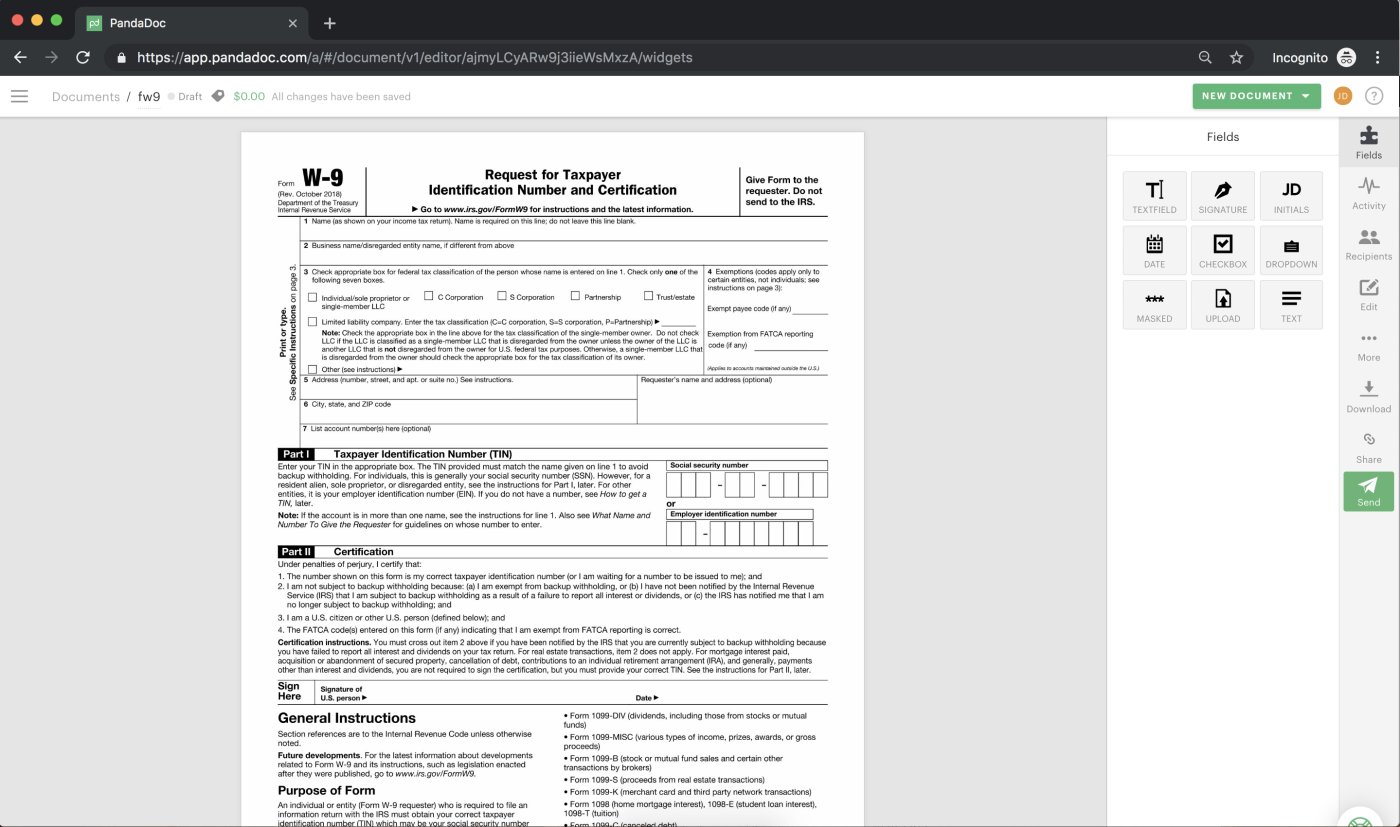

When it comes to tax forms, the IRS W-9 Form is one that many individuals and businesses are familiar with. This form is used to request the taxpayer identification number (TIN) of a U.S. person, which is typically either a Social Security number or an employer identification number. It is important for individuals and businesses to fill out this form accurately to ensure that their tax information is properly reported.

For those who prefer to have a physical copy of the IRS W-9 Form on hand, there are printable versions available online. These printable forms make it easy to fill out the necessary information and submit it to the appropriate parties. Whether you are a freelancer, independent contractor, or business owner, having a printable W-9 Form can streamline the process of providing your tax information to clients or vendors.

When filling out the IRS W-9 Form, it is important to provide accurate information such as your name, business name (if applicable), address, and TIN. Failure to provide accurate information can result in delays in processing payments or even penalties from the IRS. Additionally, be sure to sign and date the form to certify that the information provided is correct.

It is also worth noting that the IRS W-9 Form is not submitted directly to the IRS. Instead, it is typically provided to clients or vendors who will use the information to report payments made to you on Form 1099. This form is then submitted to the IRS by the payer, who is responsible for reporting certain types of payments to the government.

Overall, having access to a printable IRS W-9 Form can make it easier for individuals and businesses to comply with tax reporting requirements. By accurately completing this form and providing it to the appropriate parties, you can ensure that your tax information is properly reported and avoid potential penalties from the IRS. Be sure to keep a copy of the completed form for your records, as it may be requested in the future for tax purposes.

In conclusion, the IRS W-9 Form is a crucial document for individuals and businesses to provide their tax information to clients or vendors. With printable versions available online, it is easier than ever to fill out and submit this form accurately. By understanding the importance of the W-9 Form and following the guidelines for completion, you can stay compliant with tax regulations and avoid any potential issues with the IRS.