When tax season rolls around, it’s important to have all the necessary forms in order to accurately report your income to the federal government. One of the most common ways to do this is by filling out federal income tax forms. These forms are essential for individuals and businesses to report their income and calculate the amount of tax they owe to the IRS.

Whether you are a salaried employee, a freelancer, or a business owner, understanding and completing federal income tax forms is crucial to ensure compliance with the law and avoid any penalties or fines. Luckily, these forms are readily available online and can be easily printed for your convenience.

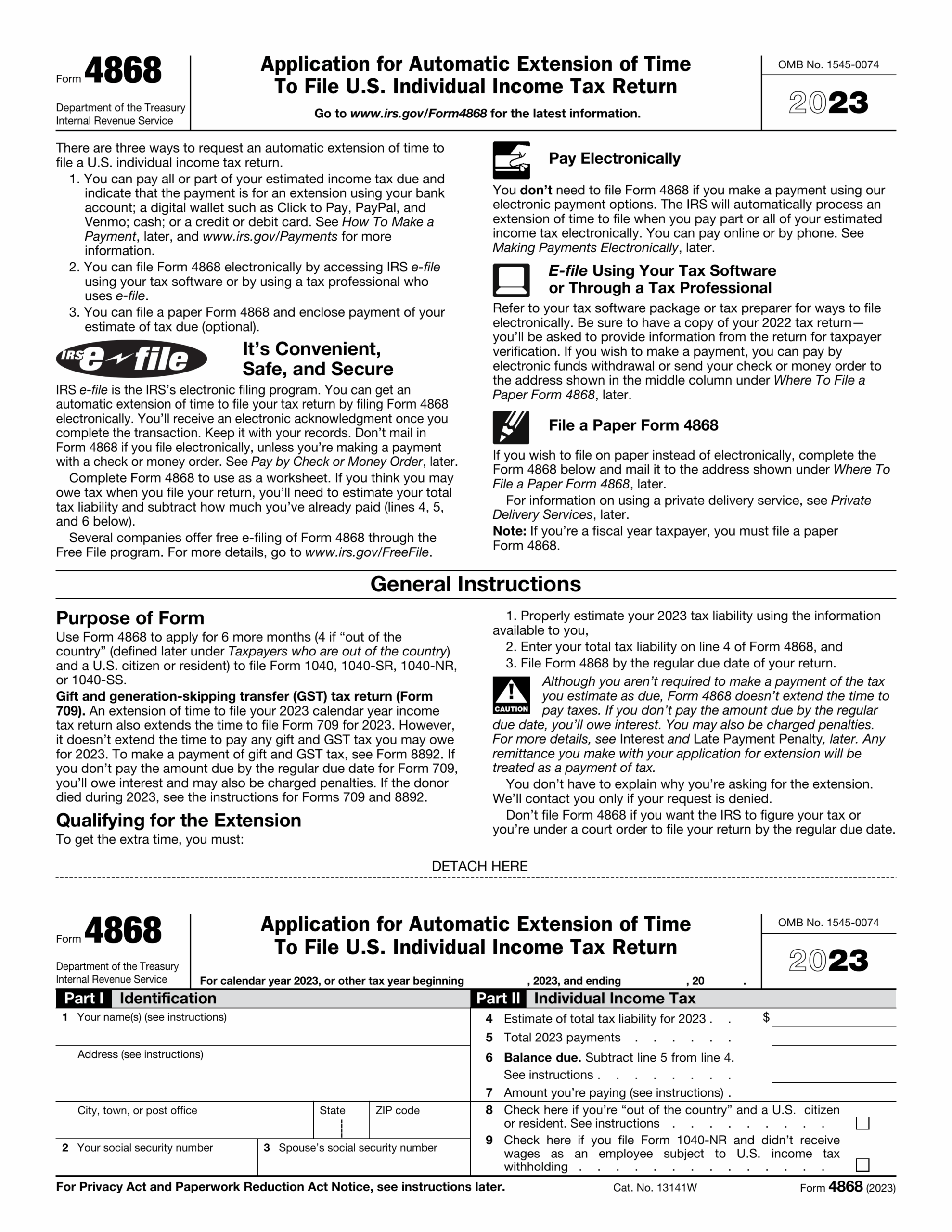

Federal Income Tax Forms Printable

Federal Income Tax Forms Printable

There are several types of federal income tax forms that you may need to fill out, depending on your individual circumstances. Some of the most common forms include Form 1040, Form 1040A, and Form 1040EZ. These forms vary in complexity, with Form 1040 being the most comprehensive and suitable for individuals with more complex tax situations.

When filling out federal income tax forms, it’s important to gather all the necessary documents, such as W-2s, 1099s, and receipts for deductions. This will ensure that you have all the information you need to accurately report your income and claim any deductions or credits that you may be eligible for.

Once you have completed your federal income tax forms, you can either file them electronically or mail them to the IRS. Filing electronically is generally faster and more convenient, as you will receive confirmation of your submission and any refund due to you can be processed more quickly.

Overall, having access to printable federal income tax forms is essential for individuals and businesses to fulfill their tax obligations. By understanding the different types of forms available and gathering all the necessary documentation, you can ensure that you accurately report your income and avoid any potential issues with the IRS.