As tax season approaches, many individuals and businesses are gearing up to file their income tax returns. One of the essential tools needed for this process is the income tax forms. The IRS provides a variety of forms that taxpayers can use to report their income, deductions, and credits. These forms are crucial for accurately calculating and submitting taxes to the government.

With the advancement of technology, many taxpayers prefer to file their taxes online. However, there are still individuals who prefer the traditional method of filing paper tax returns. For those individuals, having access to printable income tax forms is essential. These forms can be easily downloaded and printed from the IRS website or other tax preparation websites.

Printable Income Tax Forms 2025

Printable Income Tax Forms 2025

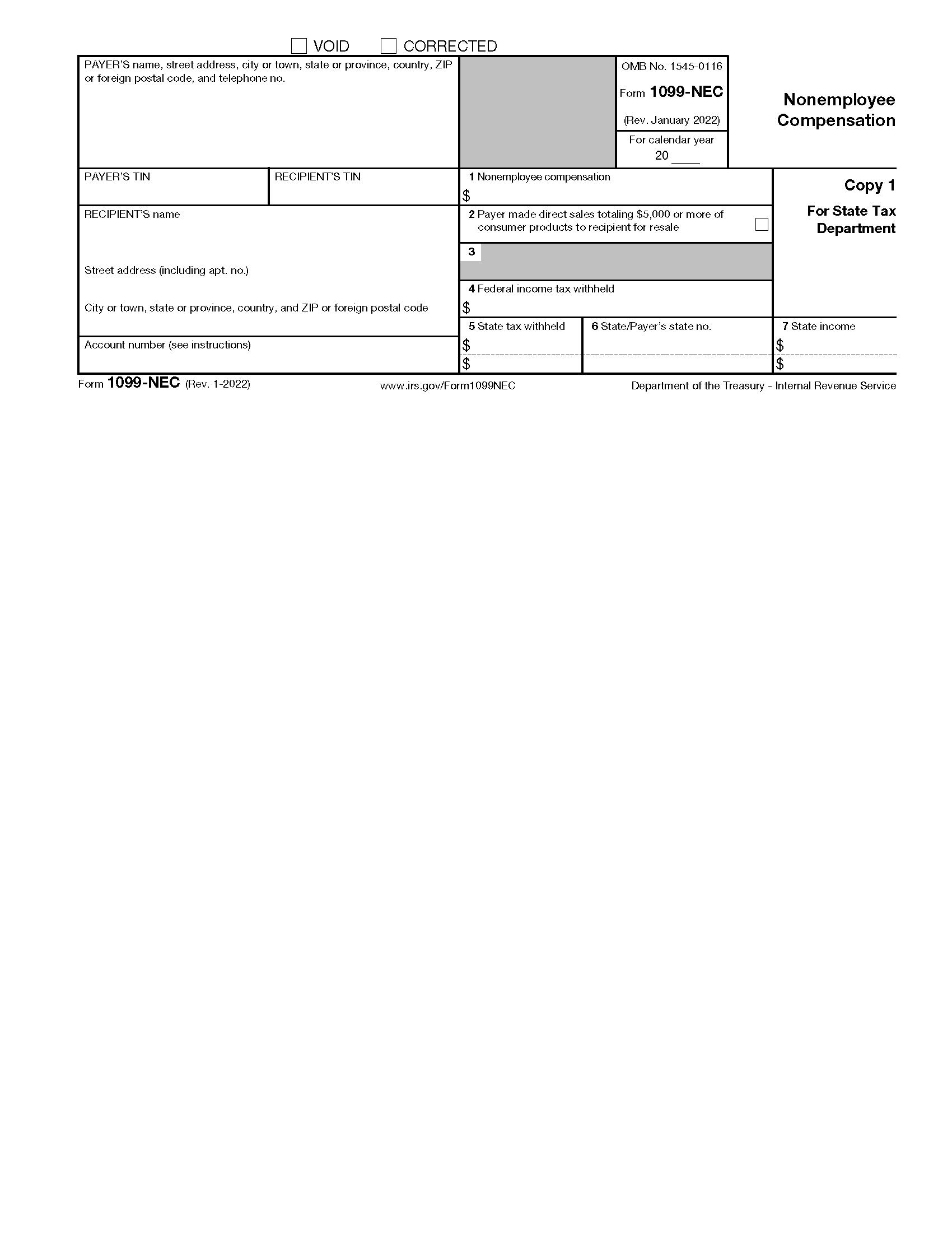

Printable income tax forms for the year 2025 will include all the necessary information and instructions for taxpayers to complete their returns accurately. Whether you are an individual taxpayer, self-employed individual, or business owner, there are specific forms tailored to your needs. It is important to ensure that you are using the correct forms for your filing status and income sources.

Some of the common printable income tax forms for 2025 may include Form 1040 for individual tax returns, Form 1065 for partnership tax returns, Form 1120 for corporate tax returns, and various schedules and worksheets for reporting specific deductions and credits. These forms can be downloaded in PDF format and easily printed for filling out by hand.

When using printable income tax forms, it is crucial to follow the instructions provided and double-check all calculations to avoid errors. Filing an accurate tax return is essential to avoid penalties and potential audits by the IRS. Additionally, taxpayers should keep copies of their completed forms and any supporting documentation for their records.

In conclusion, printable income tax forms for 2025 are essential tools for taxpayers who prefer to file their taxes on paper. These forms provide a structured format for reporting income, deductions, and credits to ensure accurate tax calculations. By utilizing the correct forms and following the instructions carefully, taxpayers can successfully complete their tax returns and fulfill their obligations to the government.