Managing employee payroll deductions can be a complex task for any business. From health insurance premiums to retirement contributions, there are numerous deductions that need to be accurately calculated and deducted from each paycheck. To simplify this process, many businesses use printable payroll deduction forms to ensure accuracy and compliance.

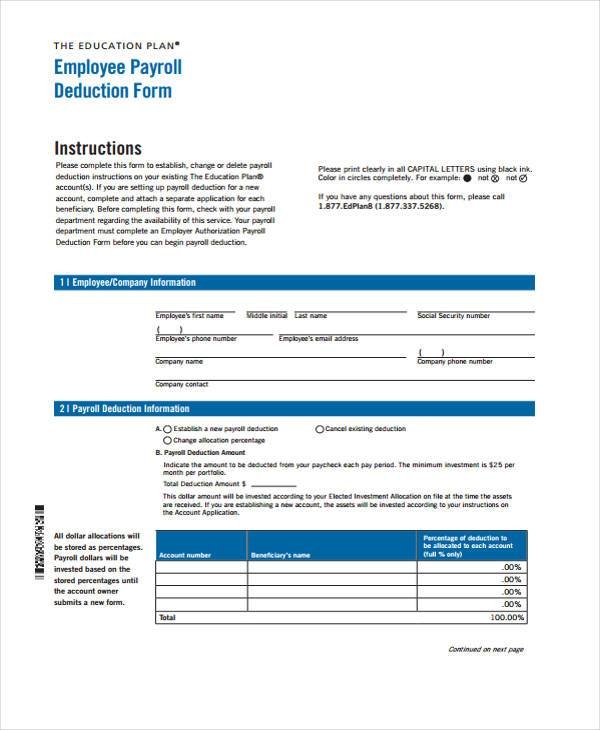

A printable payroll deduction form template is a pre-designed document that outlines the various deductions that will be taken from an employee’s paycheck. This form typically includes fields for the employee’s name, employee ID number, deduction type, deduction amount, and any additional notes or comments. By using a standardized form, businesses can ensure that all necessary information is captured and recorded consistently for each employee.

Printable Payroll Deduction Form Template

Printable Payroll Deduction Form Template

Handling employee payments doesn’t have to be overwhelming. A printable payroll form offers a fast, dependable, and user-friendly method for tracking salaries, hours, and withholdings—without the need for digital systems.

Keep Payroll in Order with a Printable Payroll Deduction Form Template – Simple & Effective Solution!

Whether you’re a startup founder, payroll manager, or sole proprietor, using aprintable payroll form helps ensure accurate record-keeping. Simply access the template, produce a hard copy, and complete it by hand or type directly into the file before printing.

One of the key benefits of using a printable payroll deduction form template is the ability to streamline the payroll process. By providing employees with a standardized form to request deductions, businesses can eliminate confusion and errors that may arise from handwritten requests or verbal agreements. This helps to ensure that deductions are processed accurately and in a timely manner.

Additionally, printable payroll deduction forms can also serve as a valuable record-keeping tool for businesses. By documenting each deduction request on a formalized form, businesses can easily track and audit employee deductions over time. This can be particularly useful during tax season or in the event of an audit, as businesses will have a clear record of each deduction taken from an employee’s paycheck.

In conclusion, a printable payroll deduction form template is a valuable tool for businesses looking to streamline their payroll processes and ensure accuracy and compliance with employee deductions. By providing employees with a standardized form to request deductions, businesses can simplify the payroll process, improve record-keeping, and mitigate potential errors or disputes. Consider implementing a payroll deduction form template in your business to enhance efficiency and accuracy in managing employee deductions.