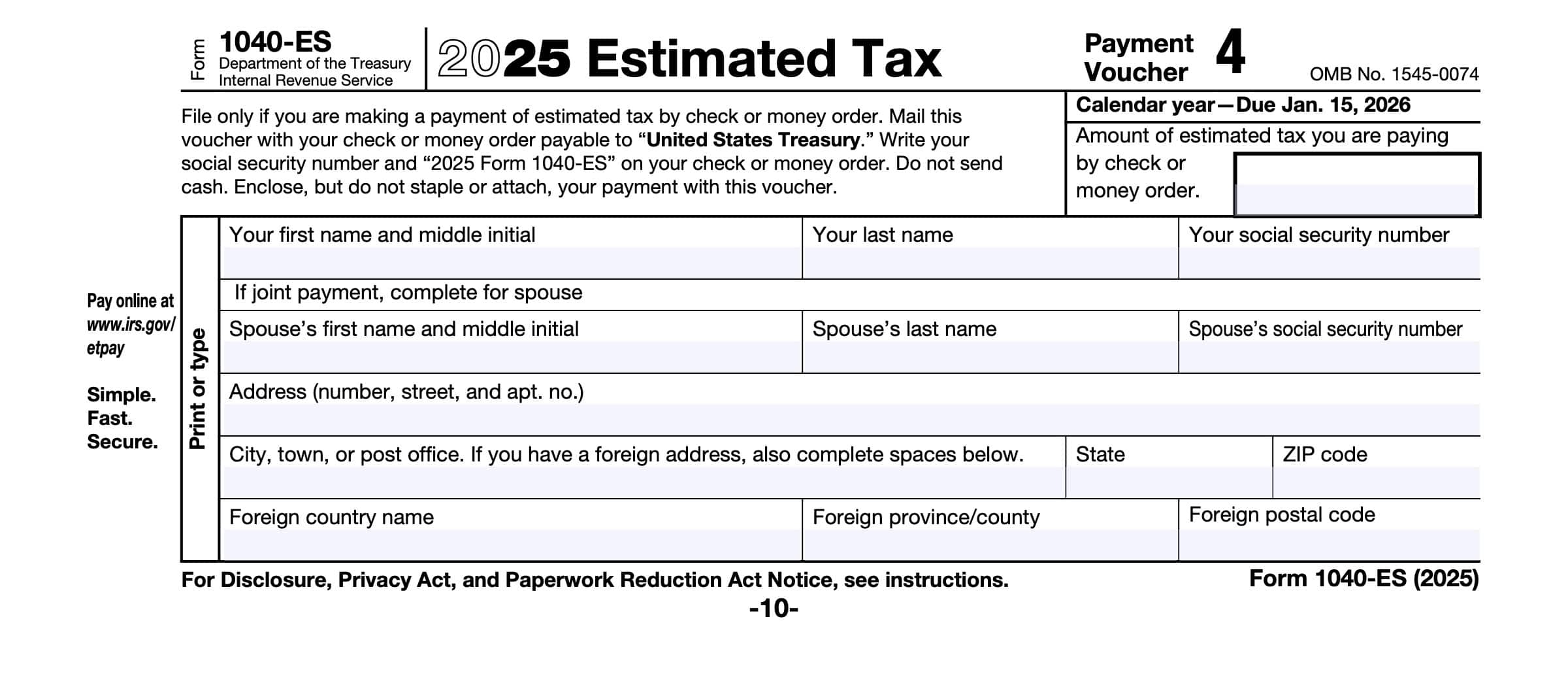

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

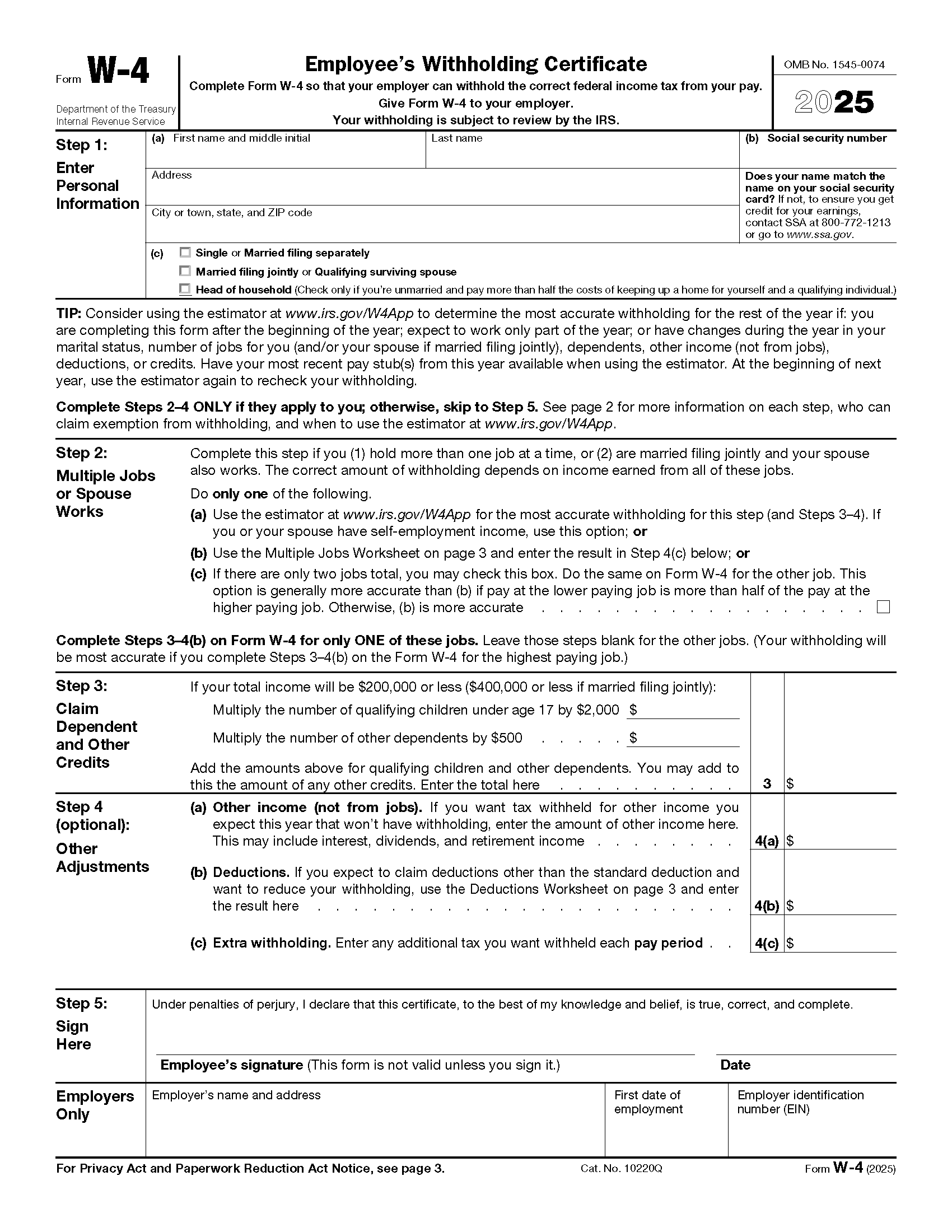

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

Managing employee payments doesn’t have to be difficult. A printable payroll form offers a speedy, accurate, and user-friendly method for tracking wages, work time, and taxes—without the need for digital systems.

Whether you’re a small business owner, administrator, or independent contractor, using aprintable payroll helps ensure compliance with regulations. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.