As tax season approaches, many Americans are preparing to file their federal income taxes. One of the key components in this process is obtaining the necessary forms to report their income, deductions, and credits. The Internal Revenue Service (IRS) provides a variety of forms that individuals can use to accurately report their financial information and calculate their tax liability.

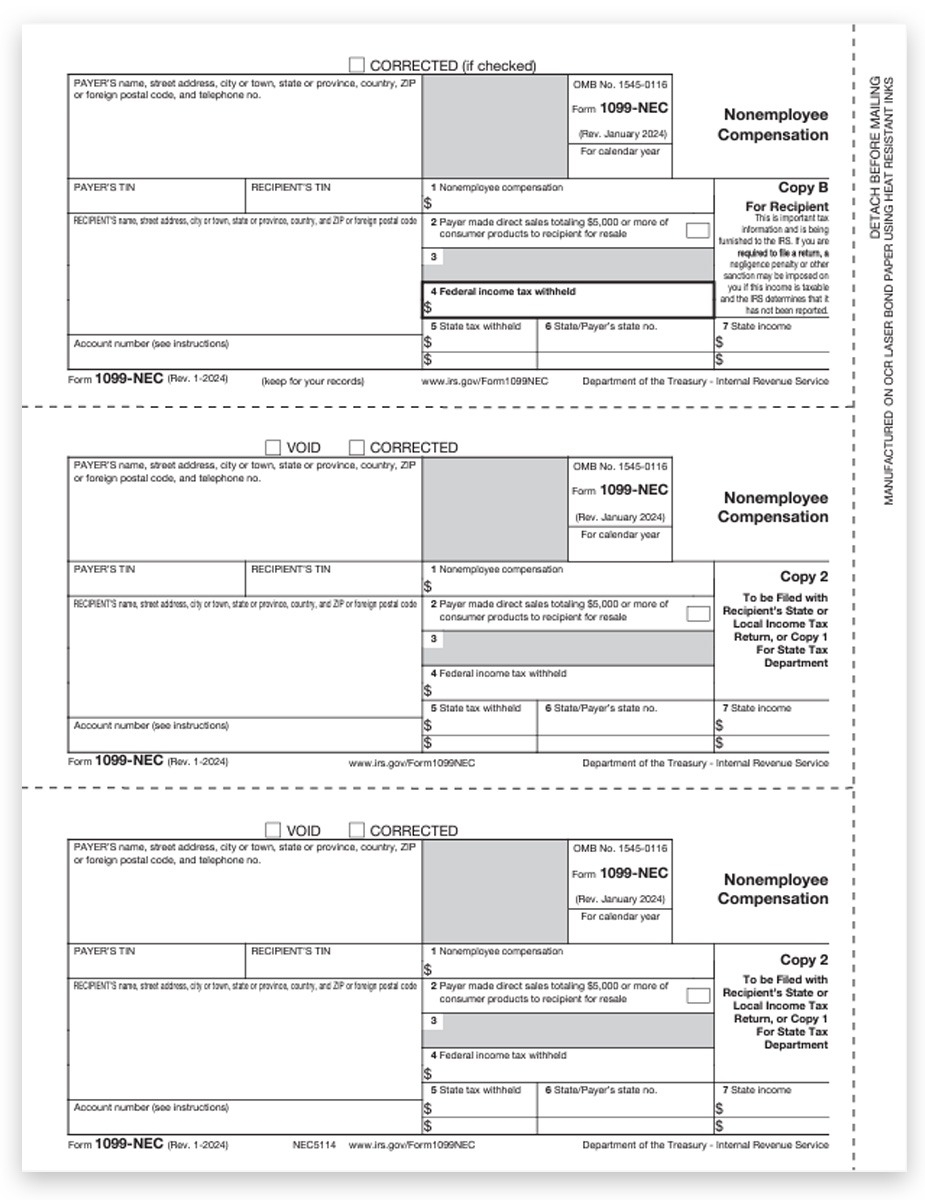

Printable federal income tax forms are essential for individuals who prefer to file their taxes by mail or in person. These forms can be easily accessed and printed from the IRS website, making it convenient for individuals to fill them out at their own pace. Whether you are a wage earner, self-employed individual, or business owner, having the correct forms on hand is crucial for accurately reporting your income and claiming any deductions or credits you are eligible for.

Printable Federal Income Tax Forms

Printable Federal Income Tax Forms

When downloading printable federal income tax forms from the IRS website, it is important to ensure that you are using the most up-to-date versions. The IRS regularly updates its forms to reflect changes in tax laws and regulations, so using outdated forms could result in errors or delays in processing your tax return. By checking the IRS website for the latest forms and instructions, you can avoid any potential issues and ensure that your tax return is accurate and complete.

Some of the most commonly used printable federal income tax forms include Form 1040, Form 1040A, and Form 1040EZ. These forms are used by individuals to report their income, deductions, and credits for the tax year. Form 1040 is the standard form for filing individual tax returns, while Form 1040A and Form 1040EZ are simplified versions that are available for individuals with less complex tax situations. By selecting the appropriate form based on your financial circumstances, you can streamline the filing process and avoid any unnecessary complications.

In addition to individual tax forms, the IRS also provides printable forms for businesses, trusts, and other entities that are required to file federal income taxes. These forms include Form 1065 for partnerships, Form 1120 for corporations, and Form 1041 for trusts and estates. By using the correct form for your entity type, you can ensure that your tax return is filed accurately and in compliance with IRS regulations.

In conclusion, printable federal income tax forms are essential tools for individuals and businesses to report their financial information and fulfill their tax obligations. By accessing the latest forms from the IRS website and using them to accurately report your income, deductions, and credits, you can ensure that your tax return is processed smoothly and without any issues. Whether you choose to file your taxes electronically or by mail, having the correct forms on hand is crucial for a successful tax filing experience.