When it comes to filing your taxes, the 1040 EZ form is a simplified version of the standard 1040 form that is designed for taxpayers with straightforward tax situations. This form is typically used by individuals who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000.

One of the benefits of using the 1040 EZ form is that it is much easier to fill out compared to the standard 1040 form. The form consists of just one page and only requires basic information such as your income, deductions, and tax credits. Additionally, the 1040 EZ form can be filed electronically or by mail, making it convenient for taxpayers.

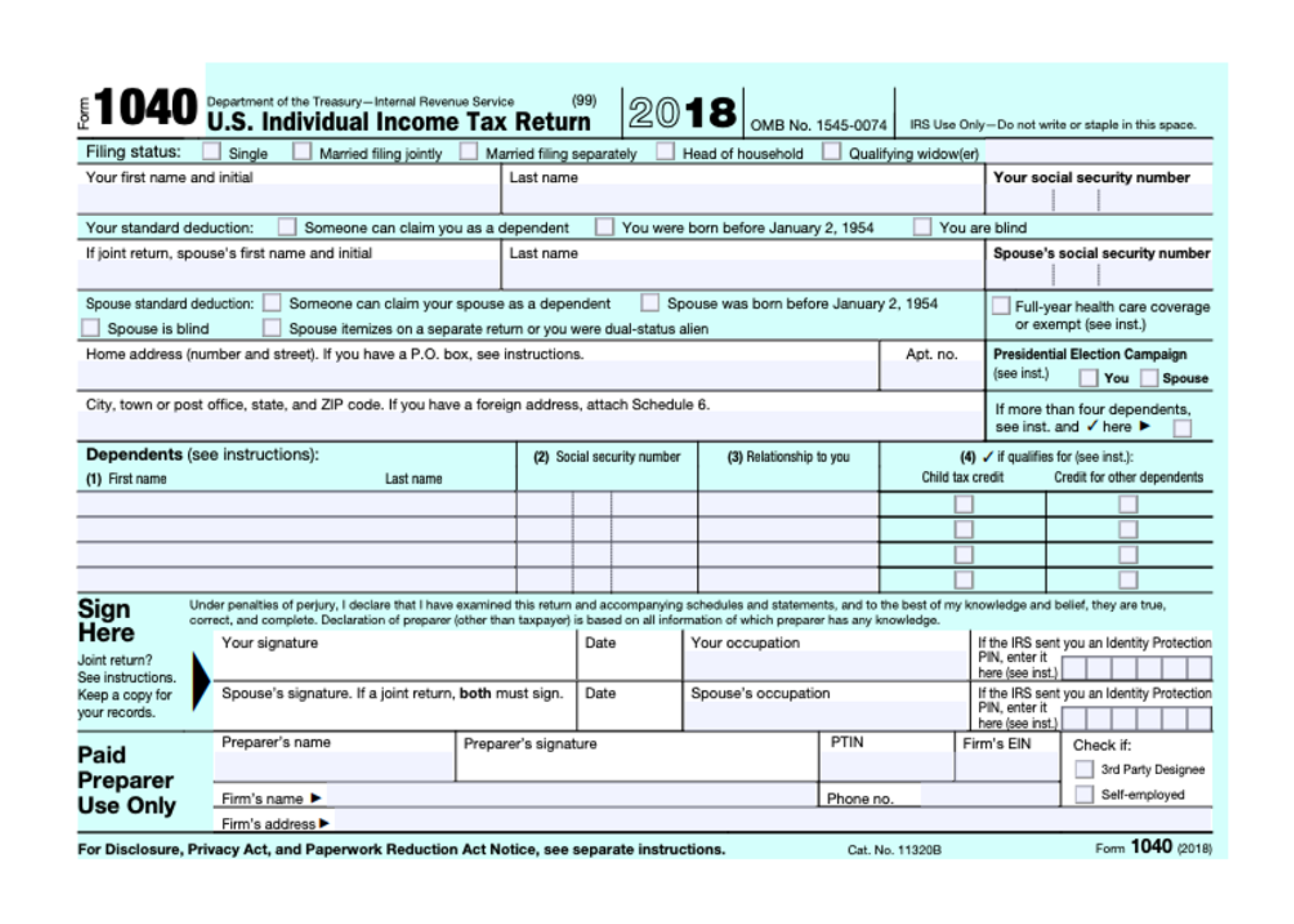

Printable 1040 EZ Form

For those who prefer to fill out their tax forms by hand, the printable 1040 EZ form is available online. This form can be easily downloaded and printed from the IRS website, allowing you to complete it at your own pace. Make sure to carefully follow the instructions provided with the form to ensure accuracy when reporting your tax information.

When filling out the 1040 EZ form, be sure to double-check your calculations and review all information for accuracy before submitting it to the IRS. Any errors or omissions on your tax return could result in delays in processing or even potential penalties. It’s always a good idea to keep copies of your completed tax forms for your records.

Overall, the printable 1040 EZ form is a convenient option for individuals with simple tax situations who prefer to file their taxes manually. By providing the necessary information and following the instructions carefully, you can ensure that your taxes are filed accurately and on time.

In conclusion, the printable 1040 EZ form offers a straightforward and easy-to-use option for taxpayers with uncomplicated tax situations. Whether you choose to file electronically or by mail, this form provides a simplified way to report your income and deductions to the IRS. Utilize the printable 1040 EZ form to streamline the tax filing process and avoid any unnecessary complications.